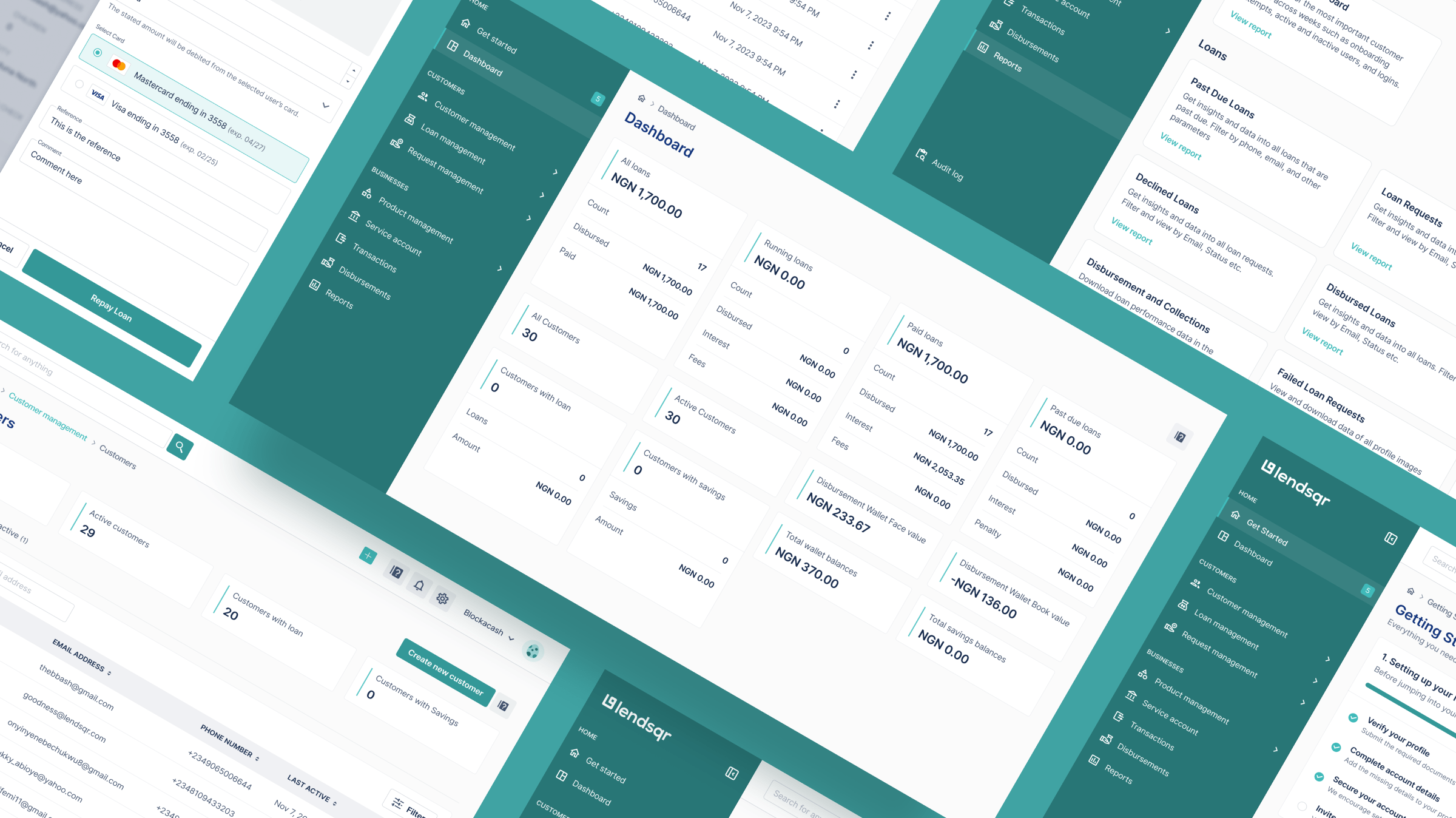

Which is better for loan repayments: Cards or Direct Debit?

Explore the use of debit cards and direct debit as options for lenders and which is more effective for loan recovery

How to tackle loan defaults in the Caribbean: A lender’s guide

This guide breaks down proven strategies to tackle loan defaults in the Caribbean, from better risk assessment to smarter debt recovery.

What NCGC will (and won’t) do for Nigerian lenders

So here’s a breakdown of five important things the NCGC will do and just as importantly, five things it won’t.