We’re giving our lending tech away for free to non-profit and DFIs

If you’re a non-profit or development finance institution (DFI), it should be easier to run a lending program if you're already doing the hard part of reaching people most others won’t.

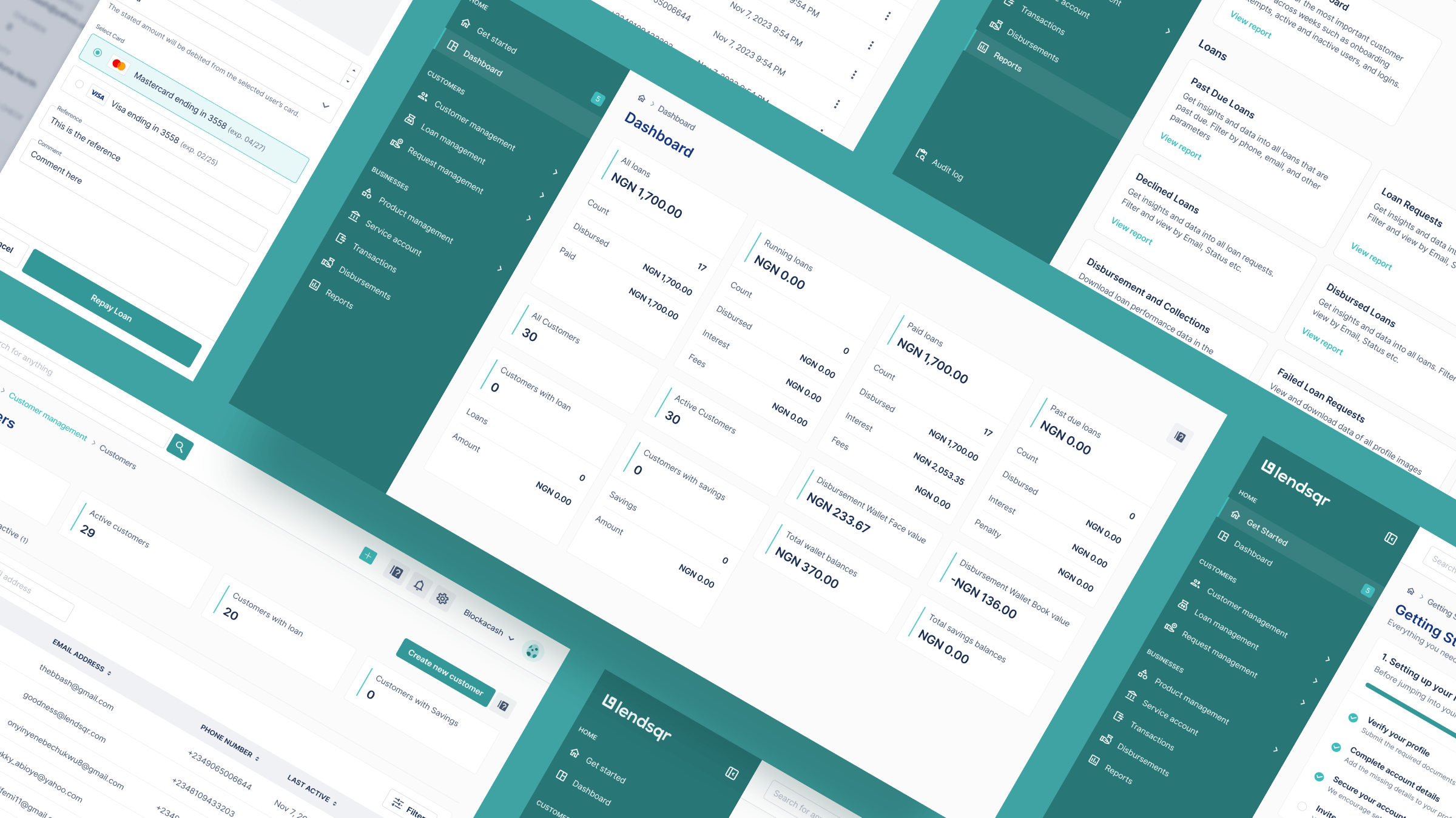

What is Lendsqr, and how does it work?

So what is Lendsqr, and how does it work? What makes Lendsqr the go-to platform for lending? Explore its key features and how they can help you build a thriving loan business.

Why Lendsqr is Africa’s most affordable loan management software

The end-to-end loan management software that’s rewriting the rules for lenders globally by offering enterprise-grade features without the enterprise-grade costs.

🛡️ Control your operational risks and prevent fraud with withdrawal approval workflows

Hello there! 👋 Happy new month and welcome to March! As we step into a new month, we’re excited to bring you more tools and updates to help you scale your lending business seamlessly. From improved workflows to smarter decision-making, we’re constantly innovating to make lending easier, faster, efficient, and more profitable for you. Here’s […]

Frequently asked questions on credit scores and blacklists

Understanding credit scores and blacklists is essential for anyone seeking loans, credit cards, or financing. This article answers the most common questions people have, from how credit scores are calculated to what being “blacklisted” really means, how long it lasts, and whether you can fix it. Whether you're building credit or trying to recover from past issues, this guide breaks everything down in simple, practical terms.

Frequently asked questions on mobile money loans

This article walks through more than twenty five of the most common questions around mobile money loans, with a clear focus on what lenders and credit providers need to understand.

How to obtain a Tier 3 or Tier 4 Microfinance License in Uganda

This article walks through how to obtain a Tier 3 Microfinance Deposit-taking Institution licence and a Tier 4 licence in Uganda

Why your loan default rate is high and five data points you’re ignoring

Many lenders blame late payments on “bad borrowers,” but the real problem is often hidden in the data they overlook. This article explains why your default rate is higher than it should be and highlights five powerful data points, often ignored by lenders that can dramatically improve underwriting accuracy, borrower monitoring, and repayment performance.

Frequently asked questions about Software Development Kits (SDKs)

This article compiles and answers the most common questions lenders and credit providers ask about SDKs, with a focus on real-world lending workflows such as borrower onboarding, KYC, credit scoring, disbursement, and repayment collection.

How to build your first credit score using diaspora-friendly loan apps

This article breaks down how long it takes to build a credit score, how credit scoring models work, how to establish credit in the US, UK, Canada, or Australia, and how to use diaspora-focused fintech platforms to strengthen your position on both sides of the ocean.

Frequently asked questions on starting a lending business in Nigeria

Starting a lending business in Nigeria offers big opportunities, but many founders struggle with regulations, setup steps, and risk management. This FAQ-style guide answers the most common questions, from licensing and CAC registration to choosing a lending model and handling collections, so you can launch your lending business with confidence.

How to use psychological triggers in your debt collection messages

This article breaks down how to apply specific psychological triggers in your debt collection messages in a way that increases voluntary repayment and preserves long-term customer relationships.

Everything you need to know about the Central Bank of Nigeria act

This article walks through the Central Bank Act with a focus on what it means for Nigerian lenders and credit providers.

Everything you need to know about Nigeria’s new tax laws

This article breaks down the tax reforms in practical terms and answers the questions lenders are already asking.