Can I use a cooperative license to lend in Nigeria?

One question that prospective Nigerian lenders always ask is if it’s legal to use a cooperative license to lend. Yes, it is.

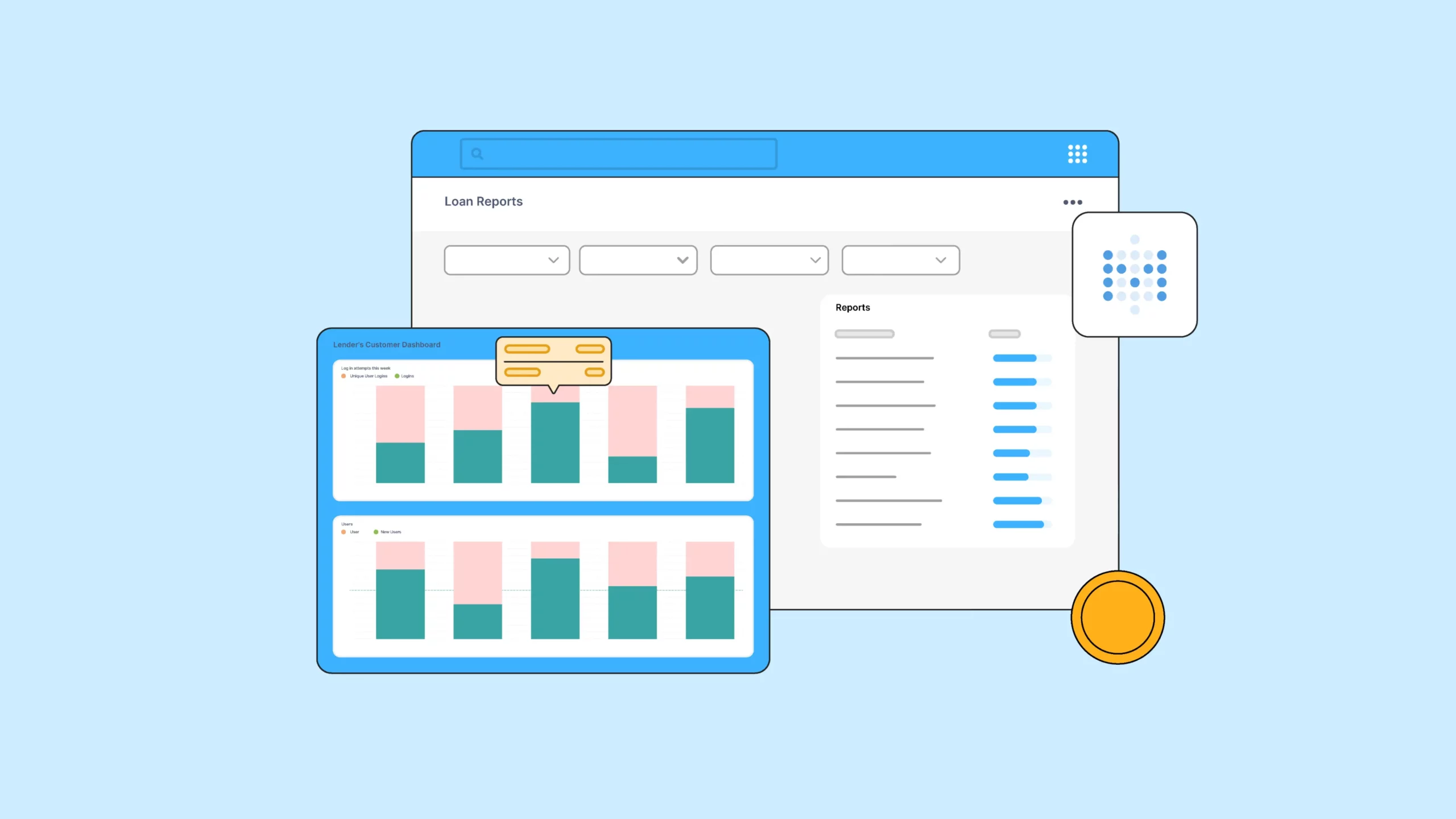

How we use Metabase to power our internal reporting

Metabase team deserves immense credit and we, at Lendsqr, are incredibly grateful to them. Their open-source platform is one of the best things we've ever gotten for free from the open source world.

7 loan apps in South Africa with low interest

This guide looks closely at 7 loan apps in South Africa that stand out for how their products hold up in practice.