Credit bureaus, credit scoring, and payments providers for lenders in Botswana

In Botswana’s lending sector, it’s not the interest rate or marketing budget that’s the most powerful tool—it’s the invisible mechanics that decide who gets approved, how money flows, and what risks lenders are willing to take. The real game-changers are credit bureaus, credit scoring models, and payment providers, and they’re reshaping how loans are managed, […]

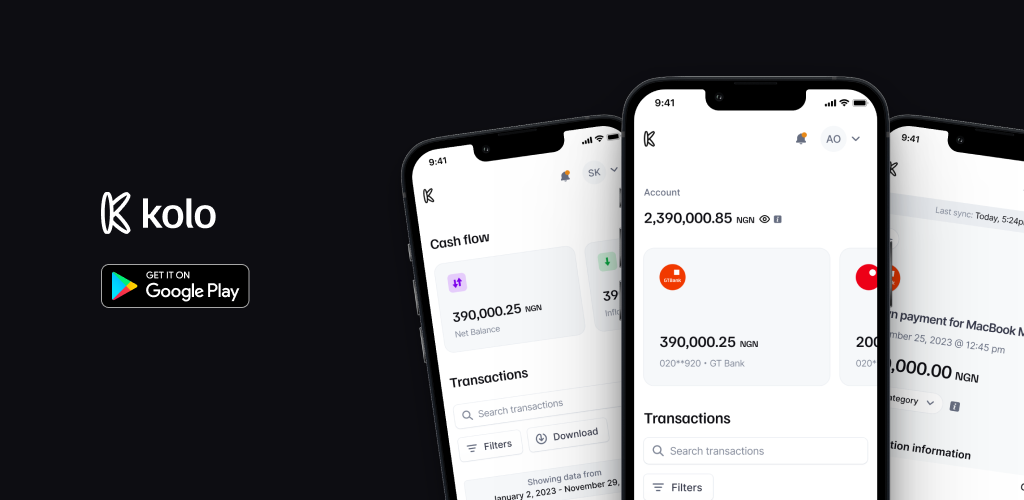

Managing your net worth across bank accounts

Handling numerous bank accounts can be a hassle so here are some tips to help you with proper management of all of your accounts:

7 lending strategies every modern lender should consider

This article lays out seven practical strategies that move measurable outcomes: lower customer acquisition cost, higher approval accuracy, faster time to decision, and stronger lifetime value.