Download the FCCPC Digital Lending Regulations 2025

Nigeria’s Federal Competition and Consumer Protection Commission (FCCPC) has published the Digital, Electronic, Online, or Non-Traditional Consumer Lending Regulations 2025. If you are in consumer lending, whether as a digital lender, app developer, service provider, or partner, these regulations are not optional. They define exactly how you can operate, the approvals you must get, and […]

💡 Give your customers flexible access to funds with overdraft

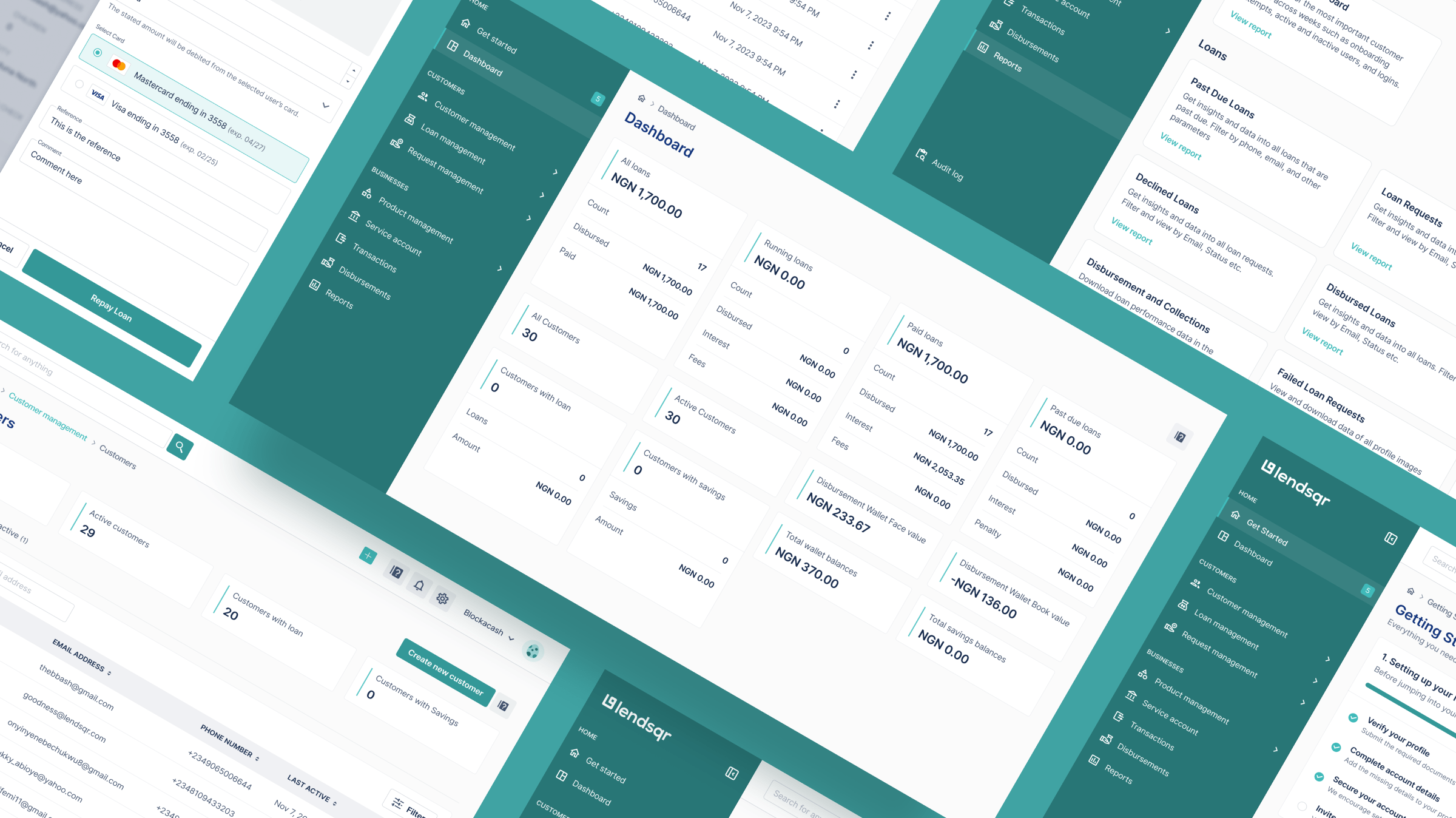

Hello there! 👋 Happy new month and welcome to September! 🌞 Two thirds of the year are already behind us. Back in January, many of us set ambitious plans and goals; September is the time to bring those intentions full circle, measure results, and push forward to finish strong. 💪 For us at Lendsqr, it’s […]

Introducing third-party disbursement: A game-changing feature for lenders

Third-party disbursement can now be configured on loan products on your Lendsqr lender account. Learn more about Lendsqr third-party disbursement feature