3 ways expense tracking can improve your financial health

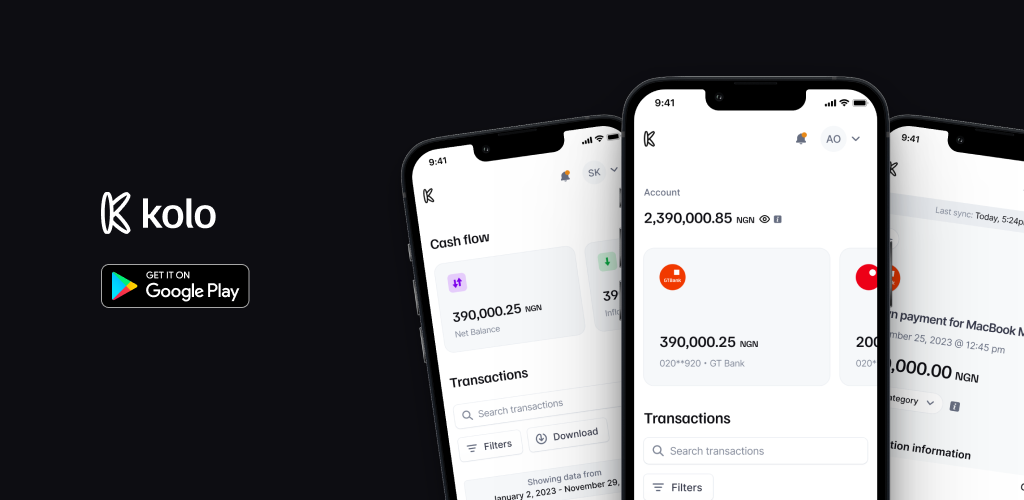

Kolo Finance — a personal finance management tool — allows you to combine all your Nigerian bank accounts. With your permission, it can get transaction data from your emails and SMS and put it all together in an understandable manner.

Answering your most asked questions

As requested, here are answers to some of the most frequently asked questions about your go to financial management app, Kolo.

How lack of consequence for loan defaults is destroying the African credit ecosystem

Lack of loan default consequences is destroying Africa’s credit ecosystem from the inside out and it's causing a vicious cycle of distrust.