A deep overview of consumer credit in Ghana

This article offers a comprehensive overview of Ghana’s consumer lending sector from 2019 to 2024. It explores the types of loans available, major lenders, the role of fintech, regulation, and the social dynamics of borrowing.

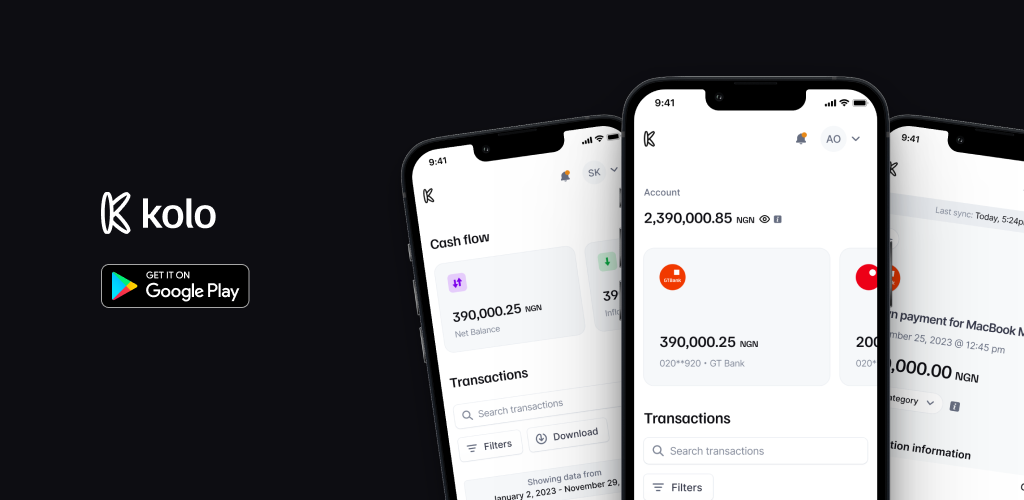

8 reasons why you should NOT use Kolo

Let's explore the different reasons why you shouldn’t make use of your Kolo account or encourage your family and friends to do so.

3 ways expense tracking can improve your financial health

Kolo Finance — a personal finance management tool — allows you to combine all your Nigerian bank accounts. With your permission, it can get transaction data from your emails and SMS and put it all together in an understandable manner.