Finance house vs. Microfinance: An overview of digital lending license

To operate a lending business in Nigeria, you must get a license. Figuring out which license suits your needs can be tricky. So, it's necessary to understand what each license allows and doesn't allow.

How to tackle loan defaults in the Caribbean: A lender’s guide

This guide breaks down proven strategies to tackle loan defaults in the Caribbean, from better risk assessment to smarter debt recovery.

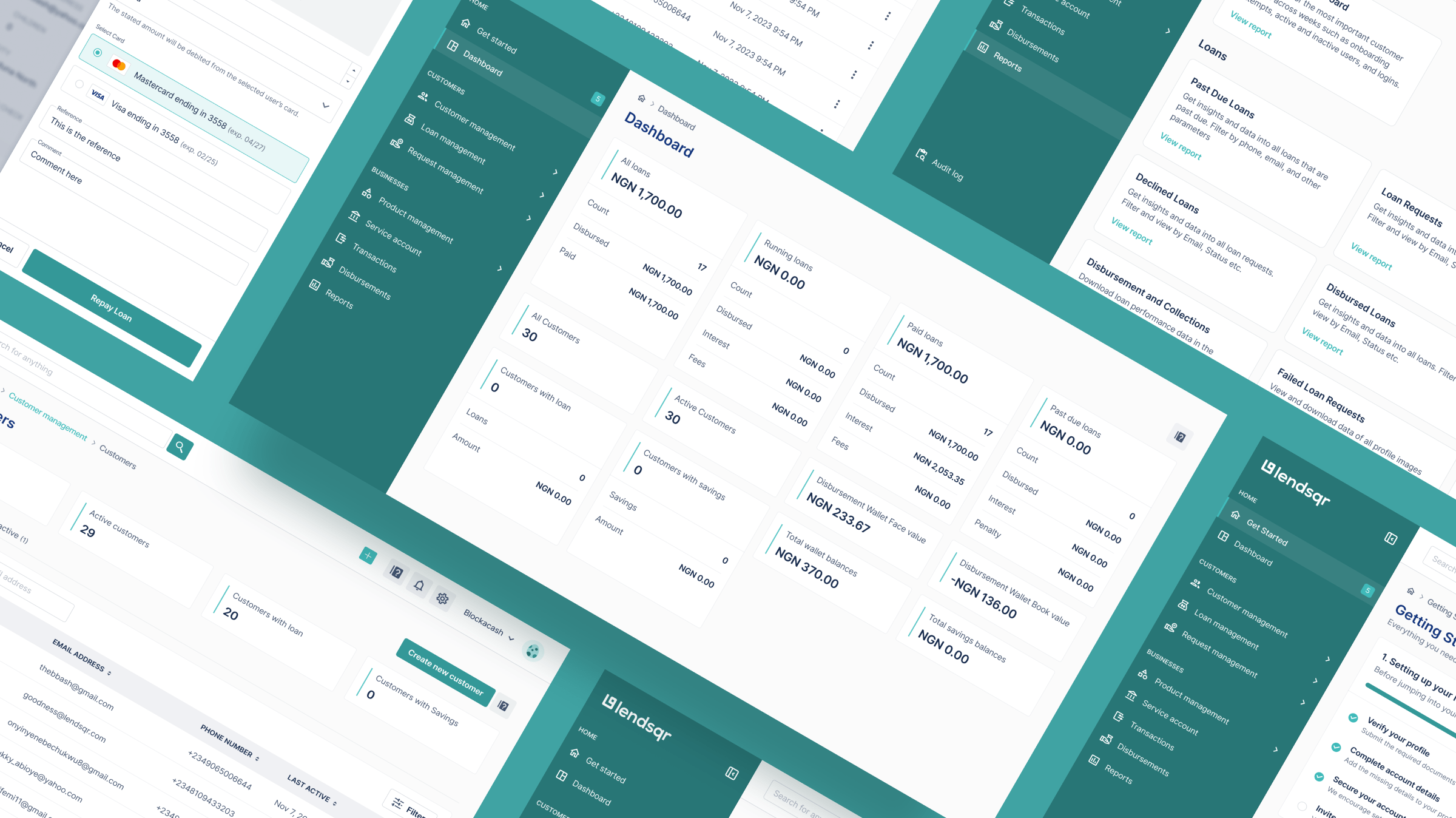

What are lending APIs and how do you get them?

Lending APIs are specialised APIs within the financial system designed specifically for lenders, who use them in part or in whole to decide loan approvals, onboard new borrowers, disburse loans, and collect repayments.