5 ways to stand out as a lender in Rwanda

Drawing from our extensive experience and industry knowledge, we've found Rwanda to be an ideal environment for digital lending. Find out 5 ways to stand out!

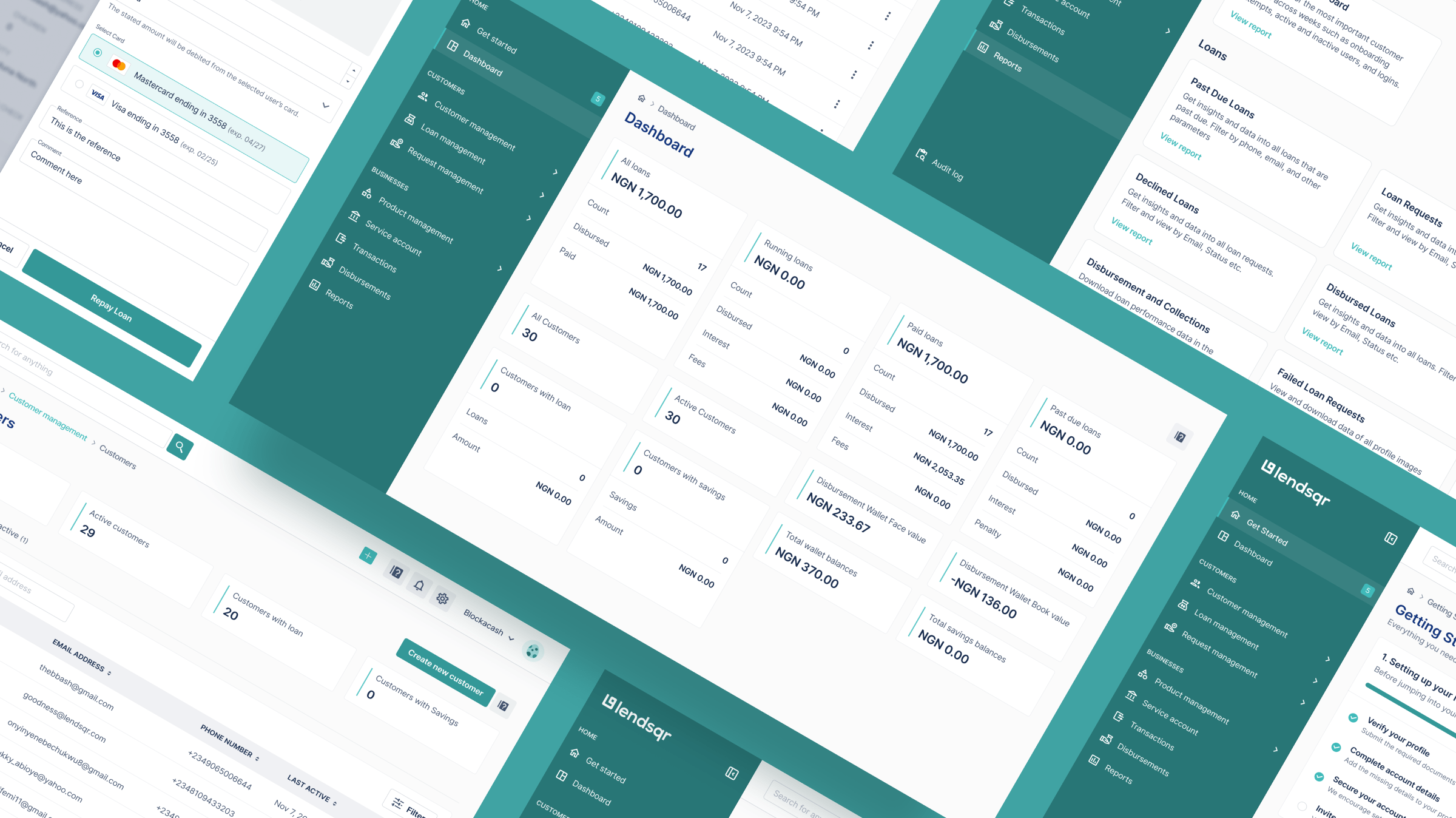

7 factors to consider when choosing a loan management software

Choosing the right loan management system is not just a decision; it’s an investment in the foundational tools that can elevate the success of your loan business. Find out what factors to consider when making this choice.

6 features in your loan app that chase borrowers away

Let's explore these potential red flags and how to ensure your loan app attracts, rather than repels, the very customers it aims to serve.