GSI vs Direct Debit: Similarities and differences

To clear the air and empower lenders to make informed decisions, let’s dive into the nuances between GSI vs direct debit.

How to start a money lending business in Zambia

In Zambia today, many people are struggling to access the credit they need. Over 60% of adults can’t get loans or use formal banking services, and the situation is even tougher in rural areas, where nearly 80% of people are excluded from financial services altogether. While Zambia’s economy has grown over the years, much of […]

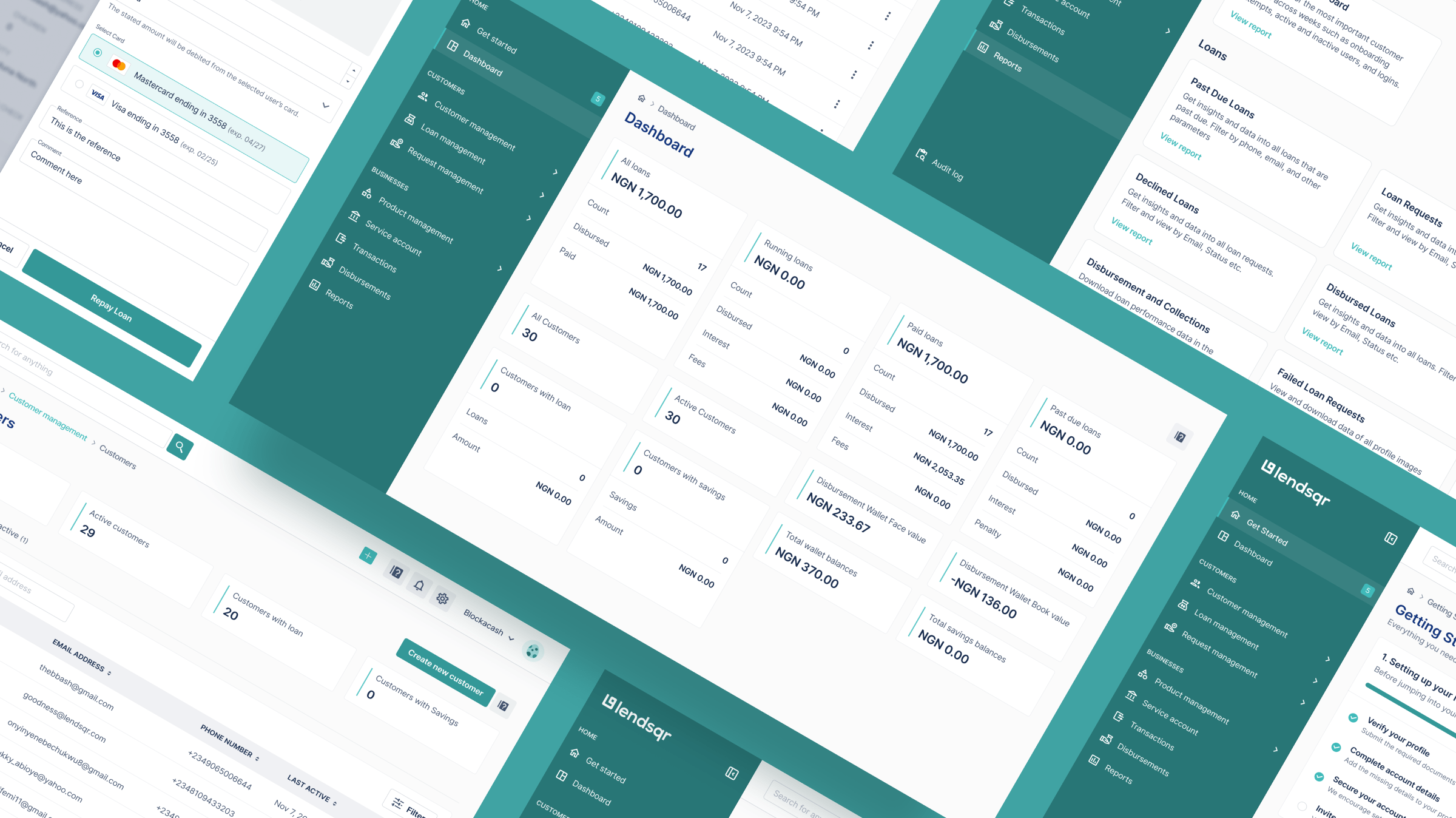

Get bank accounts and statements of your borrowers. Almost free.

Lending is a game of data – if you know as much as possible about your customer, you can make a good decision about if to give a loan, how much to give, or even for how long to give or not to give. However, getting this data is harder than breaking a coconut with […]