Why lenders check credit reports and what they really look for

Credit reports sit quietly in the background of lending, yet they influence almost every decision a lender makes.

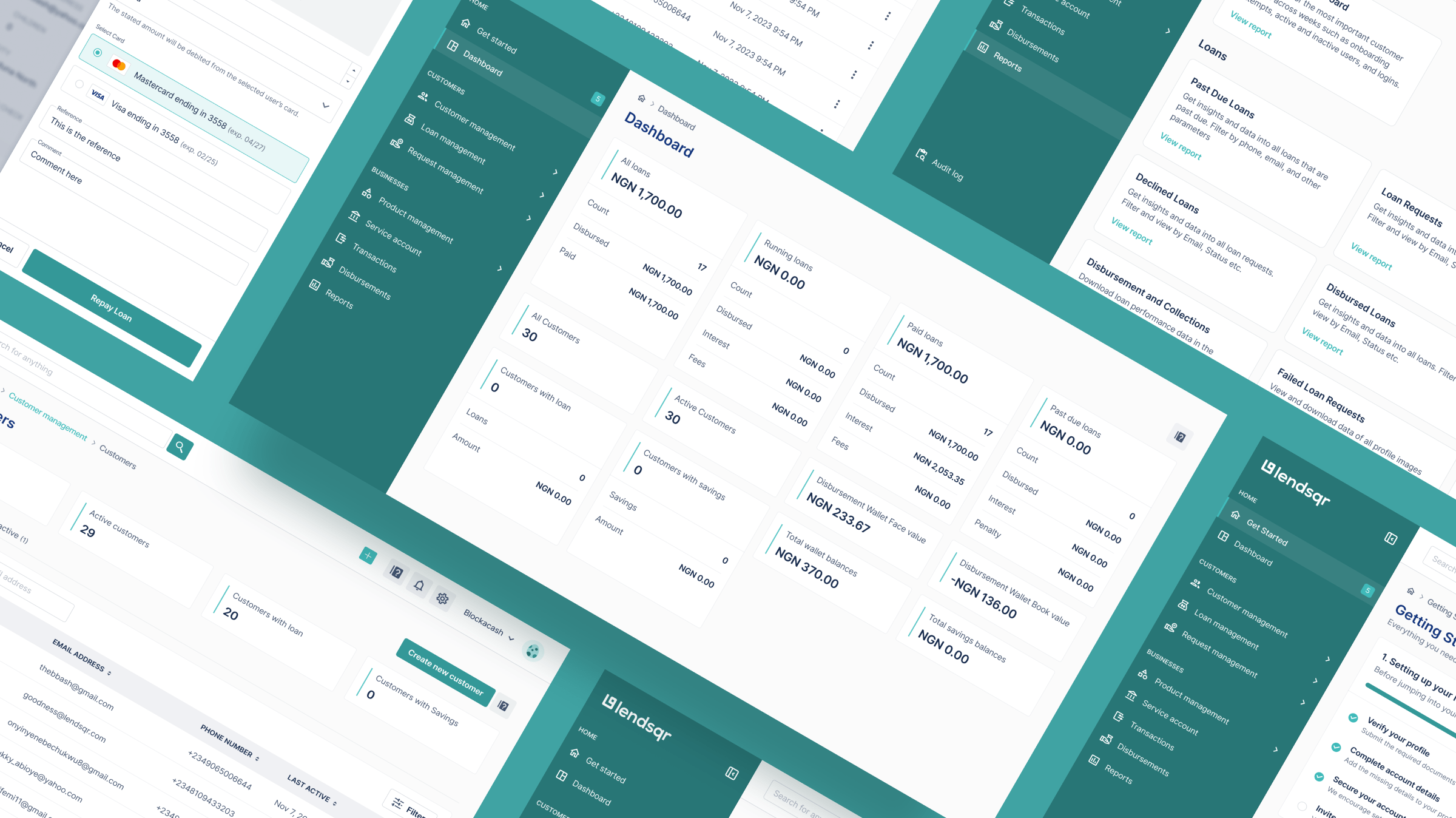

Why you need to work at Lendsqr and how to land a role with us

You’ve successfully passed the initial screening — congratulations! Now you’re entering the interview phase, and we want to help you prepare. Here’s a step-by-step breakdown of what to expect, and how to make the most of your opportunity with us.

Let’s help you separate sheep from wolves!

We both know that not all customers are the same: some are angels, others are less salubrious; some are good for the money, and others will probably fleece you. How then do you separate the wheat from chaff or the sheep from the wolves? Or how do you even meet regulatory demands of Know Your […]