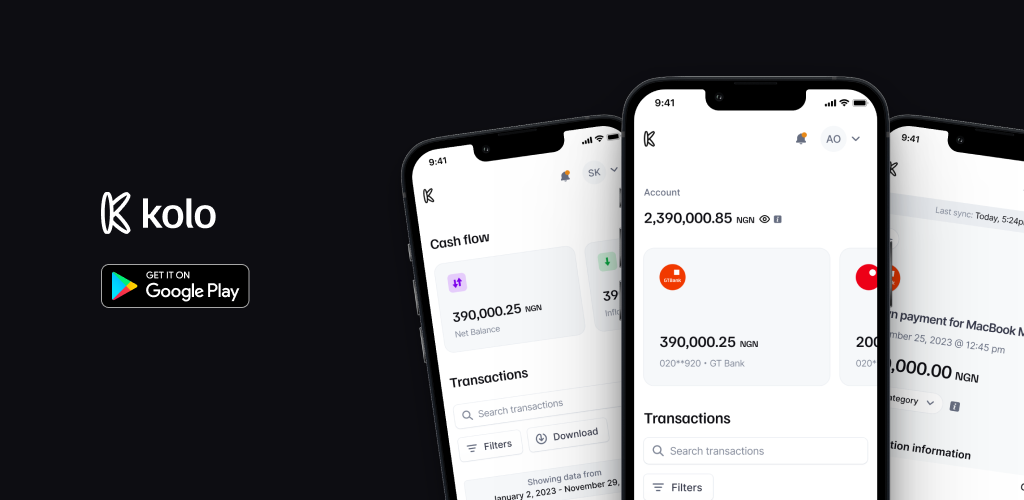

Take control of your finances this July with Kolo

To make the most out of Kolo Finance, here are some key steps to help you maximize financial management with Kolo.

Urwego finance vs SPENN: which is the best for Rwandans in 2025?

This guide is a way to look closely into Urwego finance and SPENN. If you’ve ever had to borrow just enough to keep going, this comparison is for you.

How to get lending license in Ghana

Getting a lending license in Ghana demands careful planning, from getting capital to building a strong operational foundation.