How to get the best out of Mifos? Pair it with Lendsqr

While Mifos excels at managing the back-end ledger and core banking functions, it does not offer a full suite of tools that modern digital lenders require to operate competitively.

Starting lending in Canada? Here’s how to get licensed

Getting a lending license in Canada involves understanding federal and provincial regulations because each has its own requirements.

We built Lendsqr to innovate affordable credit for all

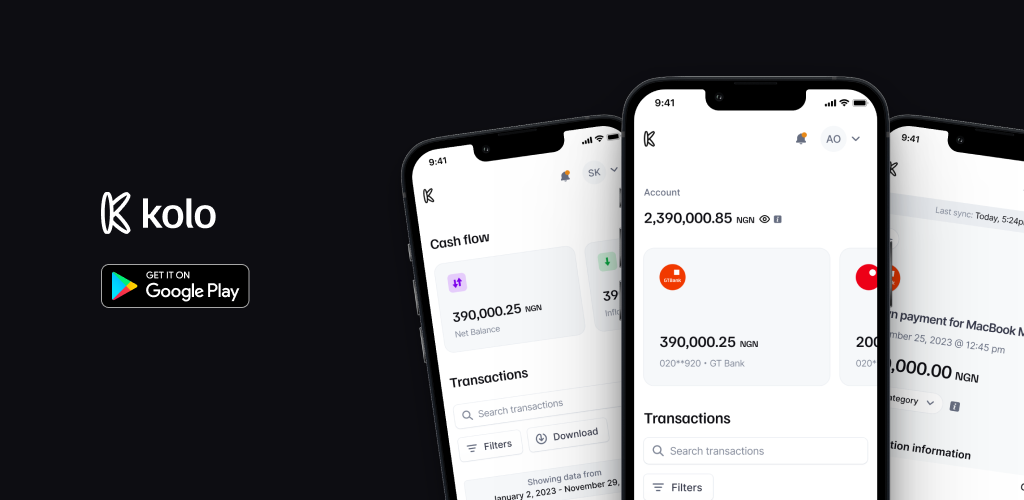

At Lendsqr, our mission is to make credit accessible, affordable, and fair for all. In 2020, we pivoted to solve this problem, and by September, our first lenders were already reaping the benefits of cost-effective cloud lending at scale. We built a cloud lending ecosystem that goes beyond technology, offering powerful, automated features to streamline loan experiences and provide access to bank data that informs smarter lending decisions.