BNPL vs. Traditional loans : What works best in Ghana

Does BNPL actually beat traditional lending from banks and microfinance institutions? That depends. Not just on the cost, but on your financial goals, discipline, and what kind of credit experience you're looking for.

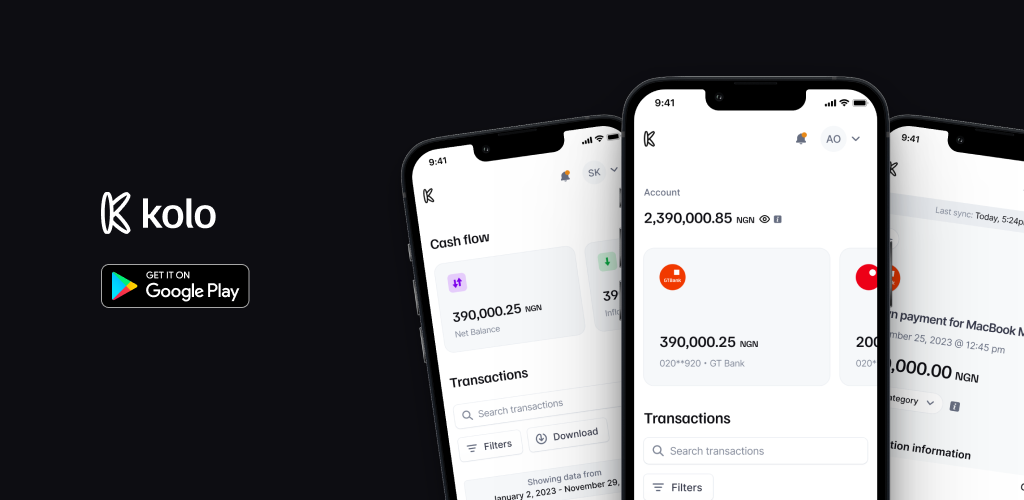

What payment gateways are available to Lendsqr lenders?

At the core of any decent loan management software, you must have payment services or providers that help you manage your loan disbursement and collection process.

How to use Lendsqr’s API to build rent-now-pay-later

The credit ecosystem is democratizing access to better housing through rent-now-pay-later (RNPL) loan services. Learn more.