A borrower’s right to data privacy is not negotiable

A borrower’s right to data privacy is not negotiable. Nothing gets your heart racing several miles per minute like the chance that you may not recover your loans, but that fear can never justify invading a borrower’s privacy. Responsible lending means collecting only the data you truly need and nothing more. Borrowers privacy is a fundamental right, and it must never be compromised.

Programu 5 Bora za Mikopo ya Ksh 5,000 Nchini Kenya

Wakenya wengi hupata chini ya Ksh 50,000 kwa mwezi, huku wastani wa mapato ya kila mwezi ukiwa Ksh 20,123. Ili kuelewa hali hii vizuri, kuishi kwa starehe nchini Kenya siku hizi kunahitaji takriban Ksh 150,000 kwa mwezi. Hii inaonyesha kuwa idadi kubwa ya Wakenya huishi kwa bajeti finyu na huenda wakapata ugumu wa kukidhi mahitaji […]

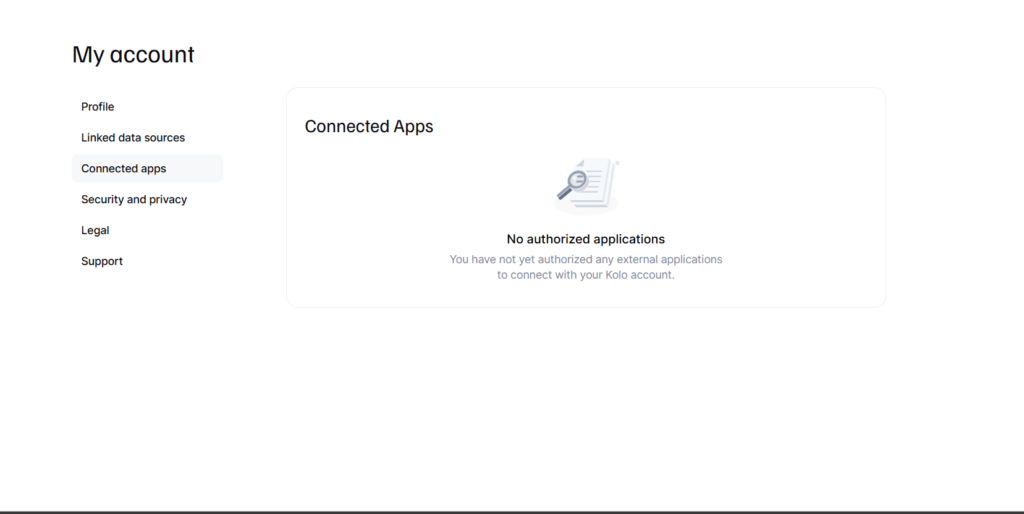

APIs for lenders to reduce NPL

Integrations via API to other ancillary platforms are key to ensuring your loans are paid back. They allow you to leverage on the tech, data and functionalities of the best providers to improve the quality of your loan flow.