10 questions you forgot to ask during your demo

Here are ten questions you probably forgot to ask during your demo with Lendsqr (but really should).

How to secure a loan without collateral

Loans are frequently tied to collateral. However, what isn’t commonly known is that not all loans require it. So how do lenders handle such risky loans?

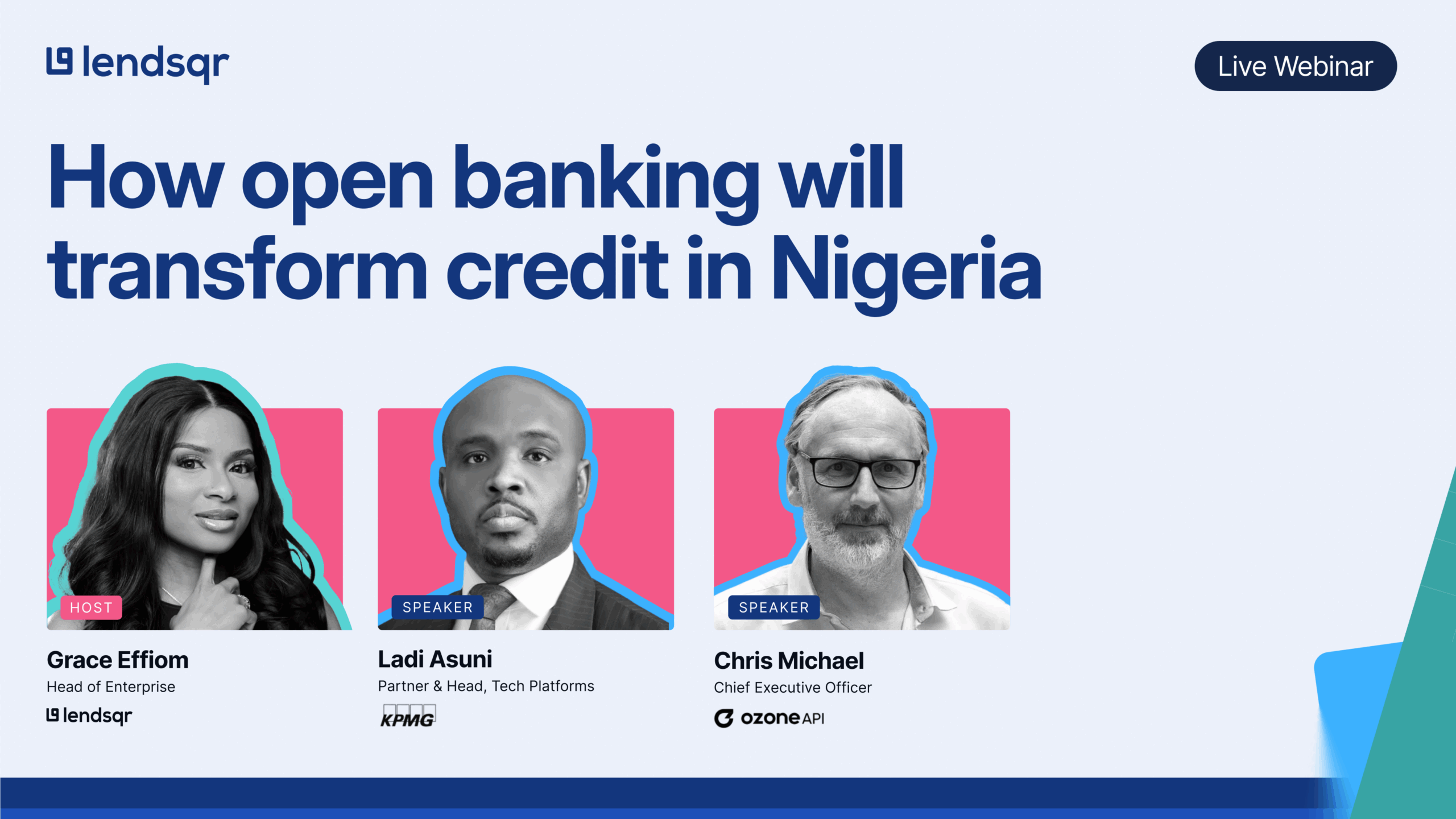

How Open Banking will transform Credit in Nigeria

On May 29, 2025, Lendsqr hosted an illuminating webinar titled “How Open Banking will transform Credit in Nigeria.” With over 100 attendees from Nigeria’s fintech, banking, and consulting sectors, this session brought together two global experts: Chris Michael, CEO of Ozone API and current lead on several open finance initiatives, and Ladi Asuni, Partner & […]