💡 Give your customers flexible access to funds with overdraft

Hello there! 👋 Happy new month and welcome to September! 🌞 Two thirds of the year are already behind us. Back in January, many of us set ambitious plans and goals; September is the time to bring those intentions full circle, measure results, and push forward to finish strong. 💪 For us at Lendsqr, it’s […]

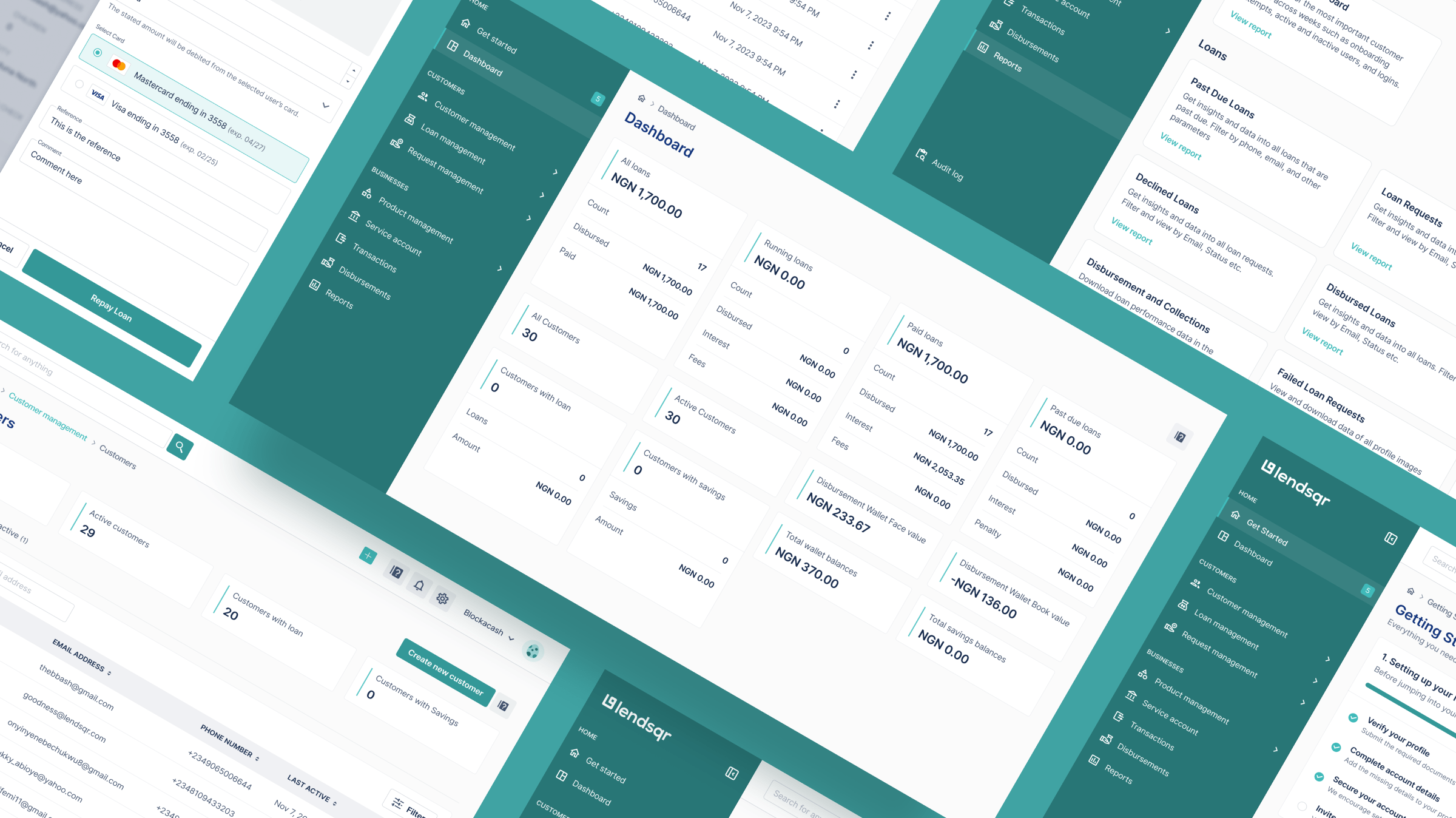

Why you need to upgrade from in-house lending software

Learn why upgrading from in-house lending software is essential for growth. Discover how modern cloud-based lending platforms deliver a smarter borrower experience.

BNPL vs. Traditional loans : What works best in Ghana

Does BNPL actually beat traditional lending from banks and microfinance institutions? That depends. Not just on the cost, but on your financial goals, discipline, and what kind of credit experience you're looking for.