How payday loan software helps lenders disburse credit faster

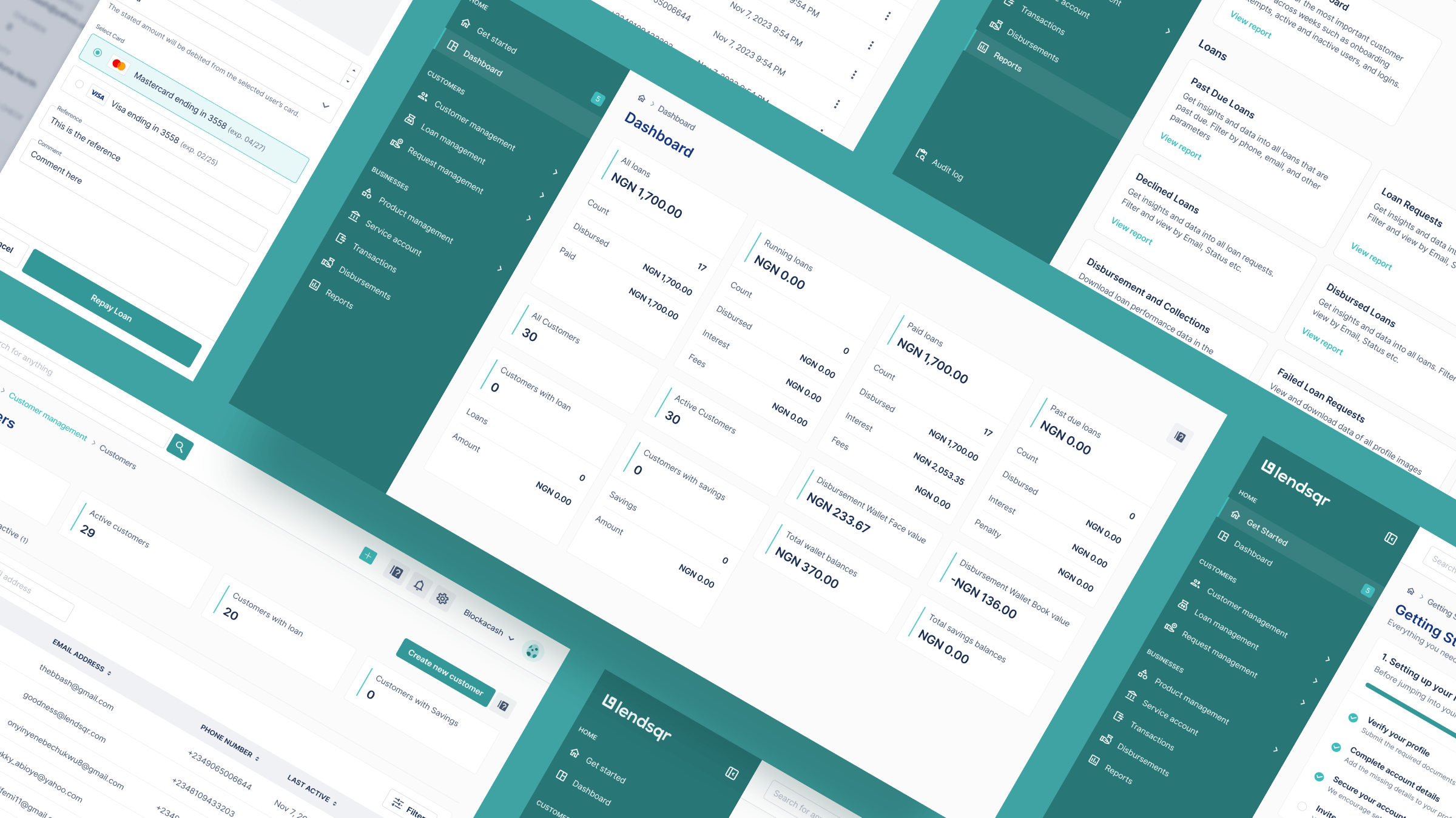

Speed matters to payday lenders because faster payouts directly affect the business in ways that quickly add up

🛡️ Control your operational risks and prevent fraud with withdrawal approval workflows

Hello there! 👋 Happy new month and welcome to March! As we step into a new month, we’re excited to bring you more tools and updates to help you scale your lending business seamlessly. From improved workflows to smarter decision-making, we’re constantly innovating to make lending easier, faster, efficient, and more profitable for you. Here’s […]

How to finance your first car as an immigrant in the US

Financing a car in the U.S. is available to you. The challenge is knowing which routes build your stability rather than drain it. That’s where this guide comes in.