How to use Mifos X and Apache Fineract with Lendsqr as a core banking system

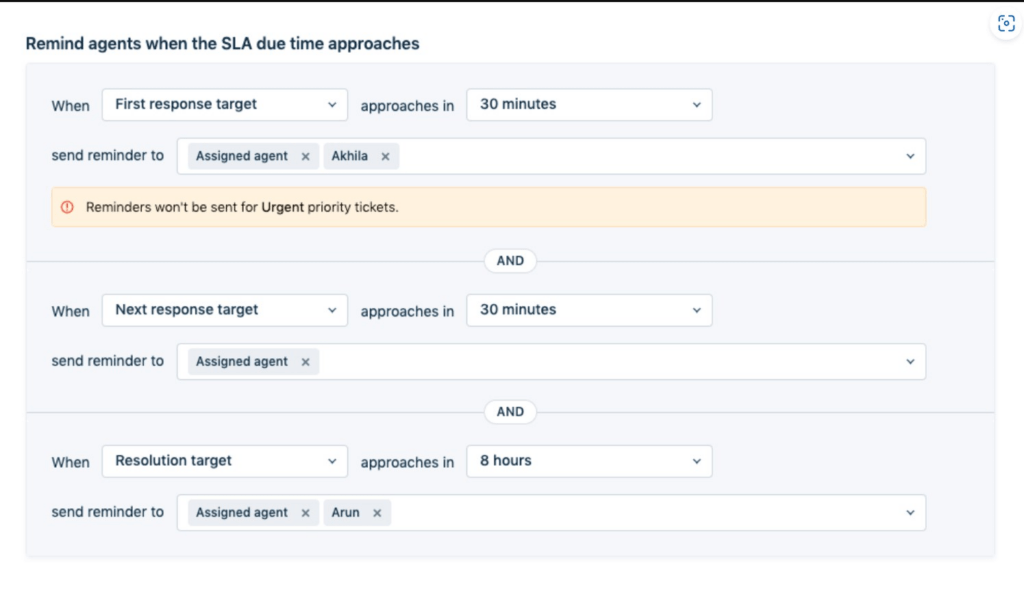

Traditionally, implementing a new core banking system can take upwards of six months. Lendsqr dramatically quickens this process with pre-built integration adapters.

A cultural view of loan defaults in Kenya

Executive summary From 2019 to 2024, Kenya experienced a steady rise in personal and consumer loan defaults, driven not just by economic challenges, but deeply rooted cultural behaviors, social expectations, and shifting attitudes towards debt. While formal banks, microfinance institutions, and mobile lenders expanded access to credit, repayment struggles mirrored longstanding cultural and communal dynamics. […]

How borrower behaviors have shifted under the threat of GSI

GSI is making borrowers think twice before taking out loans, pay closer attention to the fine print of loan agreements, and more.