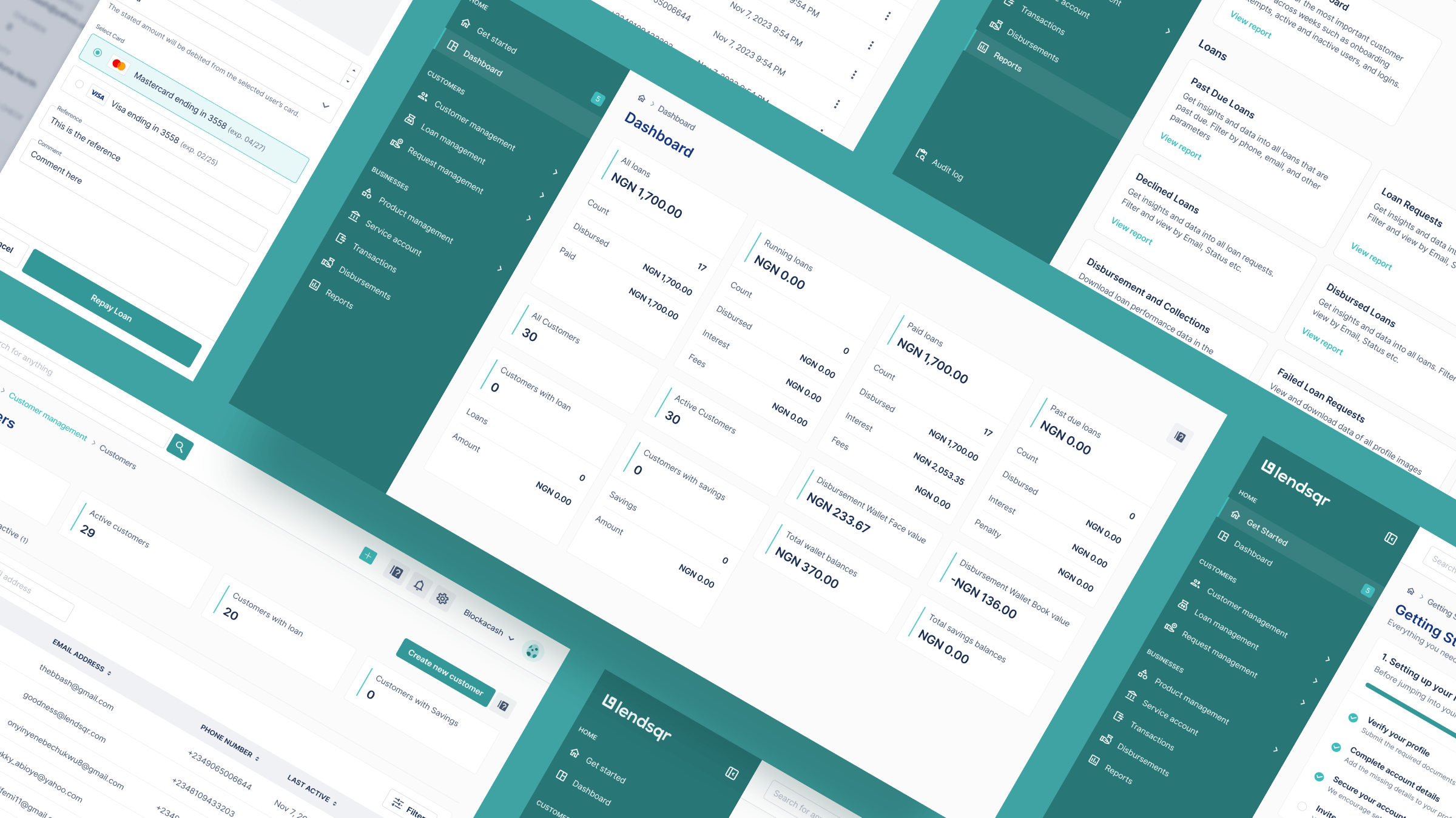

What you should expect from Lendsqr in 2026

Hello there! 👋 Happy New Year and welcome to 2026! 🌞 Before we talk about what’s next, we want to say a sincere thank you for entrusting your business to Lendsqr. Your feedback played a huge role in shaping the platform in 2025, and for many of you, choosing Lendsqr proved to be one of […]

A deep overview of business and SME loans in Ghana

Executive summary In Ghana today, running a small business isn’t just a choice. It’s a means of survival and progress. With over 80% of employment coming from the informal sector, entrepreneurship is often the default path for many Ghanaians, especially the youth. From food sellers to online vendors and fashion designers in Accra, micro and […]

5 reasons why most lenders don’t have access to GSI

While we encourage CBN to fix these issues, lenders on Lendsqr can still access more reliable ways to collect loans from customers.