How to get a student loan in Liberia

Higher education in Liberia still demands more persistence than it should. This article is a working map for students in Liberia seeking for loan options.

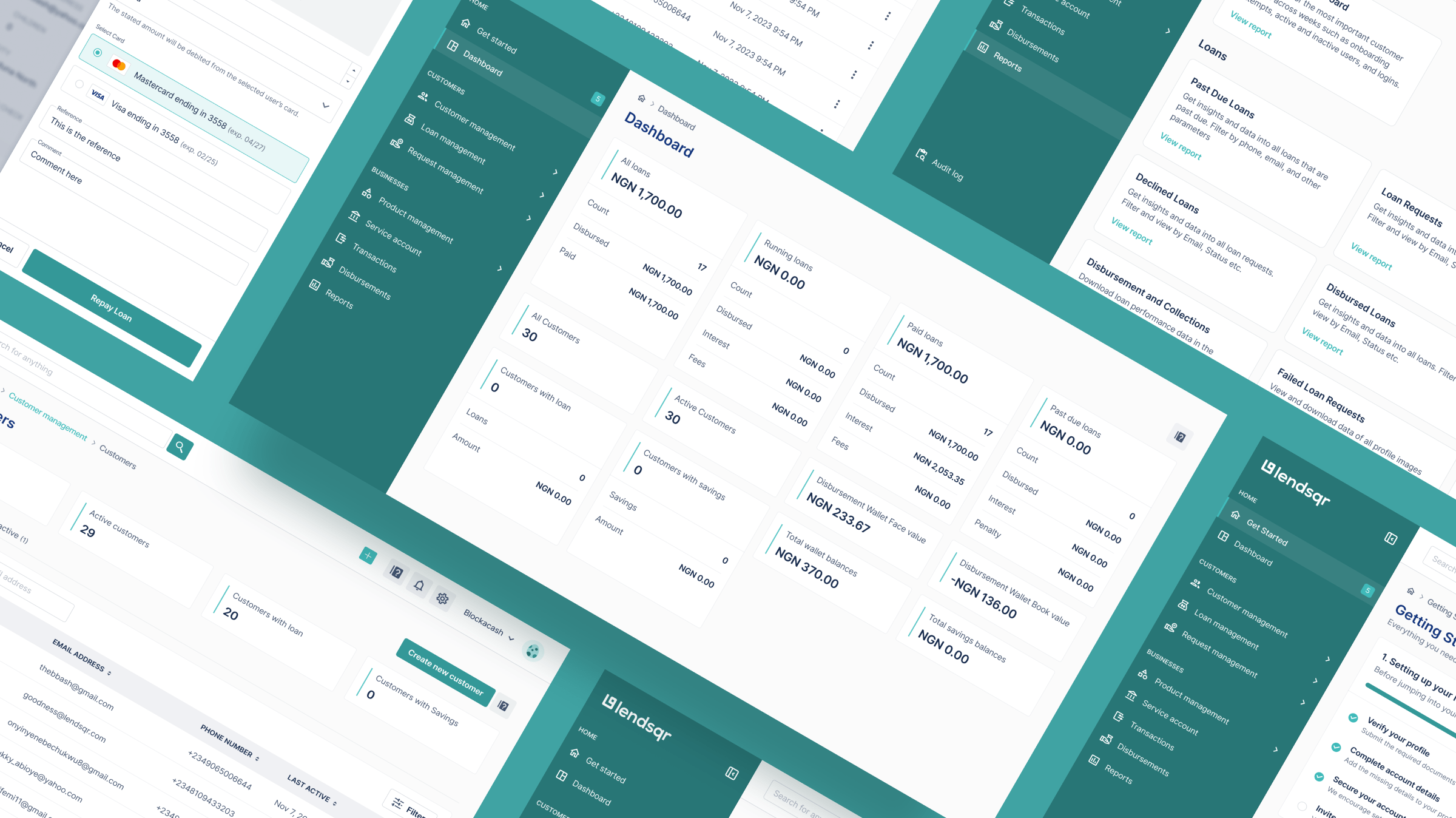

How to get the best out of Mifos? Pair it with Lendsqr

While Mifos excels at managing the back-end ledger and core banking functions, it does not offer a full suite of tools that modern digital lenders require to operate competitively.

💡 Your customers can now choose how they want to fund their savings 🆖

Hello there! 👋 Happy new month and welcome to June! Can you believe we’re already at the halfway mark of 2025? With just one month left in Q2, it’s the perfect time to evaluate the year and reprioritize if required. Remember the goals you set at the start of the year? How are they coming […]

OnePesa vs. FlexiCash – Which is the best loan app in Tanzania?

Getting access to credit in Tanzania has never been simple. For years, many people, especially those without formal jobs, collateral, or long banking histories have found themselves locked out of traditional financial services. Even for salaried individuals, the process of borrowing from a bank often involves days of paperwork, rigid eligibility criteria, and long waits […]

How to get a student loan in Canada as an international student from Botswana

Despite all the gatekeeping, there are options if you know where to look. In this guide, we'll explore these options in detail, providing you with the information needed to bring your Canadian education aspirations to fruition.

How to get a student loan in the UK as an international student from Botswana

Every year, hundreds of young Batswana dream of studying abroad, especially in the UK. This guide is here to help you figure it all out from student loans to some lesser-known ways Batswana students are making it work.

How to get a business loan in Ghana

If you’ve ever tried to grow a business in Ghana, this guide is for you, we’ll break down the types of business loans available in Ghana, where to get them, what lenders are really looking for, and how to boost your chances of getting approved.

How to get a student loan in the US as an international student from Kenya

Getting a student loan to study in the U.S. as a Kenyan might seem like a maze at first but it’s definitely doable. In this guide, we've provided practical info to help you figure out how to finance your US studies without losing your mind or your wallet.

How to get a student loan in the UK as an international student from Kenya

As a Kenyan international student, the path to funding your studies in the UK can be rough but there are still ways to overcome these challenges and build the future you’ve always desired. Let’s walk through it step by step in this guide.

How to get a business loan in Kenya

The reality for most Kenyan entrepreneurs today is that they're full of ideas but lack the capital to execute. Securing a business loan can be an overwhelming process but in this guide, we've made it easier for you to understand.

How to get a student loan in the US as an international student from Zimbabwe

If you're trying to figure out how to finance your studies in the US, here’s a step-by-step guide to securing a student loan as a Zimbabwean student.