How to get a student loan in Namibia

This article outlines the steps, timelines, and key considerations to secure the funding you need and avoid common setbacks that keep thousands locked out each year.

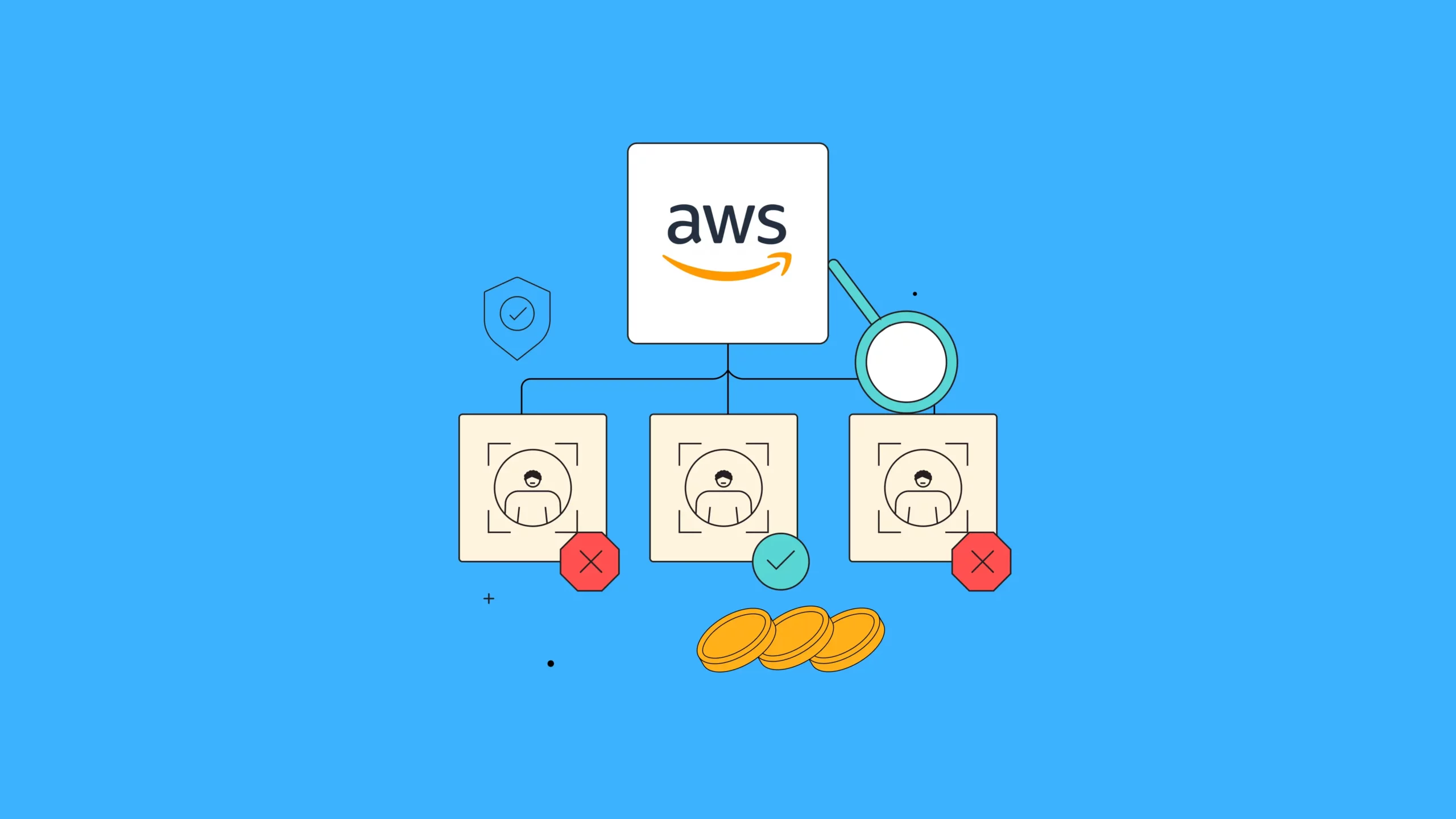

How we used AWS to build our identity and liveness system

Identity verification and liveness checks are central to lending. Learn how we used AWS to build our identity and liveness system.

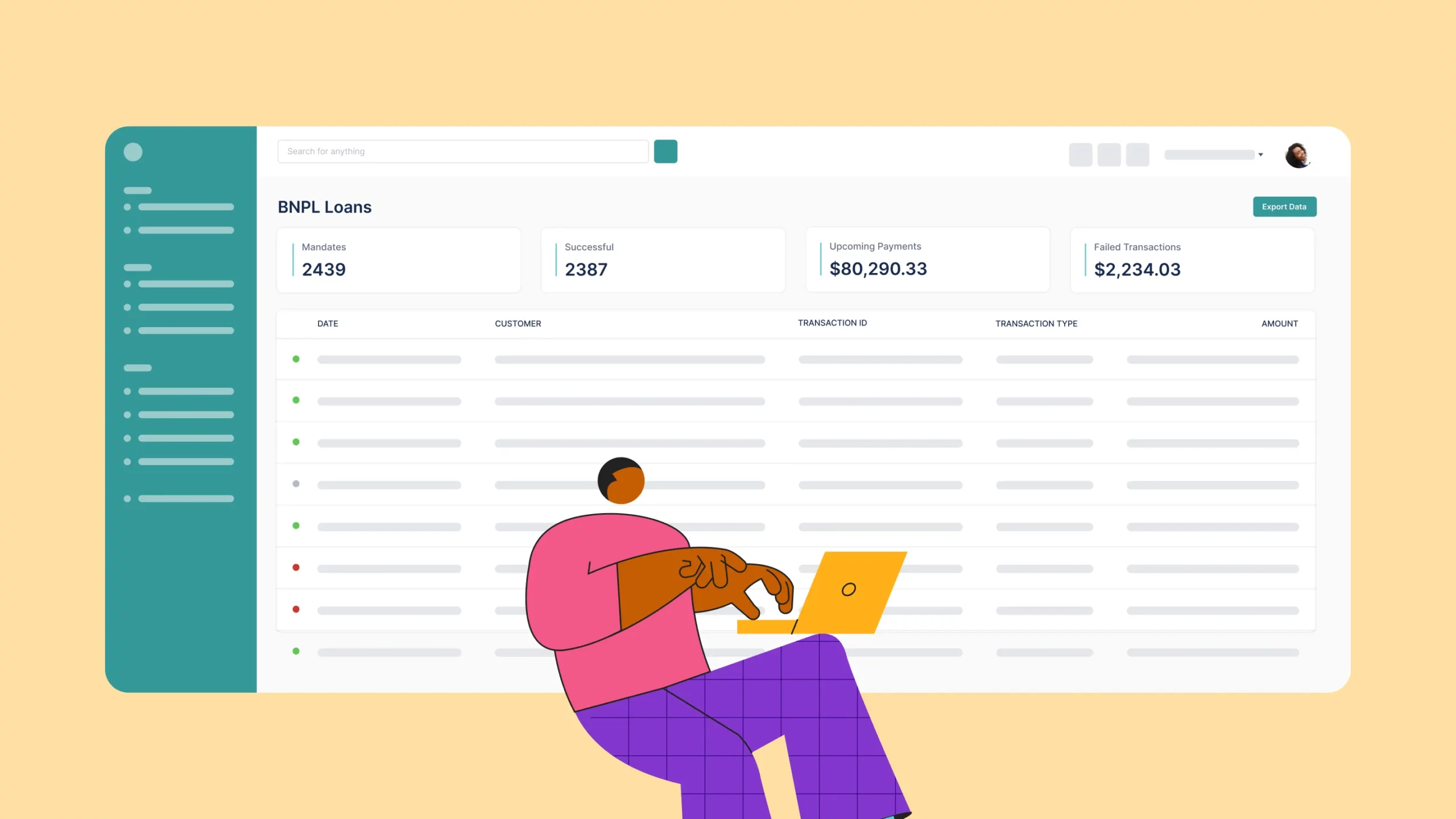

Embed BNPL into your platform without becoming a lender

It’s frustrating to know you could make the sale if only your customers had more payment options. This is where Buy Now, Pay Later (BNPL) comes in.