Top loan apps to get 100,000 rwf loan in Rwanda

Getting a loan in Rwanda today isn’t the hustle it used to be. With apps like SPENN, Muganga SACCO, Standard Life Rwanda, and Urwego Finance, cash is just a few taps away.

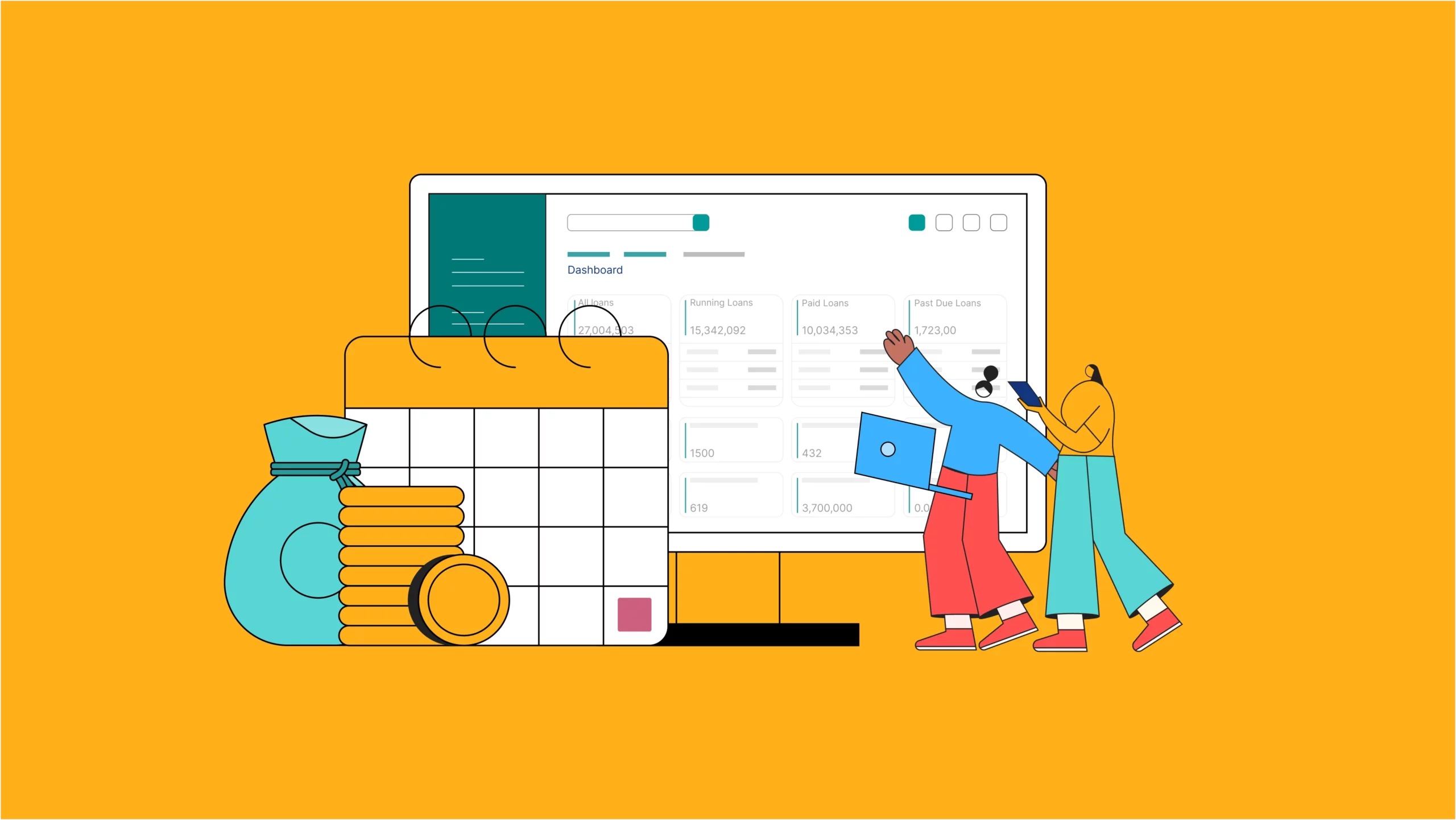

What to consider when setting up a payday loan software

Payday loans are short-term loans that help borrowers bridge the gap between paychecks. Essentially, a Payday loan is any loan that’s tied to a salary date. Now, let’s take a look at some things to consider when setting up payday loan software

Essential loan pricing strategies for every lender

Loan pricing is deciding how much interest to charge on a loan. In this article, we'll look at some factors influencing loan pricing and discuss different strategies for setting loan prices.