Best loan management software for Kenyan lenders: Lendsqr vs. Presta

Digital lending has completely transformed Kenya’s financial landscape, thanks in large part to mobile money platforms like M-Pesa. With over 83% of Kenyans using mobile money, access to quick credit has never been easier. This rise in digital lending has driven adoption rates sky-high—making it simpler for millions of Kenyans to access loans in minutes […]

How to get a lending license in South Africa

What started as a tiny tuck shop selling ice-cold drinks for Khaya soon evolved into something much bigger. However, it wasn’t long before customers, in between chatting about football and weekend plans, began to ask for small loans — a few rands here, a couple there, just enough to cover groceries or pay school fees. […]

How to secure your Finance House license in Nigeria

Today, though, we’re diving into the nitty-gritty of how to get a Finance House license. Don’t worry. We’ll walk you through the steps and show you precisely what you need. But first, let’s do a quick refresher on what a Finance House license is all about.

What investors want to see before they fund your loan startup

So, what exactly do investors want before they fund your loan startup? Let’s break it down.

Don’t have access to GSI? Use direct debit to achieve same result

With the right strategies in place, you can substitute GSI with direct debit and still achieve similar results. Let’s break this down.

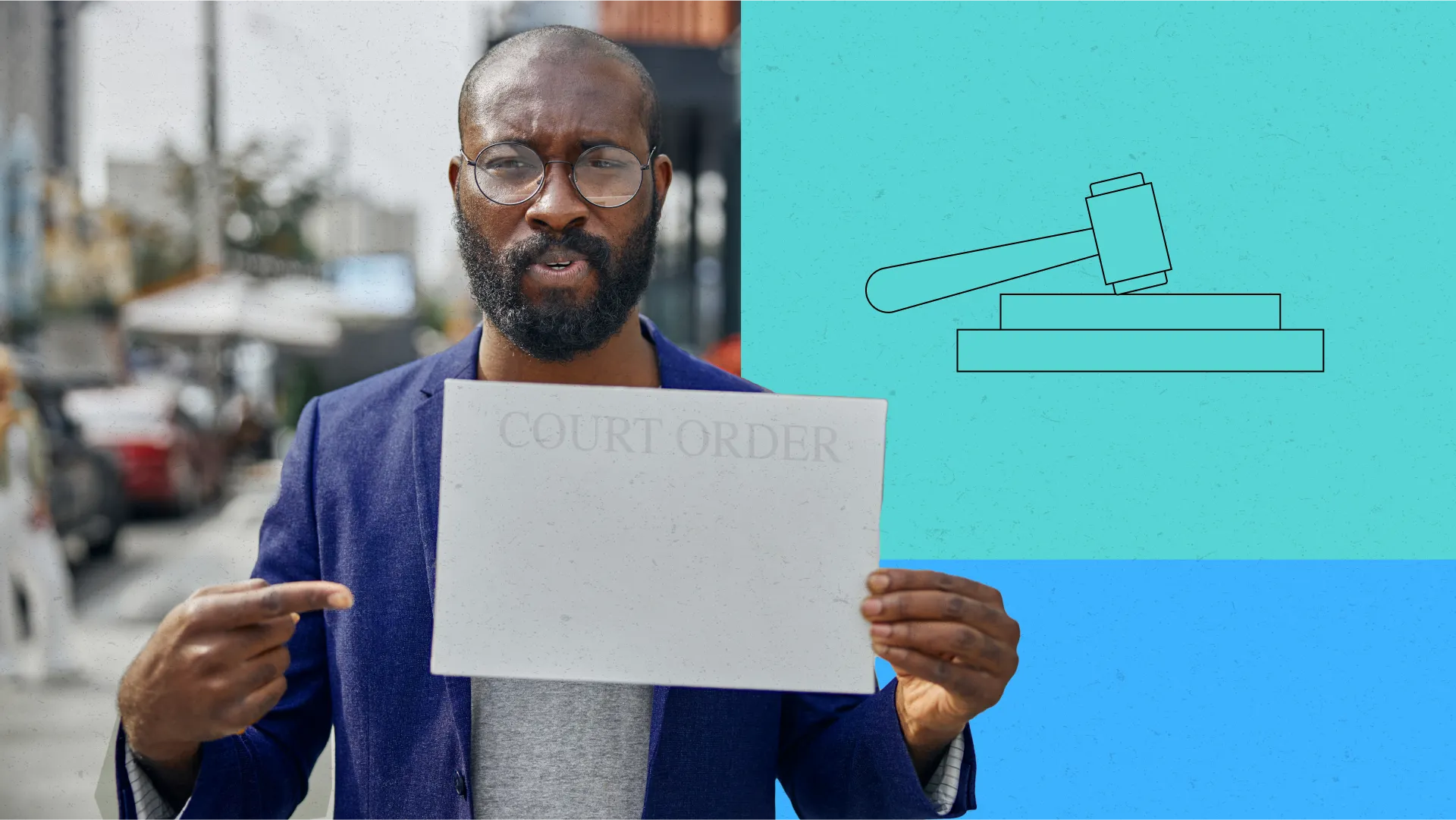

When to go legal with loan defaulters

Whether you're a small lender or a big institution, the decision to pursue legal action against a defaulter is governed by various factors, including the loan type, the borrower's behavior, and, most importantly, the legal framework in your jurisdiction.

13 female CEOs shaping the Nigerian credit ecosystem

What sets these female CEOs apart isn’t just that they’ve made it to the top—it’s how they’ve done it, and we're in awe!

How lack of consequence for loan defaults is destroying the African credit ecosystem

Lack of loan default consequences is destroying Africa’s credit ecosystem from the inside out and it's causing a vicious cycle of distrust.

Credit bureaus not enough? Try these alternatives

Credit bureaus are supposed to be the backbone of the lending process, yet they often fall short. Let’s explore three other alternatives

5 issues that lenders have with Nigerian credit bureaus

Before Nigerian credit bureaus were created, banks operated as lone wolves, reluctant to share credit information with third parties. They also didn’t have ways of knowing if a borrower had unpaid loans with other banks/financial institutions. As such, borrowers could easily secure multiple loans and cart away funds from different institutions without the lenders knowing. […]

Offline lending vs online lending: Pros and Cons

Not to declare one better than the other, but offline and online lending have their benefits and drawbacks.

3 reasons why direct debit hasn’t become a hit in Nigeria

We've championed direct debit as a better solution for loan repayments and recovery. For its efficiency and simplicity.