5 reasons why you should embed credit into your products and services

Even the most compelling marketing efforts can fail if consumers lack the means to pay. This is where embed credit becomes indispensable.

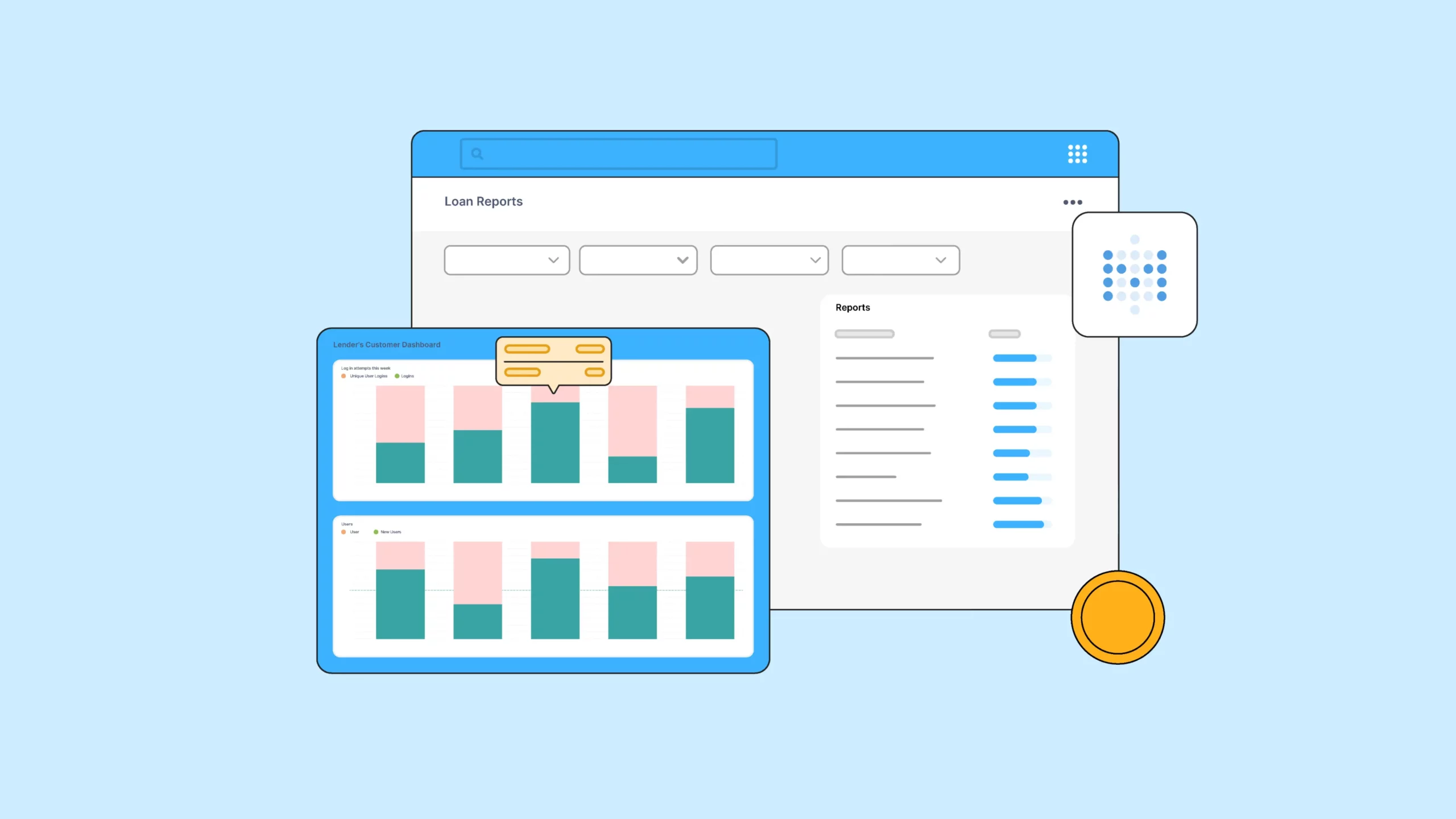

How we use Metabase to power our internal reporting

Metabase team deserves immense credit and we, at Lendsqr, are incredibly grateful to them. Their open-source platform is one of the best things we've ever gotten for free from the open source world.

How to get started as a lender in Sierra Leone

How do you start lending in a country where most people are still outside the formal financial system? In Sierra Leone, over 70% of the population are financially excluded. That means the majority of people don’t have access to bank accounts, loans, or digital payment options. This gap leaves many dependent on cash transactions, which […]