What collateral options exists for business loans

Most business owners think "collateral" means a house or a car, and if they don't have those, they assume they're out of the game. But the reality of lending in 2026 is much broader. From the equipment you use every day to the invoices your customers haven't paid yet, your business is likely sitting on assets you didn't even know you could leverage. We’re breaking down the actual collateral options available today, so you can stop guessing and start securing the capital your business actually needs to grow.

Key providers for lenders in Jamaica: Credit scoring, KYC, and payment

If you’re considering lending in Jamaica, you will need the best of these service providers. Let’s talk about a few of them that will make you the go-to lender on the island.

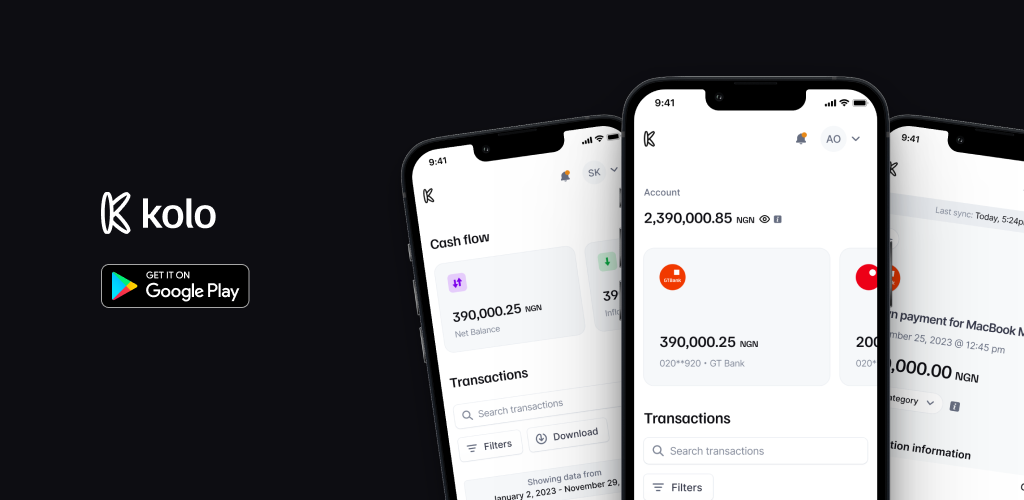

8 reasons why you should NOT use Kolo

Let's explore the different reasons why you shouldn’t make use of your Kolo account or encourage your family and friends to do so.