BNPL vs. traditional lending: What works best in Uganda?

Choosing between BNPL and traditional loans really comes down to what you need and when. They operate under different models, offer distinct benefits, and carry unique risks.

How to start a lending business in Nigeria from Canada, UK, and the US

So, if you’re serious about starting a lending business in Nigeria from the comfort of your Japa base, you’re in the right place. We’ve laid out the steps you need to turn that vision into reality.

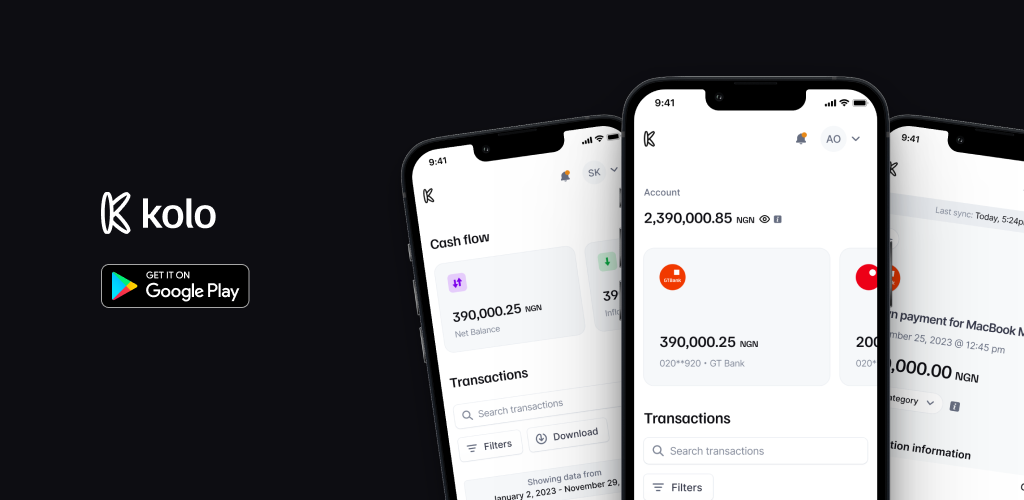

8 reasons why you should NOT use Kolo

Let's explore the different reasons why you shouldn’t make use of your Kolo account or encourage your family and friends to do so.