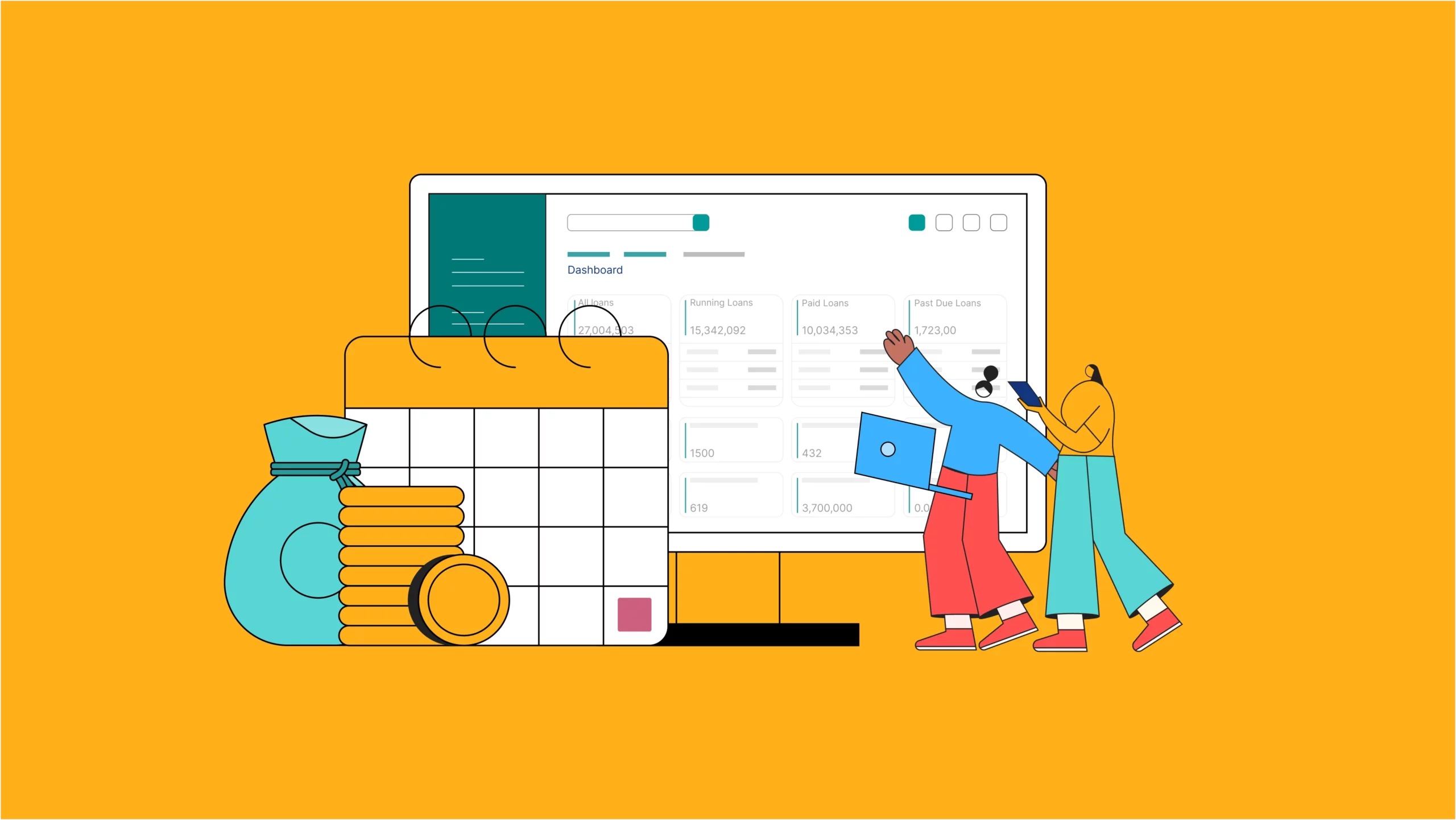

What to consider when setting up a payday loan software

Payday loans are short-term loans that help borrowers bridge the gap between paychecks. Essentially, a Payday loan is any loan that’s tied to a salary date. Now, let’s take a look at some things to consider when setting up payday loan software

8 reasons why you should NOT use Kolo

Let's explore the different reasons why you shouldn’t make use of your Kolo account or encourage your family and friends to do so.

Collect smarter, not harder: Ethical debt collection with technology

As a digital lender, how can technology be ethically employed for effective debt recovery? To find out how...