Build your own web and mobile apps with our core services API

At Lendsqr, we are continuously committed to making lending seamless and reducing the credit gap by providing technology that empowers you to offer credit to underserved populations one country at a time.

4 reasons why most loan defaulters are fraudsters

It’s time we stop sugarcoating this. Loan defaulters, in many cases, are fraudsters and here’s how they reveal themselves as such.

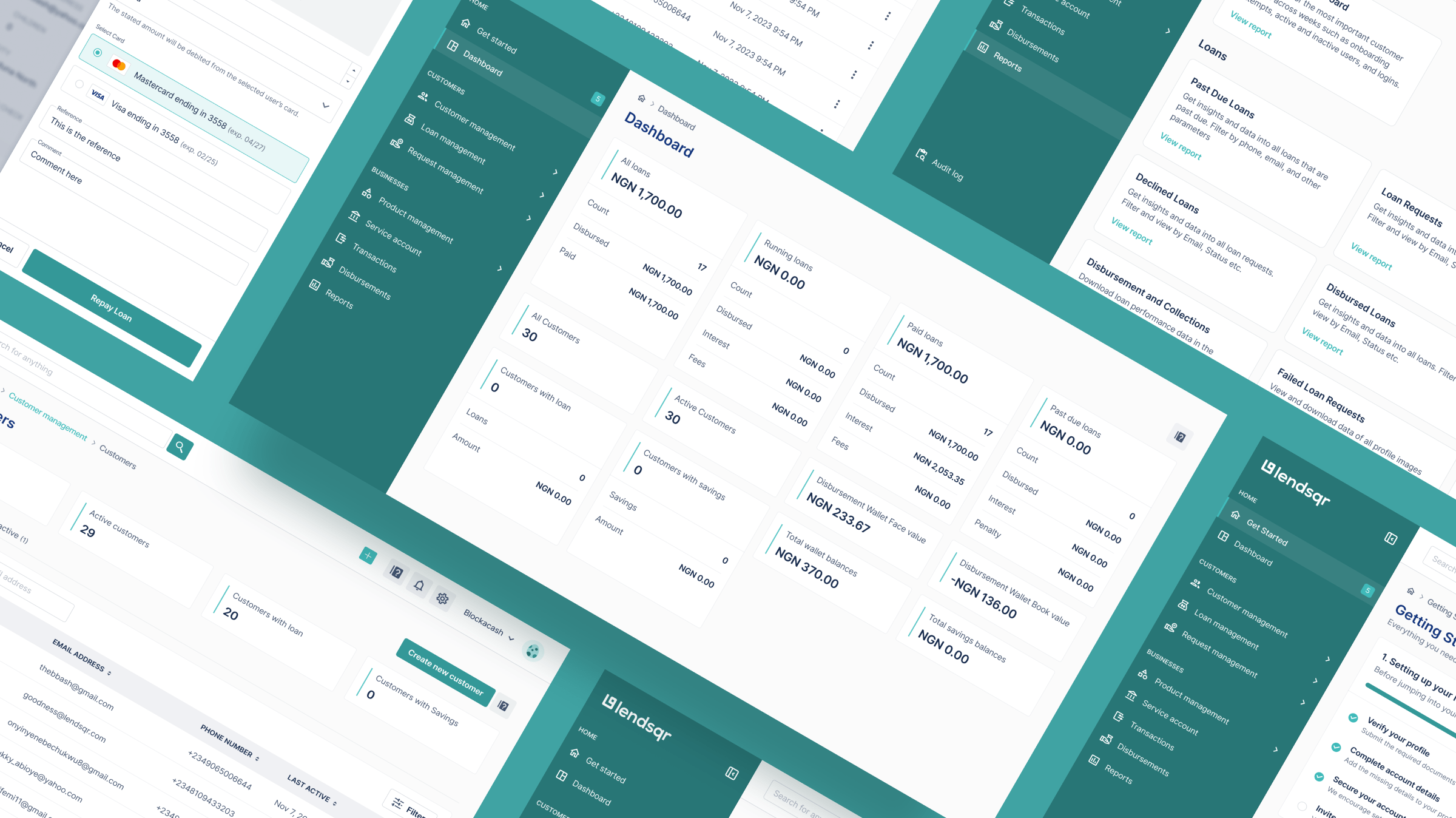

What is a loan management software?

A loan management software is the operating system for lenders, without which most modern and progressive lenders cannot succeed. Any idea what it is?