How to get a student loan in the UK as an international student from Zimbabwe

This guide will walk you through everything you need to know about securing a student loan as a Zimbabwean studying in the UK.

CBN’s Global Standing Instruction (GSI) explained

Understand what the CBN's Global Standing Instruction (GSI) is and how it affect loan repayments within the Nigerian financial ecosystem

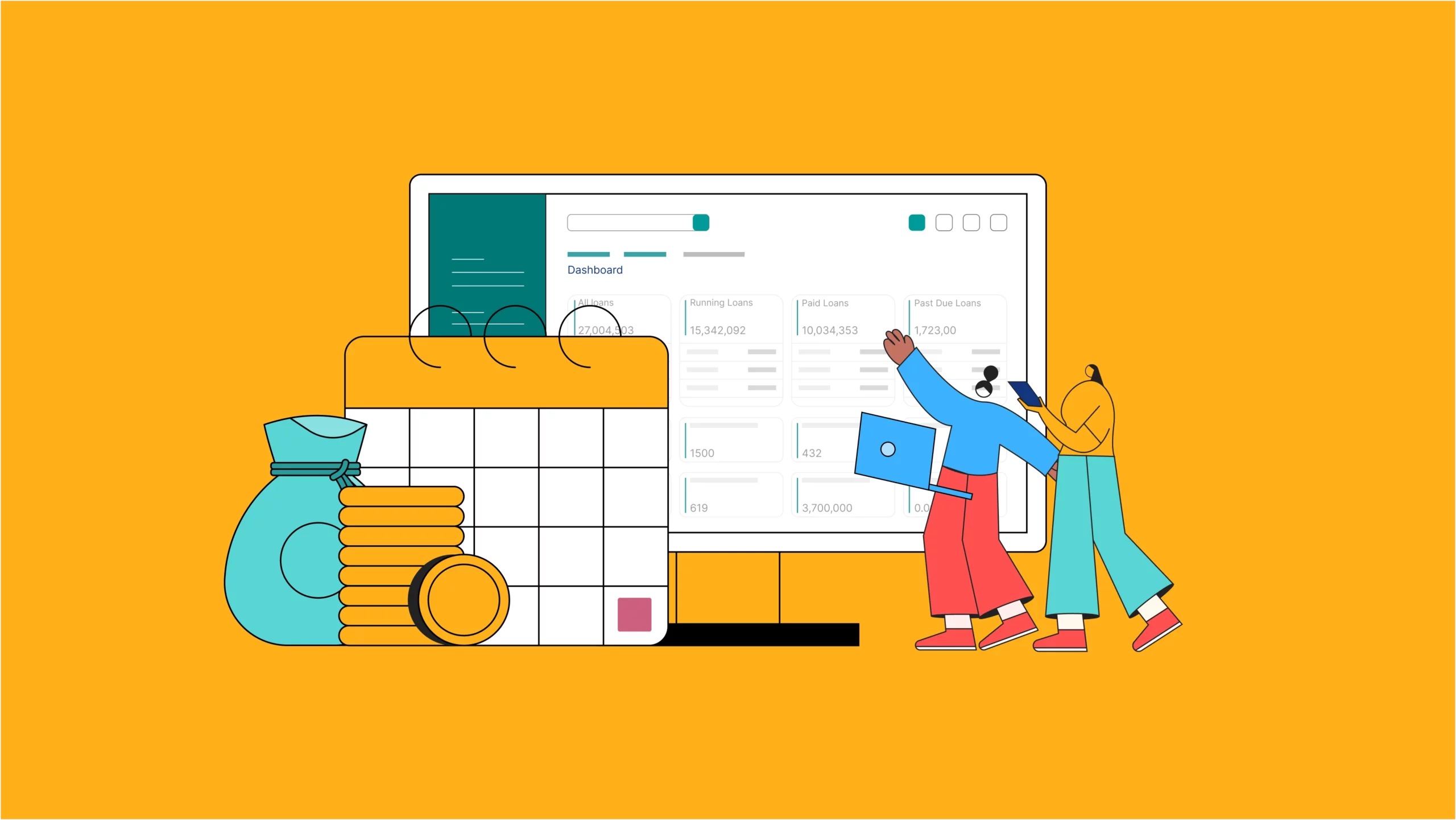

What to consider when setting up a payday loan software

Payday loans are short-term loans that help borrowers bridge the gap between paychecks. Essentially, a Payday loan is any loan that’s tied to a salary date. Now, let’s take a look at some things to consider when setting up payday loan software