Everything to know about the Nigeria credit reporting act

This article provides an explanation of the Credit Reporting Act. It stays close to the law while focusing on how the provisions affect lenders in practice.

Lendsqr expands to Zimbabwe with its Lending-as-a-Service platform to empower local lenders

Lendsqr, a leading global provider of loan management technology, has officially launched its Lending-as-a-Service (LaaS) platform in Zimbabwe.

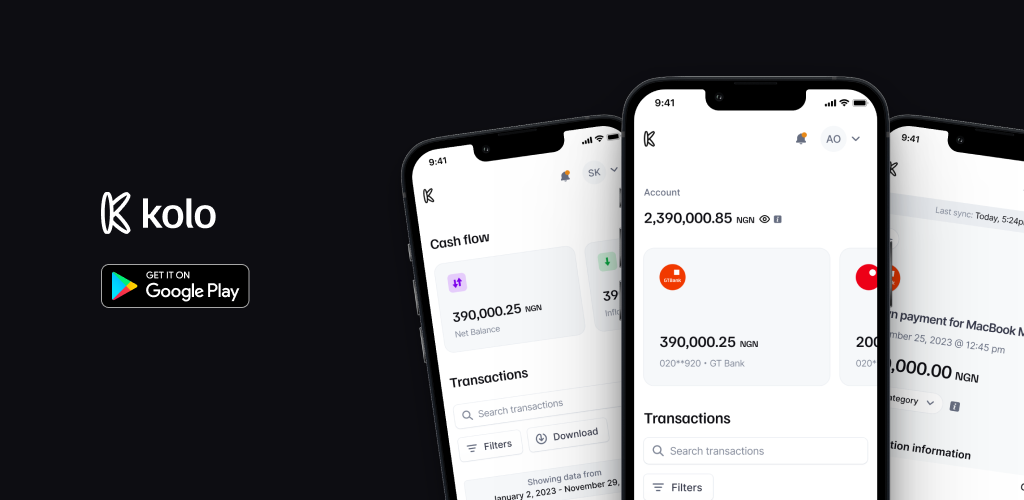

Take control of your finances this July with Kolo

To make the most out of Kolo Finance, here are some key steps to help you maximize financial management with Kolo.