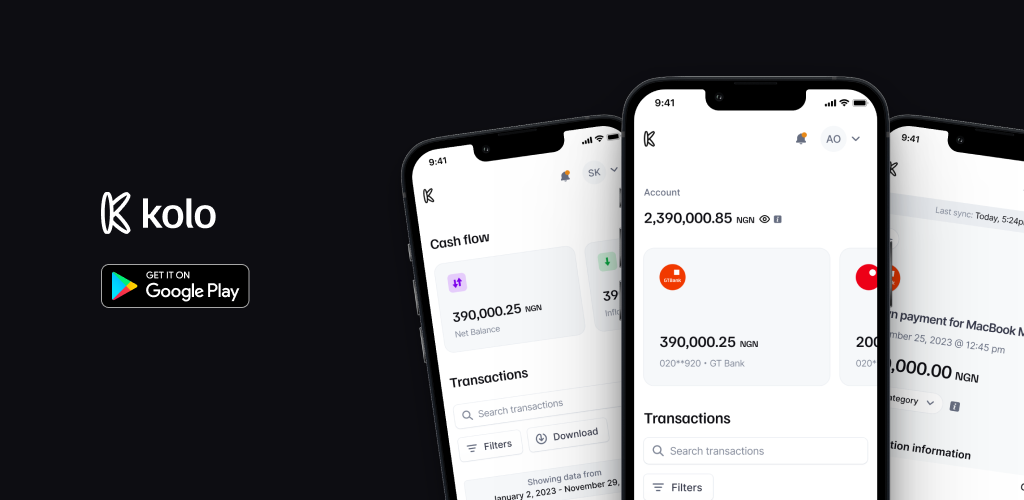

Managing your net worth across bank accounts

Handling numerous bank accounts can be a hassle so here are some tips to help you with proper management of all of your accounts:

Frequently asked questions on USSD channel for loans

This FAQ explains how the USSD loan channel works, what users can do on it, and what to know when troubleshooting or setting it up.

How to find a profitable lending niche and target the right borrowers

As a loan business owner looking to succeed, scale and stand out in the lending ecosystem, you must recognize that you can’t lend to everyone. We’ve highlighted several ways to target the right borrowers and find a profitable niche.