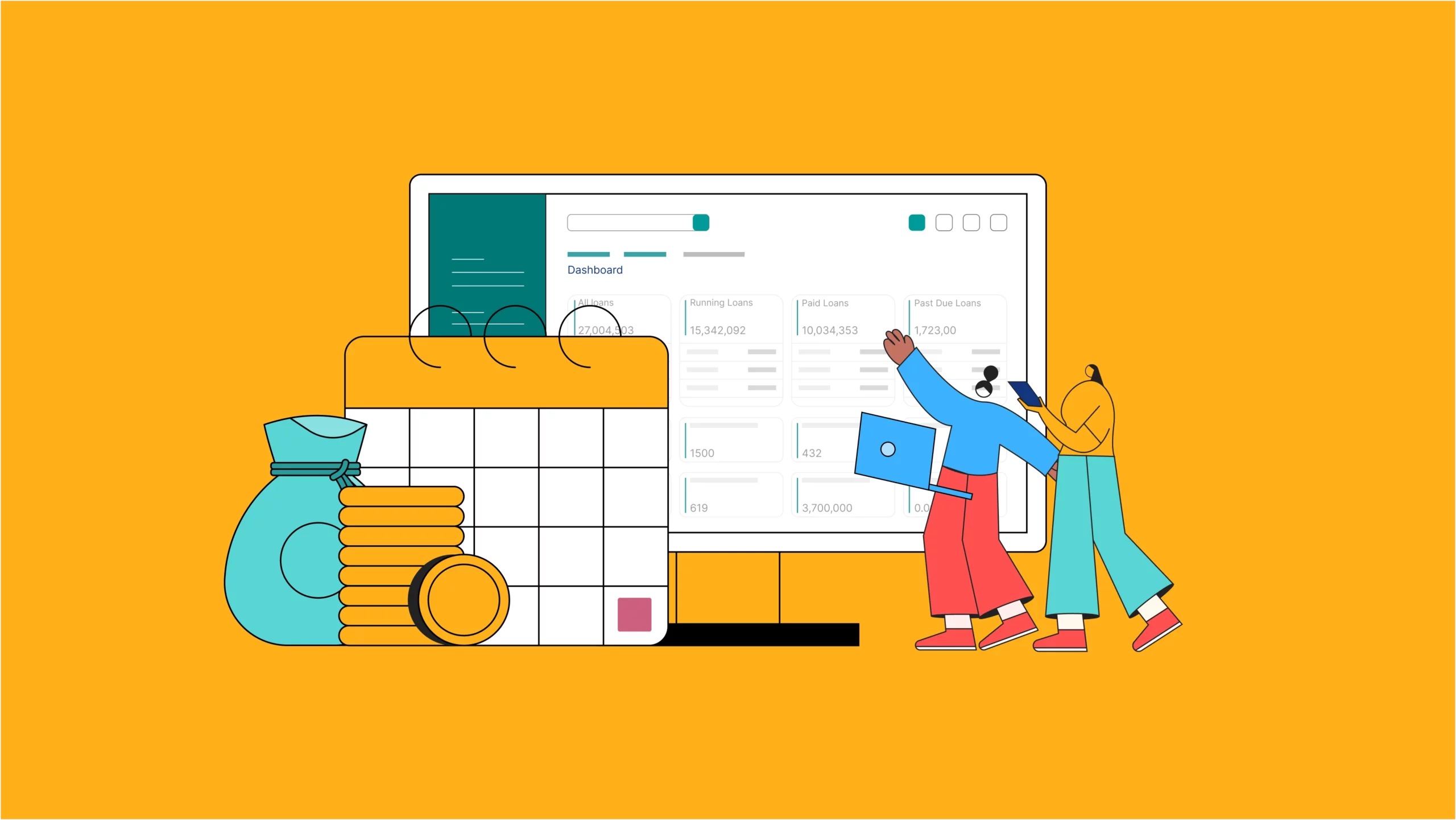

What are lending APIs and how do you get them?

Lending APIs are specialised APIs within the financial system designed specifically for lenders, who use them in part or in whole to decide loan approvals, onboard new borrowers, disburse loans, and collect repayments.

All you need to set up a student loan software

In most advanced countries, student loans are the norm, allowing almost everyone to attend university. Sadly, that’s yet to be the case in Nigeria.

You can now activate your direct debit mandates in 1 minute

Our direct debit system is now equipped with E-Mandate, an addition that puts control directly in the hands of your customers. Gone are the days when you and your customers have to chase bank officers around to approve mandates.