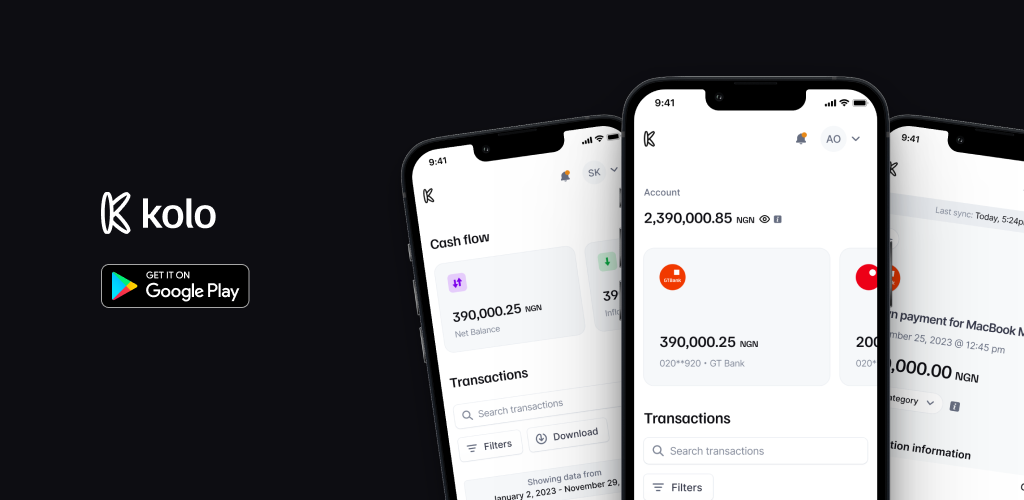

Answering your most asked questions

As requested, here are answers to some of the most frequently asked questions about your go to financial management app, Kolo.

What is the Credit Card Act and why was it introduced?

In the years before 2009, credit cards had become one of the most common forms of consumer borrowing in the United States. By 2008, household credit card debt had climbed past $900 billion, according to Federal Reserve data, and card issuers were enjoying some of their most profitable years. The business model was clear: interest […]

Handle payment collection like a pro with direct debit

Direct debit feature simplifies the payment collection process and enhances the monitoring of transactions.