Meilleures applications de prêt pour un besoin urgent de 50 000 RWF au Rwanda

Qu'il s'agisse d'une facture médicale soudaine, d'une réparation imprévue à la maison ou simplement de tenir jusqu'au jour de paie, nous vous présenterons quelques-unes des meilleures applications de prêt pour obtenir rapidement ces 50 000 RWF urgents.

What are the legal consequences of failed direct debit due to insufficient funds?

Today, we’ll look at the legal implications of failed direct debits in three very different places: Nigeria, the UK, and Dubai. Each country handles the situation differently, and the differences might surprise you.

When to go legal with loan defaulters

Whether you're a small lender or a big institution, the decision to pursue legal action against a defaulter is governed by various factors, including the loan type, the borrower's behavior, and, most importantly, the legal framework in your jurisdiction.

When silence speaks volume: communicating with defaulters 101

For small and medium lenders, communicating with defaulters is like walking a tightrope. Do it well; you might salvage the relationship and recover your money. Handle it poorly, and you risk losing not just your funds but also your reputation.

What repayment methods are available for lenders to get paid?

Ensuring that loans get repaid can be a real headache for lenders, and the stakes are high. Whether you’re looking for the steady reliability or quick turnarounds, each method provides a different way to manage and secure loan repayments.

What factors affect loan interest rates?

But here's the thing: interest rates aren't plucked out of thin air. Many factors shape them. Things you and I might not think about when we're in the heat of the moment.

Credit bureaus not enough? Try these alternatives

Credit bureaus are supposed to be the backbone of the lending process, yet they often fall short. Let’s explore three other alternatives

How to secure your MFB license in Nigeria

When it lending is large-scale, the options are usually finance houses and MFBs. Today, we’ll cover the processes and requirements to obtain the MFB license.

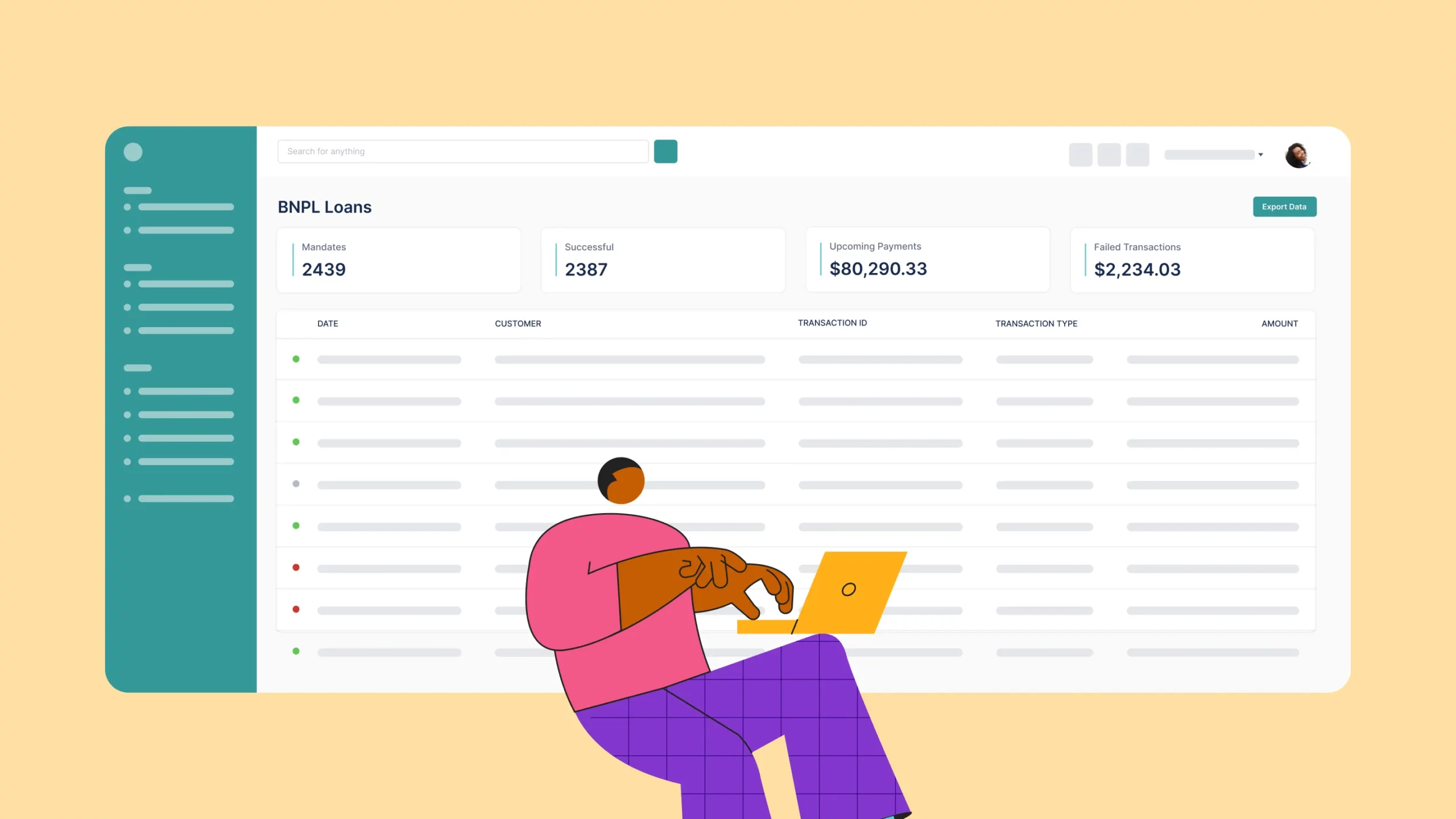

Embed BNPL into your platform without becoming a lender

It’s frustrating to know you could make the sale if only your customers had more payment options. This is where Buy Now, Pay Later (BNPL) comes in.

Are you still chasing payments? Direct debit can turn your loan collections around

Why endure the headache of chasing payments when direct debit can do the hard work for you?

3 reasons why direct debit hasn’t become a hit in Nigeria

We've championed direct debit as a better solution for loan repayments and recovery. For its efficiency and simplicity.