Paycient Finance is transforming healthcare with credit

Thanks to Lendsqr, Paycient Finance was able to reach more healthcare providers and close the funding gap in Nigeria’s healthcare sector.

How Lendsqr helped Sterling Bank use SnapCash to bridge the credit divide

We sat down with the Sterling team and ideated. Born from a single loan product, the name SnapCash resonated better with Sterling Bank's one goal — to provide cash to the average Nigerian at the snap of their finger. Thus, SnapCash came into being.

Coverdey dey for you: Empowering underserved traders with credit

Many up-and-coming lenders claim to be financially inclusive and say they are bridging the credit gap. However, not many are truly bringing credit closer to the often marginalized populace. That is, until Coverdey.

234Loan is transforming lives, one loan at a time

As their journey progresses, 234Loan has expanded its reach and encountered both challenges and triumphs. Let’s see how it all started and their story so far…

Assurdly increased employee happiness by 100%. You can do the same!

Assurdly helped its staff get access to loans for them to buy personal items and work tools. The employee happiness and engagements went through the roof!

A1 Credit: Using digital channels to give loans to Nigerians and SMEs

A1 Credit is helping millions of Nigerians and small businesses get access to credit without asking for an arm and a leg.

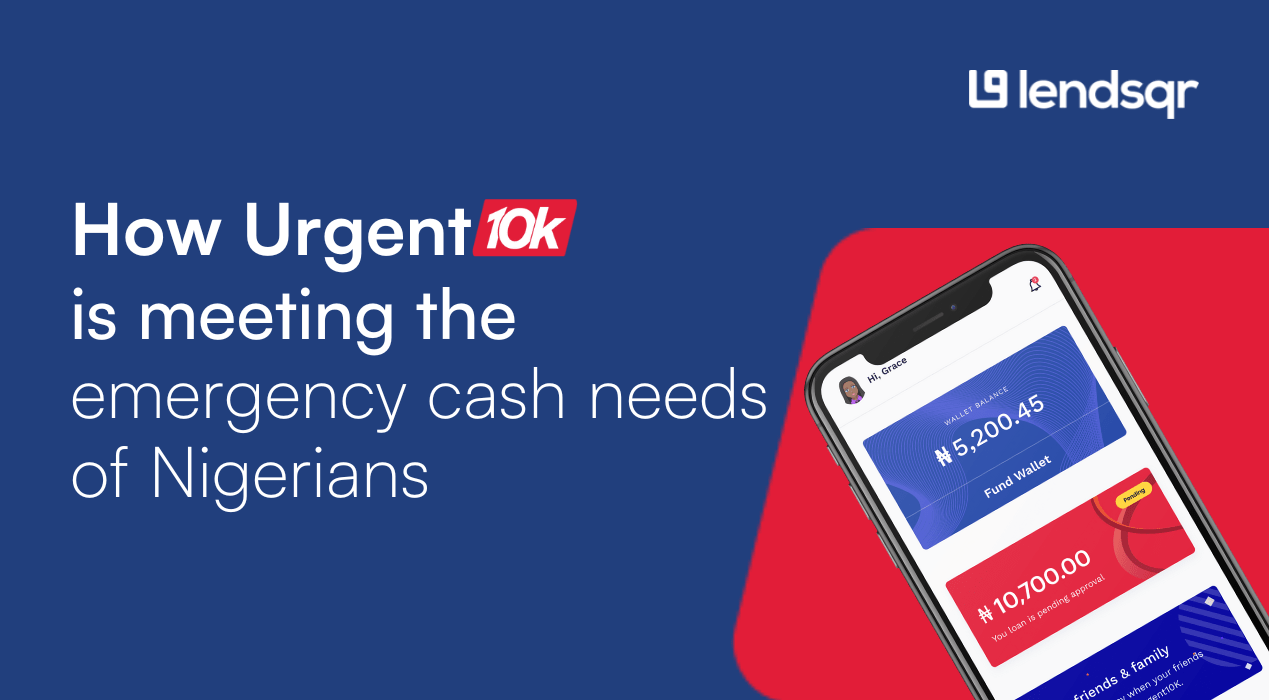

Urgent10k: Meeting the emergency cash needs of Nigerians

Nigeria’s untapped consumer credit needs currently stands at about N109 trillion. Urgent10k is meeting the emergency cash needs of Nigerians

How Blocka Cash got its lending groove

Blocka Cash is one of the fastest growing and the easiest digital lenders in Nigeria with a clear ambition to become the lender of choice in a market where over N74 trillion of credit gap is a perennial problem.