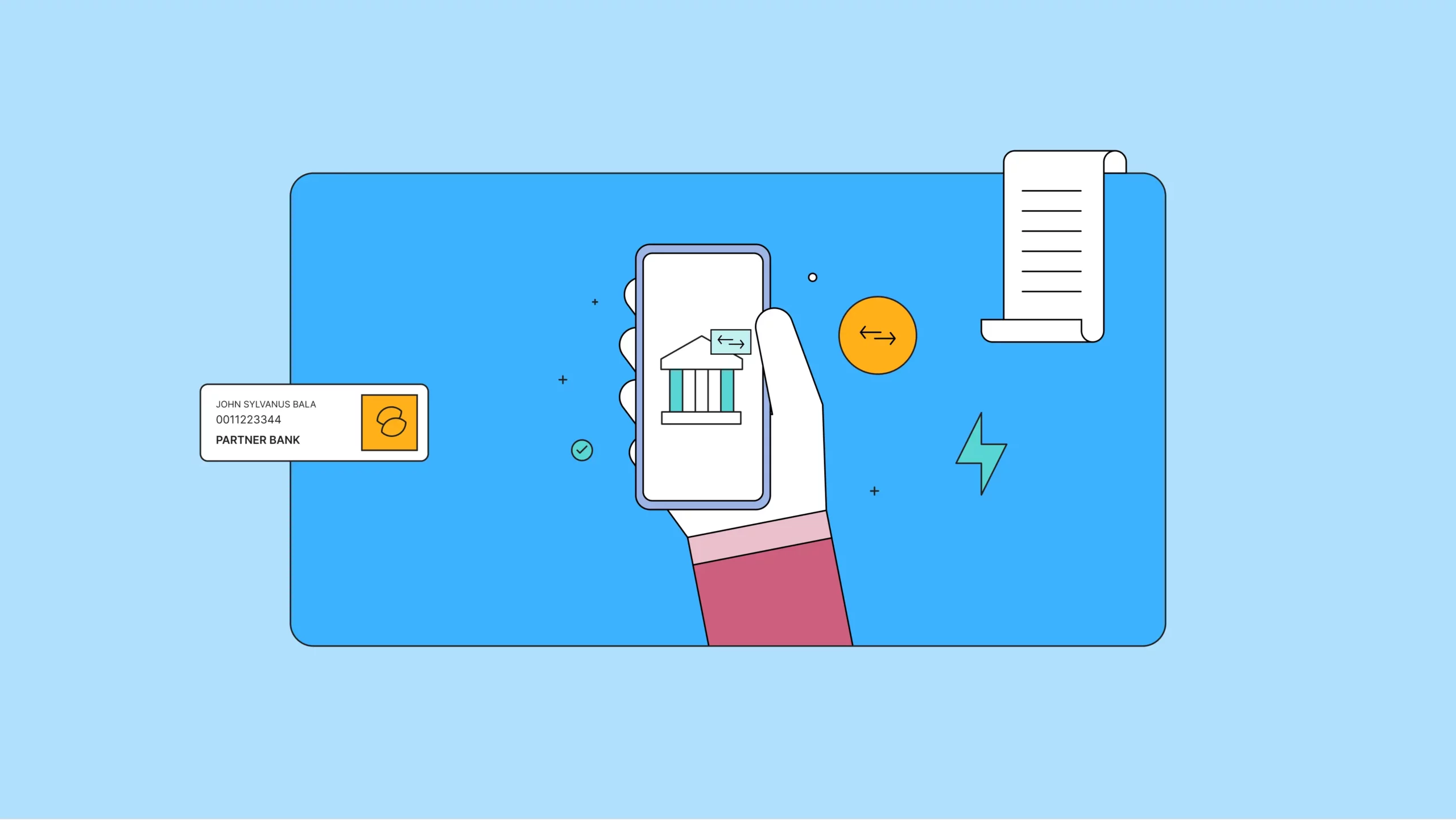

What are virtual accounts and how do they work?

From understanding their inception to deciphering their inner workings, come with us as we explore the ins and outs of virtual accounts especially in Nigeria.

How to get your USSD code as a lender in Nigeria

USSD code for lenders are available in two ways: either from the Nigerian Communications Commission (NCC) or through VASPs. Learn more.

Top 5 loan apps for N$5,000 in Namibia 2025

We’ve sifted through the noise to bring you the top 5 loan apps that get you N$5,000 quickly and do so with transparency and ease.