5 best loan apps in Zambia with low interest

This article looks at the loan apps in Zambia that stand out for keeping interest rates lower, being clearer about repayment, and treating borrowers with more fairness.

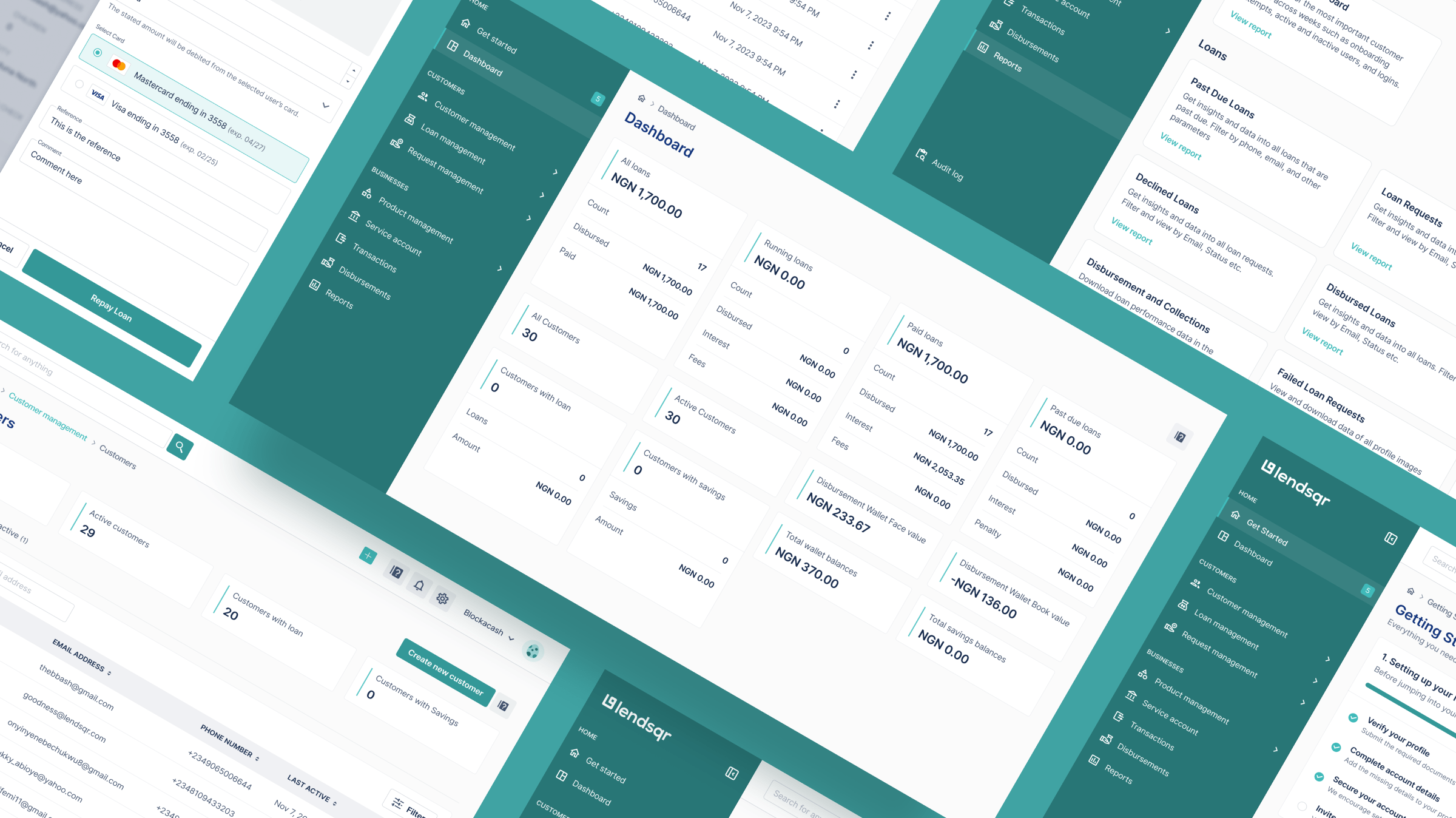

Lendsqr brings its lending technology to Kenya’s non-profits and DFIs

Lendsqr is revolutionizing Kenya's development sector by offering its world-class lending software for free to non-profits and DFIs. Automate your loan cycles and scale your impact to reach the unbanked across Kenya with ease.

Frequently Asked Questions on FCCPC’s new consumer lending regulations

Below are answers to common questions from Lenders, compliance teams, and other stakeholders about FCCPC's DEON CL.

How to finance your first car as an immigrant in the UK

Can immigrants finance a car in the UK? In this guide, we’ll focus on the steps, the lenders, and how you can finance your car as an immigrant in the UK.

How to comply with FCCPC’s new consumer lending regulations

If you gain any form of benefit from a lending transaction, whether in cash, goods, commissions, or barter, the FCCPC considers you covered under these regulations.

How to finance your first car as an immigrant in the US

Financing a car in the U.S. is available to you. The challenge is knowing which routes build your stability rather than drain it. That’s where this guide comes in.

What are the three C’s of credit and how do lenders actually use them?

Understanding this framework is useful for lenders and equally strategic for borrowers. Knowing how the three C’s are weighed provides insight into what strengthens or weakens an application.

Who regulates lending in the Philippines

Understanding who regulates lending in the Philippines helps to know who sets the rules in a system that affects households, entrepreneurs, and communities every day.

FCCPC’s new consumer lending regulation

This guide breaks down what the new FCCPC regulations mean, who they apply to, and how affected businesses can prepare.

📖 Docs.lendsqr.com is live with fresh guides and documentation

Hello there! 👋 Happy new month and welcome to August! 🌞 Just like that, 7 out of 12 months are in the rearview mirror, and the countdown to year-end has officially begun. For us at Lendsqr, this is a time to refine and refocus as we work to ensure you have the tools and support […]

What is the Credit Guarantee Scheme (CGS)

By covering part of the risk, the Credit Guarantee Scheme makes it easier for banks to offer better loan terms; larger amounts, longer timelines, and lower collateral requirements.