Where to get loans in Zambia without collateral

Finding loans in Zambia without collateral can be challenging, but it’s possible with the right lenders. Many financial institutions, fintech platforms, and microfinance providers now offer unsecured personal and business loans, allowing borrowers to access funds without pledging assets. This article explores reliable options, eligibility requirements, and tips for securing a loan safely and efficiently in Zambia.

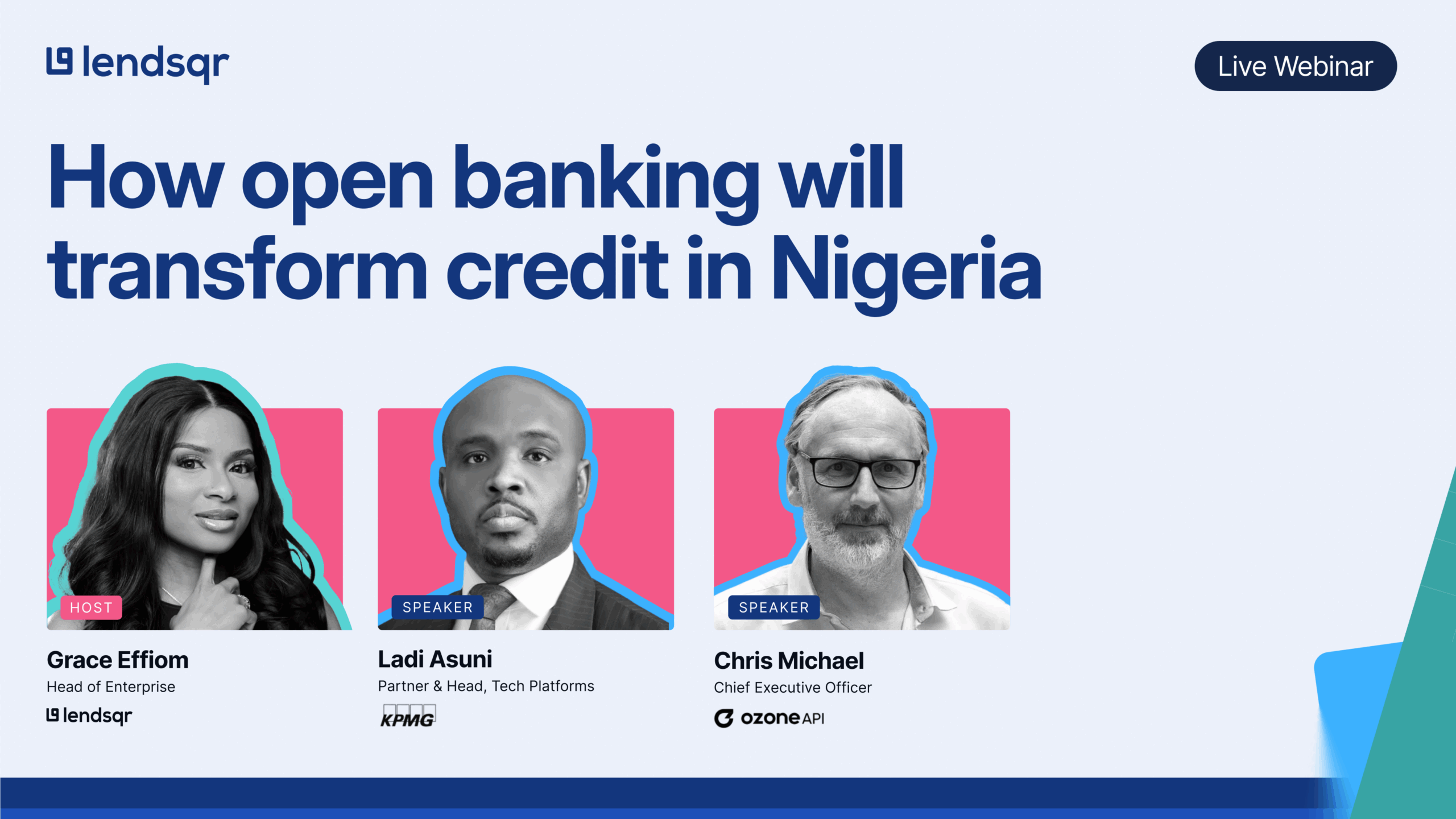

How Open Banking will transform Credit in Nigeria: Audience Q&A

We had a vibrant turnout at our recent webinar, “How Open Banking will transform Credit in Nigeria,” with dozens of questions from professionals across banking, fintech, and policy. Below is a detailed Q&A covering everything from payments and privacy to infrastructure and cross-border insights. Whether you missed the session or want to dive deeper, here’s […]

How Open Banking will transform Credit in Nigeria

On May 29, 2025, Lendsqr hosted an illuminating webinar titled “How Open Banking will transform Credit in Nigeria.” With over 100 attendees from Nigeria’s fintech, banking, and consulting sectors, this session brought together two global experts: Chris Michael, CEO of Ozone API and current lead on several open finance initiatives, and Ladi Asuni, Partner & […]

Programu 5 Bora za Mikopo ya Ksh 5,000 Nchini Kenya

Wakenya wengi hupata chini ya Ksh 50,000 kwa mwezi, huku wastani wa mapato ya kila mwezi ukiwa Ksh 20,123. Ili kuelewa hali hii vizuri, kuishi kwa starehe nchini Kenya siku hizi kunahitaji takriban Ksh 150,000 kwa mwezi. Hii inaonyesha kuwa idadi kubwa ya Wakenya huishi kwa bajeti finyu na huenda wakapata ugumu wa kukidhi mahitaji […]

Uburyo 5 bwo Kwigaragaza nk’Umugurizabikorwa Utandukanye mu Rwanda

U Rwanda rwahinduye amateka yarurangwagamo n’ibikomere rukaba kimwe mu bihugu bifite iterambere ryihuse muri Afurika, bigaragarira mu mahame arugenga no mu bushake bwo kwiyubaka. Dushingiye ku bunararibonye dufite mu nganda z’imari, twasanze u Rwanda ari ahantu heza ho gukorera inguzanyo hifashishijwe ikoranabuhanga. Imiyoborere myiza n’iyubahirizwa ry’amategeko bigaragara mu Rwanda bituma habaho icyizere ku isoko ry’imari. […]

Uburyo bwo Gusohoza Inguzanyo neza ku Batanga Inguzanyo mu Rwanda

Uzi uko biba bimeze. Umuntu afata inguzanyo, wenda ngo yongere ibicuruzwa mu iduka rye, agure imirima, cyangwa agure moto ya kabiri kugira ngo agure ubucuruzi bwe bwo gutwara abantu. Mu ntangiriro, ibintu byose bigenda neza. Umugurijwe yishyura ku gihe, nawe ukumva uhagaze neza ku masezerano. Ariko ubuzima bushobora kuzana ibibazo. Isoko iradindira, haboneka indwara itunguranye, […]

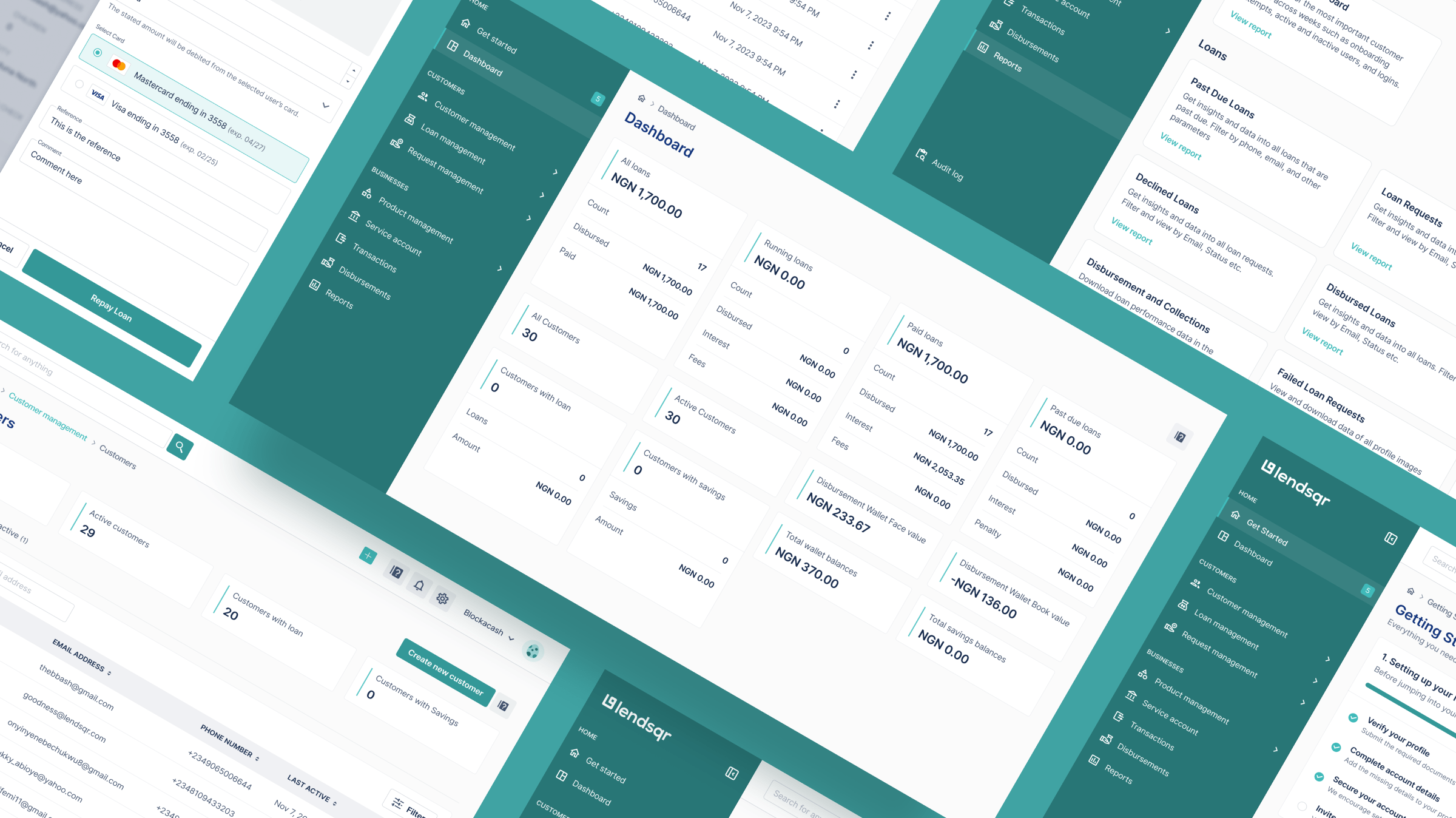

💡 Your customers can now choose how they want to fund their savings 🆖

Hello there! 👋 Happy new month and welcome to June! Can you believe we’re already at the halfway mark of 2025? With just one month left in Q2, it’s the perfect time to evaluate the year and reprioritize if required. Remember the goals you set at the start of the year? How are they coming […]

A deep overview of consumer credit in Botswana

This report explores these developments in depth and presents a narrative-driven overview of Botswana’s consumer lending journey over the past five years.

How to reduce loan defaults in Tanzania: Best strategies for lenders

Tanzania’s banking sector has turned a corner on loan defaults. that’s not just a technical milestone, it’s a strong sign that risk management is improving, credit is being better monitored, and lenders are adapting fast.

A cultural view of loan defaults in Tanzania

This article presents a comprehensive cultural and behavioral analysis of loan defaults in Tanzania, drawing on Central Bank data, academic research, case studies, and media reports to offer an accessible, nuanced understanding of this critical issue.

OnePesa vs. FlexiCash – Which is the best loan app in Tanzania?

Getting access to credit in Tanzania has never been simple. For years, many people, especially those without formal jobs, collateral, or long banking histories have found themselves locked out of traditional financial services. Even for salaried individuals, the process of borrowing from a bank often involves days of paperwork, rigid eligibility criteria, and long waits […]