8 reasons why you should NOT use Kolo

Let's explore the different reasons why you shouldn’t make use of your Kolo account or encourage your family and friends to do so.

Take control of your finances this July with Kolo

To make the most out of Kolo Finance, here are some key steps to help you maximize financial management with Kolo.

Answering your most asked questions

As requested, here are answers to some of the most frequently asked questions about your go to financial management app, Kolo.

Debt management strategies

Debt management can seem challenging, but with the right strategies in place, you can avoid losing control of your finances.

Managing your net worth across bank accounts

Handling numerous bank accounts can be a hassle so here are some tips to help you with proper management of all of your accounts:

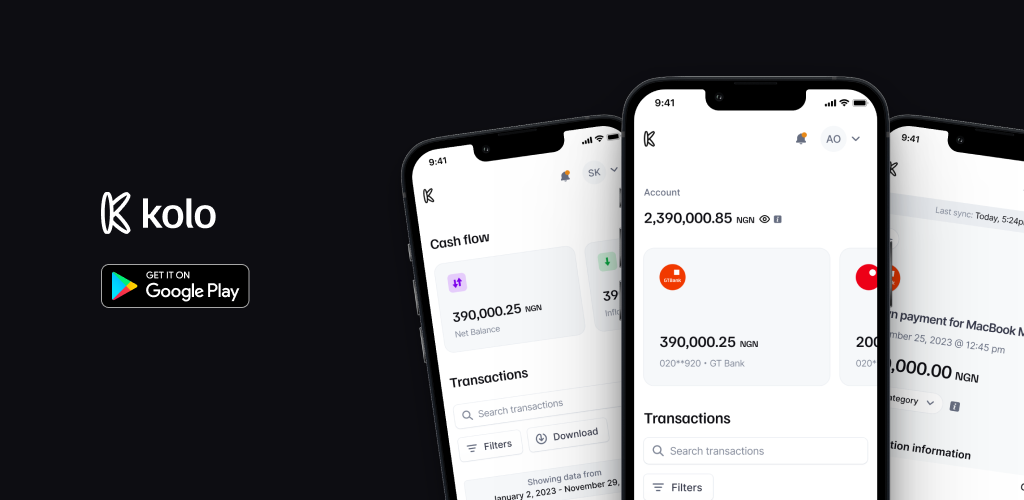

Kolo, your key to financial management

Fresh out of Lendsqr Labs, we're excited to present Kolo—an all-in-one for managing your bank balances and transactions.

3 ways expense tracking can improve your financial health

Kolo Finance — a personal finance management tool — allows you to combine all your Nigerian bank accounts. With your permission, it can get transaction data from your emails and SMS and put it all together in an understandable manner.