We’re giving our lending tech away for free to non-profits and DFIs

If you’re a non-profit or development finance institution (DFI), it should be easier to run a lending program if you're already doing the hard part of reaching people most others won’t.

Open banking in Africa: Continental progress made as of 2025

In London or Sydney, open banking was about breaking up bank monopolies. In Africa, it’s about building the pipes. Basic ones. The kind that lets people send money, access credit, or even check a bank balance without friction. Here, open banking isn’t just a policy play, it’s a workaround. A way to fill gaps that […]

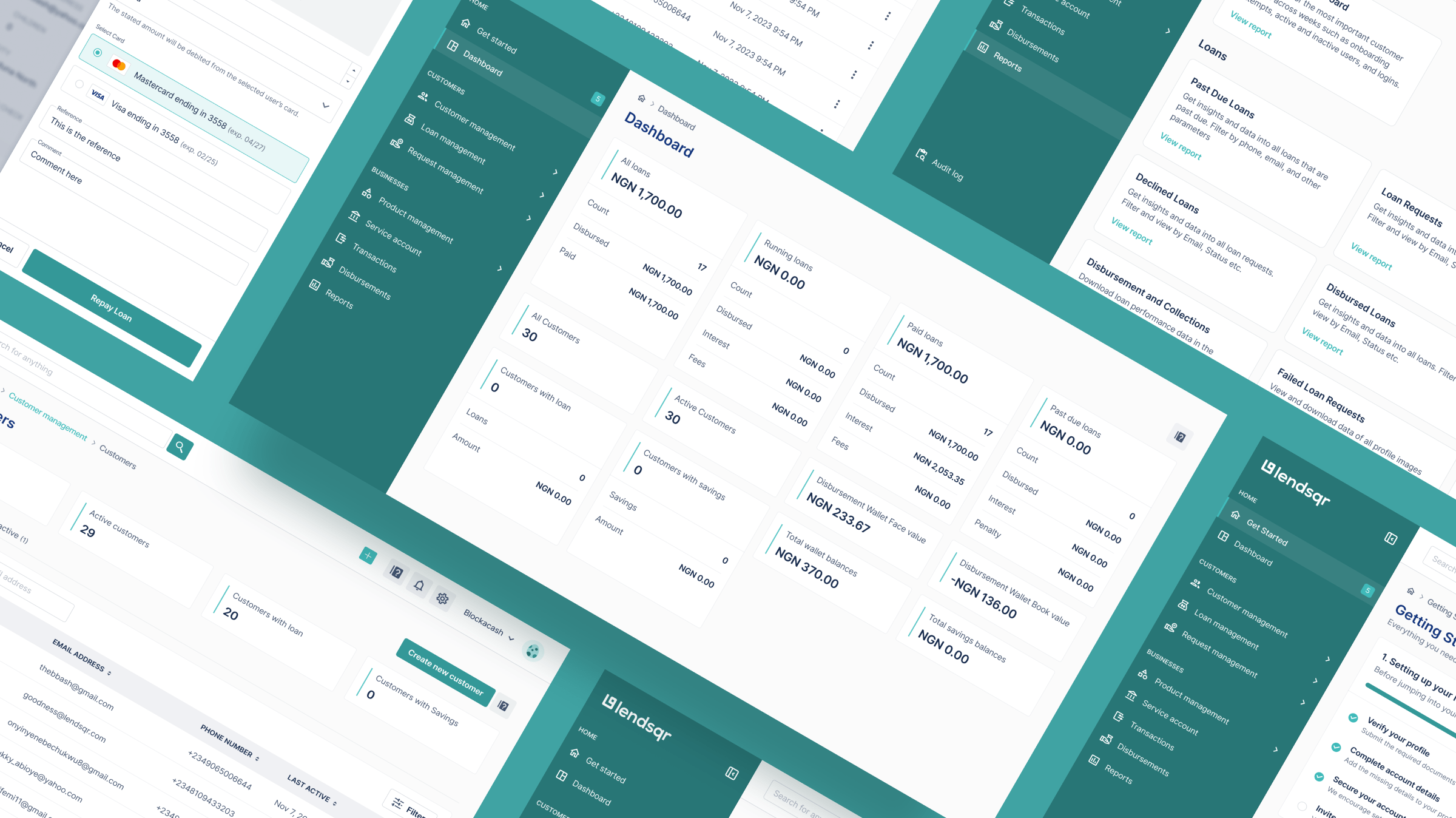

What is Lendsqr, and how does it work?

So what is Lendsqr, and how does it work? What makes Lendsqr the go-to platform for lending? Explore its key features and how they can help you build a thriving loan business.

Earn extra income by helping businesses access better lending solutions

If you have a knack for making connections and helping businesses succeed, the Lendsqr Affiliate Program is your chance to monetize that talent.

Why Lendsqr is Africa’s most affordable loan management software

The end-to-end loan management software that’s rewriting the rules for lenders globally by offering enterprise-grade features without the enterprise-grade costs.

How Lendsqr is using AI to transform its processes

Lendsqr, like many forward-thinking companies, has embraced AI to transform several aspects of our operations. Let's take a closer look at three key areas where AI has made a significant impact

🔄 Top up loans without starting from scratch

Hello there! 👋 It’s July. New month, new quarter, and a new half year. A good point to step back, refocus, and pick up the pace. Whether the last quarter felt like a mad dash or a lazy stroll, the next six months will decide how the year closes. Maybe you need to tighten your […]

Loandisk vs. LendFusion: Which loan management software is better for you?

The gap between fast-growing lenders and those stuck comes down to software. If you're running a growing operation, this guide will help you figure out which system actually fits your business, your team, and your future as a lender.

How debit order works in South Africa

This report provides an in-depth analysis of the debit order ecosystem in South Africa from 2019-2024, covering its regulatory framework, operational mechanics, key players, adoption trends, infrastructure, challenges, and future innovations.

How debit order works in Botswana

This report provides an in-depth analysis of the debit order ecosystem in Botswana from 2019-2024, covering its regulatory framework, operational mechanics, key players, adoption trends, infrastructure, challenges, and future innovations.

How to get a student loan in Liberia

Higher education in Liberia still demands more persistence than it should. This article is a working map for students in Liberia seeking for loan options.

LetsGo vs ExpressCredit: which is the best in Botswana

LetsGo and ExpressCredit are solving different problems for different people in Botswana. If you’ve ever found yourself unsure about where to borrow or you simply want to get smarter about your options, this article is for you.

Who regulates lending in South Africa?

This article unpacks the key regulators involved in South Africa’s lending sector, what each one does, and why their roles matter now more than ever.

Who regulates lending in Botswana?

Lending, particularly outside traditional banks, is a growing and tightly regulated sector in Botswana. Whether you're a micro-lender or a fintech company looking to build credit services for the underserved.

Why Oradian users still need a dedicated loan management system

For a growing number of institutions, the answer is becoming clearer; they need more than a core system. They need a loan management system that was purpose-built for credit.

BankOne can’t handle your full loan lifecycle, Lendsqr can

While BankOne continues to offer a stable foundation for core banking operations, Lendsqr brings the lending expertise and infrastructure needed to manage credit with precision and at scale.