🇳🇬 Nigeria @64; Gaining financial Independence in financially uncertain times

Congratulations on making it to the final quarter of 2024 🎉 You’ve come a long way and you deserve to be celebrated. Not only are we celebrating a new month, but our beloved nation is also celebrating 64 years of Independence *cue the national anthem* 🫡 As we celebrate this milestone, it’s important to reflect […]

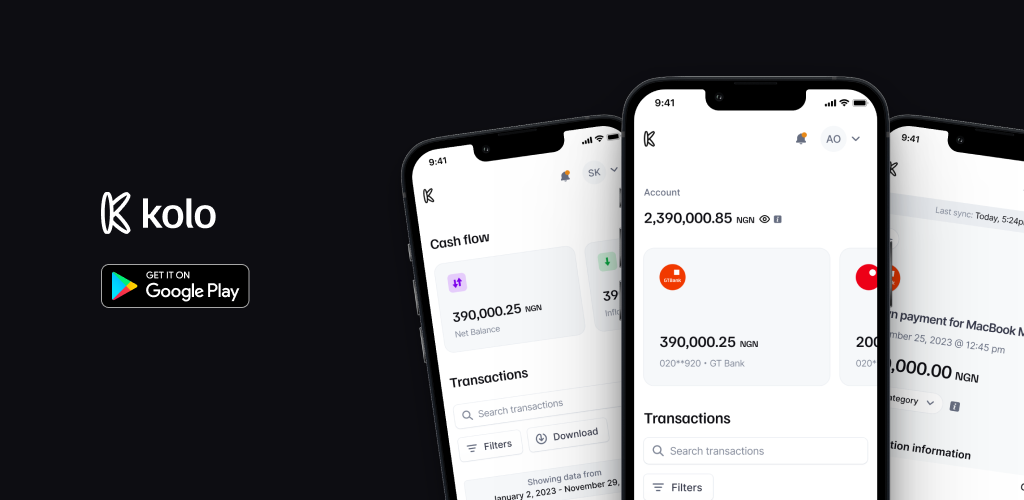

8 reasons why you should NOT use Kolo

Let's explore the different reasons why you shouldn’t make use of your Kolo account or encourage your family and friends to do so.

Let’s protest against financial indiscipline

It’s hard to believe it’s already been five months since we launched Kolo. But we’re grateful you’re alive to read our email. Your continued support has been our driving force, and we’re thrilled to share some exciting updates and important financial insights with you. What’s popping in the finance space? 📰 💰 Interest Rate Hike […]

Take control of your finances this July with Kolo

To make the most out of Kolo Finance, here are some key steps to help you maximize financial management with Kolo.

Answering your most asked questions

As requested, here are answers to some of the most frequently asked questions about your go to financial management app, Kolo.

Debt management strategies

Debt management can seem challenging, but with the right strategies in place, you can avoid losing control of your finances.

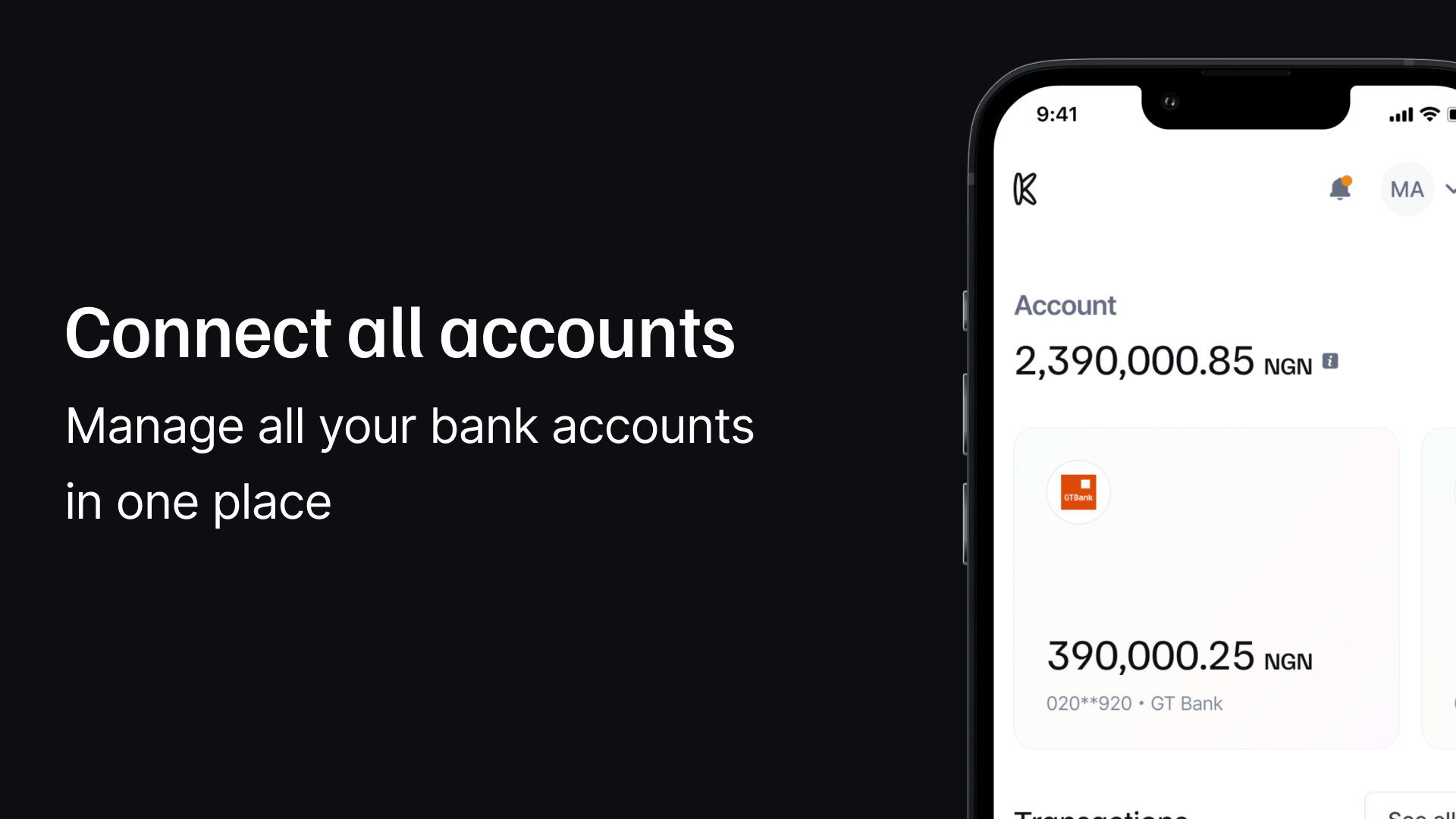

Managing your net worth across bank accounts

Handling numerous bank accounts can be a hassle so here are some tips to help you with proper management of all of your accounts:

How to spot and block fraudulent borrowers

Grace Effiom, the Head of Enterprise at Lendsqr, hosted a webinar featuring Ope Adeoye, CEO of OnePipe, where they discussed the latest approaches to combating fraud in the digital lending space.

How to get your loans repaid with Direct Debit

Grace Effiom, Head of Enterprise at Lendsqr, sat down with Unyime Tommy, the CEO and Managing Partner of Assurdly, to discuss the fundamentals of direct debit and its benefits for lenders.

We built Kolo to help you tame your bank accounts

The average Nigerian today has about three bank accounts, and most often than not, being able to see all bank balances across means juggling through bank apps, SMS alerts, email notifications. And when things go really bad, you start digging through pages of bank statements. Yet, even with these, it’s difficult to find everything. It’s […]

The risks and benefits of mobile apps for financial inclusion

Read about the pros and cons of using mobile apps as a tool for financial inclusion