A1 Credit: Using digital channels to give loans to Nigerians and SMEs

A1 Credit is helping millions of Nigerians and small businesses get access to credit without asking for an arm and a leg.

Paystack vs. Flutterwave – which is better for loan collection?

This is where many lenders get into arguments about which of Flutterwave or Paystack is better for loan collection. We decided to find out for our lenders.

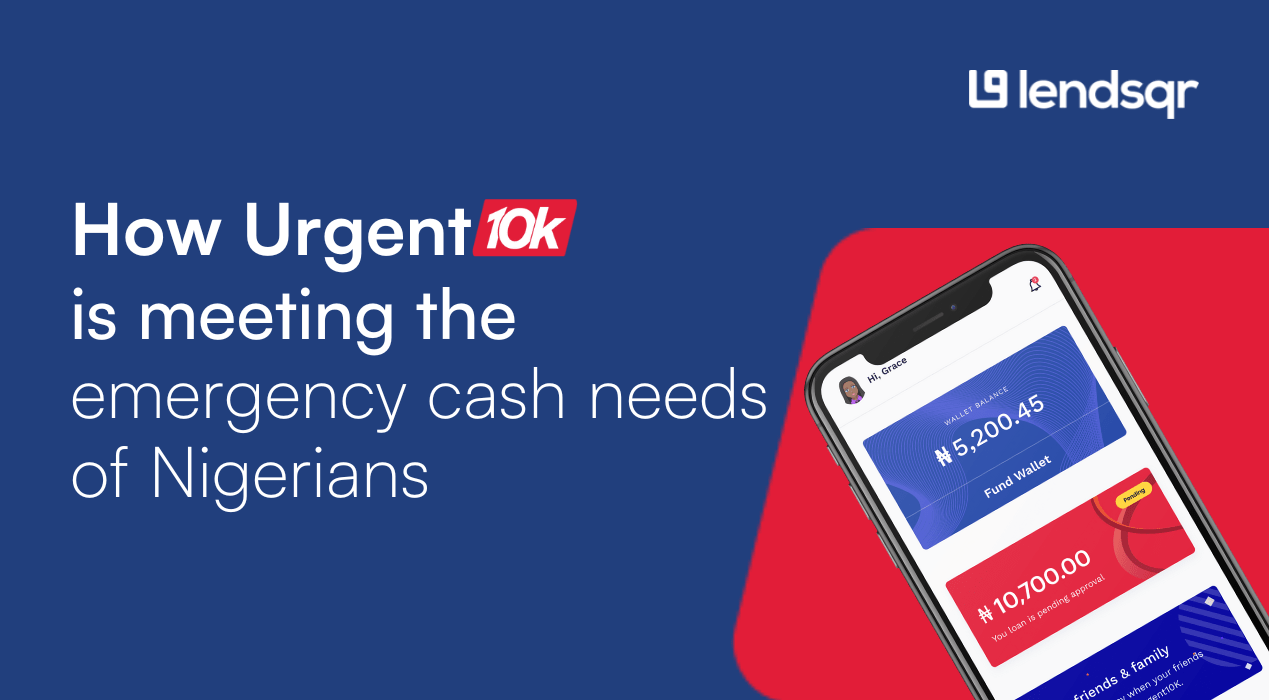

Urgent10k: Meeting the emergency cash needs of Nigerians

Nigeria’s untapped consumer credit needs currently stands at about N109 trillion. Urgent10k is meeting the emergency cash needs of Nigerians

FCCPC regulations for digital lenders

The Federal Competition and Consumer Protection Commission (FCCPC); the regulatory agency responsible for ensuring consumer protection and regulating competition in Nigeria, recently released a Limited Interim Regulatory/Registration Framework for Digital Lending. This regulatory framework is enforceable whilst they work on a more comprehensive framework to guide the operations of digital lenders in Nigeria. The Commission […]

Everything’s getting better this September

A happy new month to our excellent lenders! We hope last month was filled with good surprises and that September’s surprises will be even better. In the last month, we’ve worked tirelessly to bring you some really great features that we know will make your lending experience much better. Keep reading to know more about […]

How to design a customer centric lending product

The importance of having your products suited to the needs of customers is often understated. A good product is one which fits/ addresses specific needs of the market. It’s almost impossible to gain market share or domination without tailoring one’s offerings to the needs of customers. Achieving customer-centric product design requires an intimate understanding of […]

What do borrowers want from lenders?

It’s a widely spread belief amongst lenders that handing over cash or processing loans faster is all that borrowers want. Unfortunately, lending is more nuanced than this. To have a deeper understanding into what drives Nigerians towards one lender or the other, Lendsqr conducted a survey to find out the preferences of borrowers in Nigeria. […]

Why you should digitize your Ajo lending business

Savings and investment have been an integral part of our local community from pre-colonial times. This largely due to the communal nature of the African community – we naturally tend to look out for each other, even where finances are concerned. The advent of formal and structured financing avenues have not completely substituted the thrift […]

Drafting a strategy for your lending business

The business strategy is the foundation of every business, it provides guidance to what the organization is set-up to achieve. The first step towards building a strong lending business, with long-term sustainable growth is having a clearly defined strategy. In simple terms, your strategy tells your stakeholders (internal and external) what your organization will be […]

Expand your lending business with customer incentives

Human psychology indicates that human beings make purchase decisions based on emotions which are subsequently justified by rational suggestions. According to Simon Sinek, it’s easier to sell a product that’s emotionally charged. This is where incentives come in. Humans as consumers generally respond to incentives as a big motivating factor for their purchase decisions. The […]

Customer count or profitability: which is more important for a lender?

Running a lending business, as is the case with running any other business, requires business owners to make some tough decisions. Most lenders, especially those new to the lending business, are typically faced with the high-consequence question: “What should I primarily focus on -growing my customer count or growing profitably?” The former is concerned with […]