🛡️ Control your operational risks and prevent fraud with withdrawal approval workflows

Hello there! 👋 Happy new month and welcome to March! As we step into a new month, we’re excited to bring you more tools and updates to help you scale your lending business seamlessly. From improved workflows to smarter decision-making, we’re constantly innovating to make lending easier, faster, efficient, and more profitable for you. Here’s […]

💳 Team expense requests on the admin console

Hello there! 👋 Lending operations don’t usually break in obvious ways. They break through failed disbursements, disputes, repayment adjustments, schedule changes, and last-minute escalations that compound as your loan book grows. This month’s updates focus on reducing those moments. We’ve shipped improvements that give you better control over repayments, adjustments, receipts, internal expenses, and portfolio-wide […]

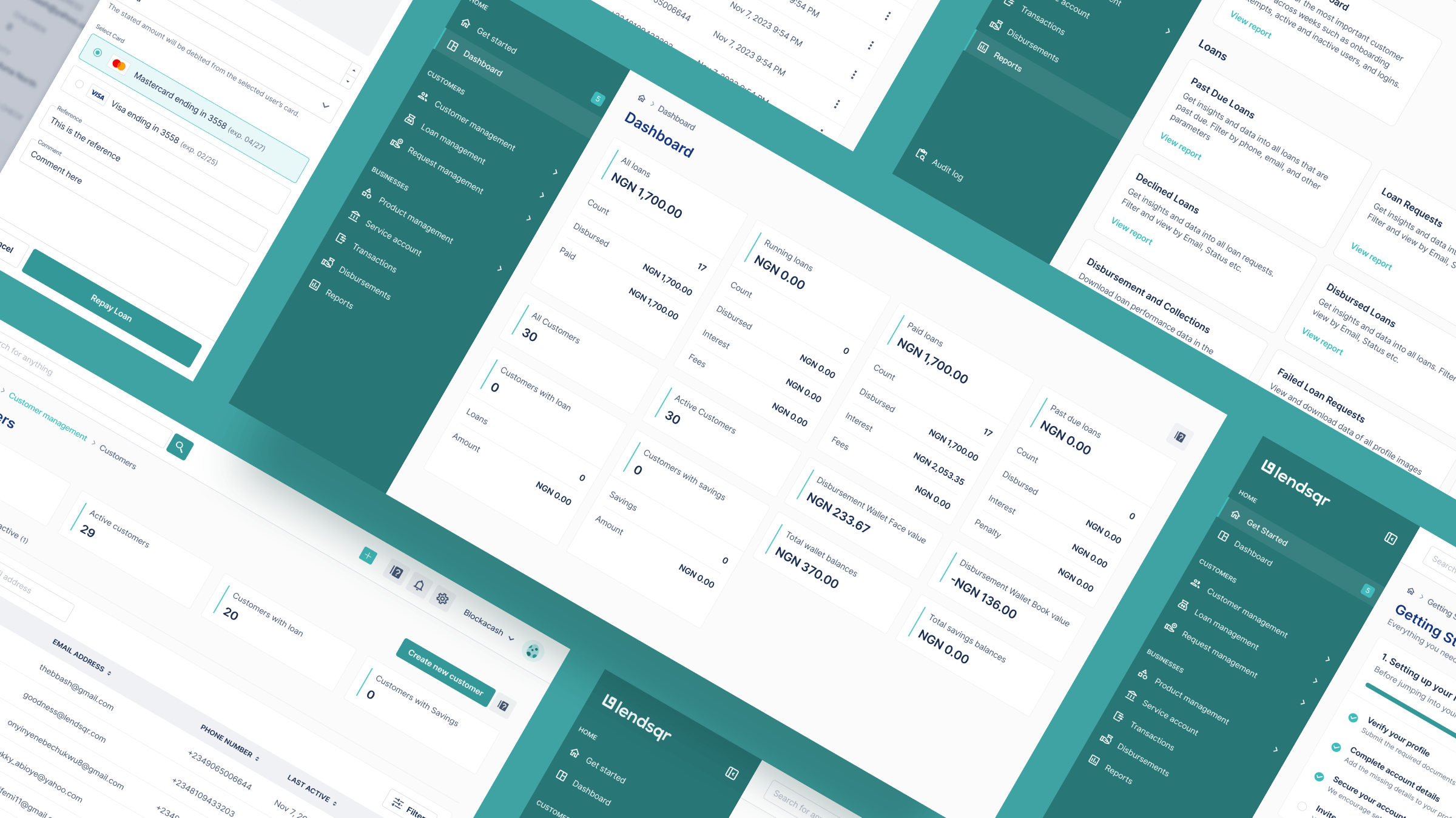

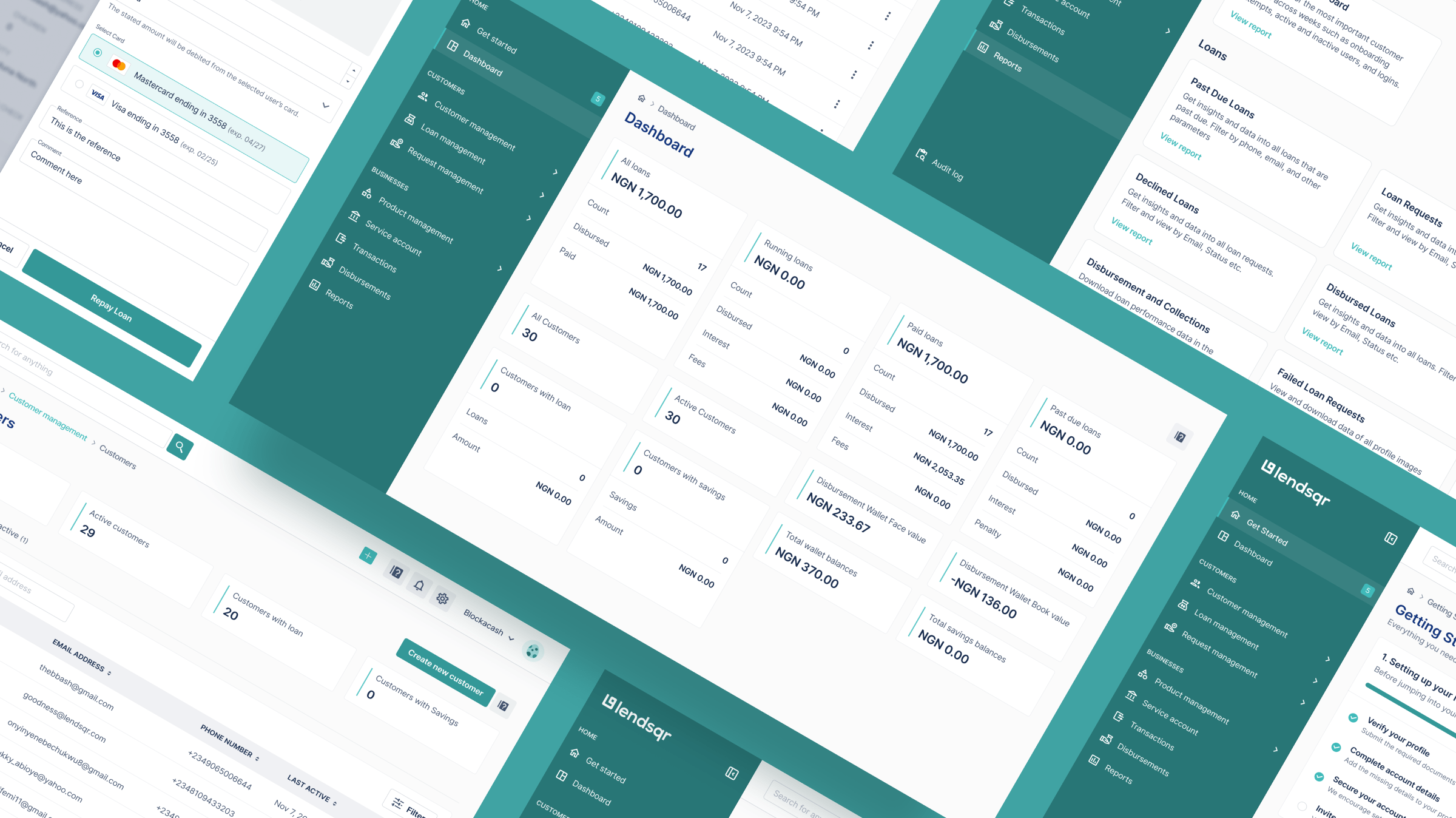

What you should expect from Lendsqr in 2026

Hello there! 👋 Happy New Year and welcome to 2026! 🌞 Before we talk about what’s next, we want to say a sincere thank you for entrusting your business to Lendsqr. Your feedback played a huge role in shaping the platform in 2025, and for many of you, choosing Lendsqr proved to be one of […]

💬We’re bringing lending and banking to WhatsApp

Hello there! 👋 Happy new month and welcome to December! 🌞 We’ve finally made it to the last month of 2025 and what a journey it has been! Time truly does fly, and it’s a gentle reminder that we should make the most of every moment. With this in mind, Lendsqr is excited to wrap […]

Key Takeaways from the Q&A Session on FCCPC, DEON-CL, GSI, and the Future of Consumer Credit

The audience Q&A at the From Compliance to Capital webinar turned out to be one of the most revealing parts of the entire conversation. While the main session focused on the structure and opportunity that regulation brings, the Q&A clarified the industry’s real fears: inflation risk, costs, crowding out, GSI delays, market fairness, and what […]

From Compliance to Capital: How the FCCPC’s Regulation Unlocks Nigeria’s Consumer Credit

A Deep Dive into the Lendsqr Webinar with Olu Akanmu and Grace Effiom (November 27, 2025) Nigeria’s non-bank lending industry has been reshaped dramatically in the last few years. But for many lenders, the shift from an unregulated environment to a structured FCCPC framework still feels like a burden rather than an opportunity. The latest […]

💪🏾 We partnered with Herconomy to give women a better future

Hello there! 👋 Happy new month and welcome to November! 🌞 November is here, reminding us that while the year may be winding down, the opportunities are not. As the days grow shorter, the chance to expand your lending business is still within reach. Whether you’re considering introducing new loan products, fine-tuning your existing ones, […]

📝 Design your forms, just the way you want it

Hello there! 👋 Happy new month and welcome to October! 🌞 To our amazing lenders in Nigeria, we’re also wishing you a Happy Independence Day! 🇳🇬✨ October is not just the start of another month. It is the beginning of the final quarter of the year, a perfect moment to pause, reflect on how far […]

How the New FCCPC Regulation Will Shape Consumer Lending: Audience Q&A

We had a vibrant turnout at our recent webinar, “How the New FCCPC Regulation Will Shape Consumer Lending,” with professionals from banks, fintechs, microfinance institutions, cooperative societies, and digital lenders joining us to unpack how Nigeria’s updated consumer-credit rules will impact their businesses. Below is a detailed Q&A capturing the highlights, from compliance and licensing […]

💡 Give your customers flexible access to funds with overdraft

Hello there! 👋 Happy new month and welcome to September! 🌞 Two thirds of the year are already behind us. Back in January, many of us set ambitious plans and goals; September is the time to bring those intentions full circle, measure results, and push forward to finish strong. 💪 For us at Lendsqr, it’s […]

📖 Docs.lendsqr.com is live with fresh guides and documentation

Hello there! 👋 Happy new month and welcome to August! 🌞 Just like that, 7 out of 12 months are in the rearview mirror, and the countdown to year-end has officially begun. For us at Lendsqr, this is a time to refine and refocus as we work to ensure you have the tools and support […]