🔄 Top up loans without starting from scratch

Hello there! 👋 It’s July. New month, new quarter, and a new half year. A good point to step back, refocus, and pick up the pace. Whether the last quarter felt like a mad dash or a lazy stroll, the next six months will decide how the year closes. Maybe you need to tighten your […]

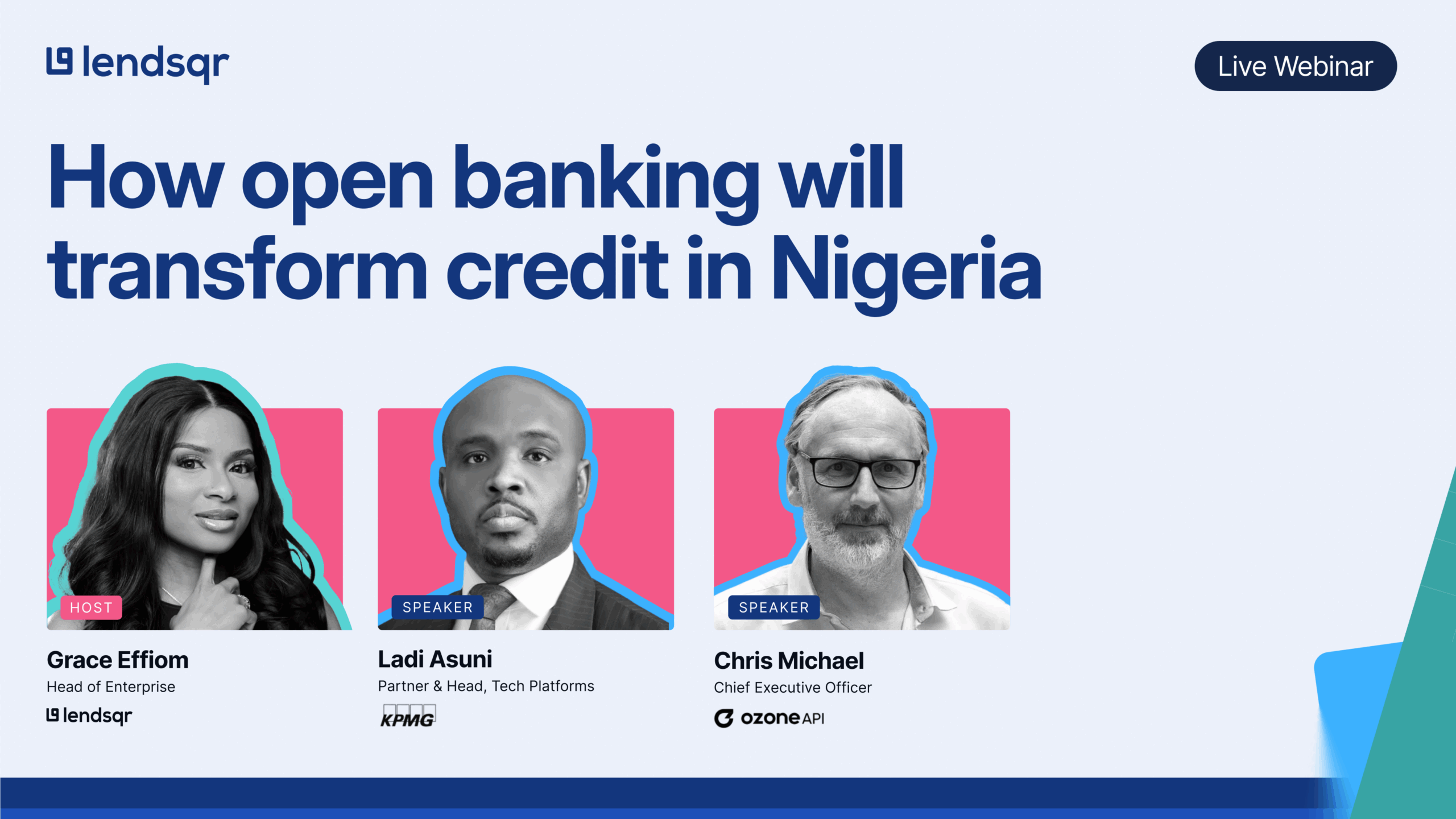

How Open Banking will transform Credit in Nigeria: Audience Q&A

We had a vibrant turnout at our recent webinar, “How Open Banking will transform Credit in Nigeria,” with dozens of questions from professionals across banking, fintech, and policy. Below is a detailed Q&A covering everything from payments and privacy to infrastructure and cross-border insights. Whether you missed the session or want to dive deeper, here’s […]

How Open Banking will transform Credit in Nigeria

On May 29, 2025, Lendsqr hosted an illuminating webinar titled “How Open Banking will transform Credit in Nigeria.” With over 100 attendees from Nigeria’s fintech, banking, and consulting sectors, this session brought together two global experts: Chris Michael, CEO of Ozone API and current lead on several open finance initiatives, and Ladi Asuni, Partner & […]

💡 Your customers can now choose how they want to fund their savings 🆖

Hello there! 👋 Happy new month and welcome to June! Can you believe we’re already at the halfway mark of 2025? With just one month left in Q2, it’s the perfect time to evaluate the year and reprioritize if required. Remember the goals you set at the start of the year? How are they coming […]

💳 We now support direct debit in loan invites and guarantor verification

Hello there! 👋 Happy New Month and welcome to February ❤️, the month of love, growth, and fresh starts! At Lendsqr, we’re here to ensure your hard work pays off. To support you, this month’s newsletter is packed with important updates designed to turbocharge your loan business. Here’s to a February filled with meaningful strides, […]

A look back at 2024 and what’s coming in 2025 🚀

“Success is not final, failure is not fatal: It is the courage to continue that counts.” – Winston Churchill As we step into this new year, we want to take a moment to reflect. 2024 was a remarkable year for us at Lendsqr, filled with achievements, valuable lessons, and opportunities for growth. We’re confident that […]

Reduce abandoned loan offers by 50% with fewer surprises

Hello 👋, Happy new month and welcome to December! We’ve finally made it to the last month of 2024—what a journey it has been! Time truly does fly, and it’s a gentle reminder that we should make the most of every moment. As the author Harvey MacKay once said, “Time is free, but it’s priceless. […]

🔄 What happens when life hits your borrowers?

Hello there! 👋 Hello, and Happy New Month! 🎉 November is here, reminding us that while the year may be winding down, the opportunities are not. As the days grow shorter, the chance to expand your lending business is still within reach. Whether you’re considering introducing new loan products, fine-tuning your existing ones, or embracing […]

🎥 You can now request videos during loan applications

Hello, and Happy New Month! 🎉 Welcome to October! To our Nigerian lenders, we extend our warmest congratulations on celebrating Independence Day 🇳🇬. As we enter the final quarter of the year, it’s time to reflect on the goals you set for your lending business at the start of 2024. Whether you’ve met them or […]

Struggling to get the capital you need to run your loan business?

We are happy to announce the Onlending initiative, which is geared towards providing capital to lenders at affordable rates to boost their operations and business. With this initiative, you can start or expand your lending business capacity without worrying about where and how to raise capital.

Half of the year is gone but the other half is going to be awesome

We’ve officially blown through 50% of 2024, and we want to extend our gratitude for your continuous support and trust in us. Over the past six months, we've rolled out important features and enhancements to help you manage your loan business better.