What is Lendsqr, and how does it work?

So what is Lendsqr, and how does it work? What makes Lendsqr the go-to platform for lending? Explore its key features and how they can help you build a thriving loan business.

Earn extra income by helping businesses access better lending solutions

If you have a knack for making connections and helping businesses succeed, the Lendsqr Affiliate Program is your chance to monetize that talent.

Why Lendsqr is helping lenders in the Caribbean

With a proven track record of powering over 4,000 lenders across Africa, Lendsqr has honed its expertise in regions where access to credit is notoriously difficult. This wealth of experience enables us to bring innovative, practical solutions to the Caribbean, addressing the unique hurdles lenders and borrowers face.

How AI Agents will empower lenders

Earlier this year, Lendsqr set out to test how well a generative AI could support its internal teams. Using OpenAI’s custom GPT, they created a Lendian GPT specifically for their Product Support team, and it worked like a charm.

How Lendsqr is using AI to transform its processes

Lendsqr, like many forward-thinking companies, has embraced AI to transform several aspects of our operations. Let's take a closer look at three key areas where AI has made a significant impact

How we are using AI and ChatGPT to transform our internal support

We loaded all our existing knowledge base into our internal ChatGPT support system and the results were impressive!

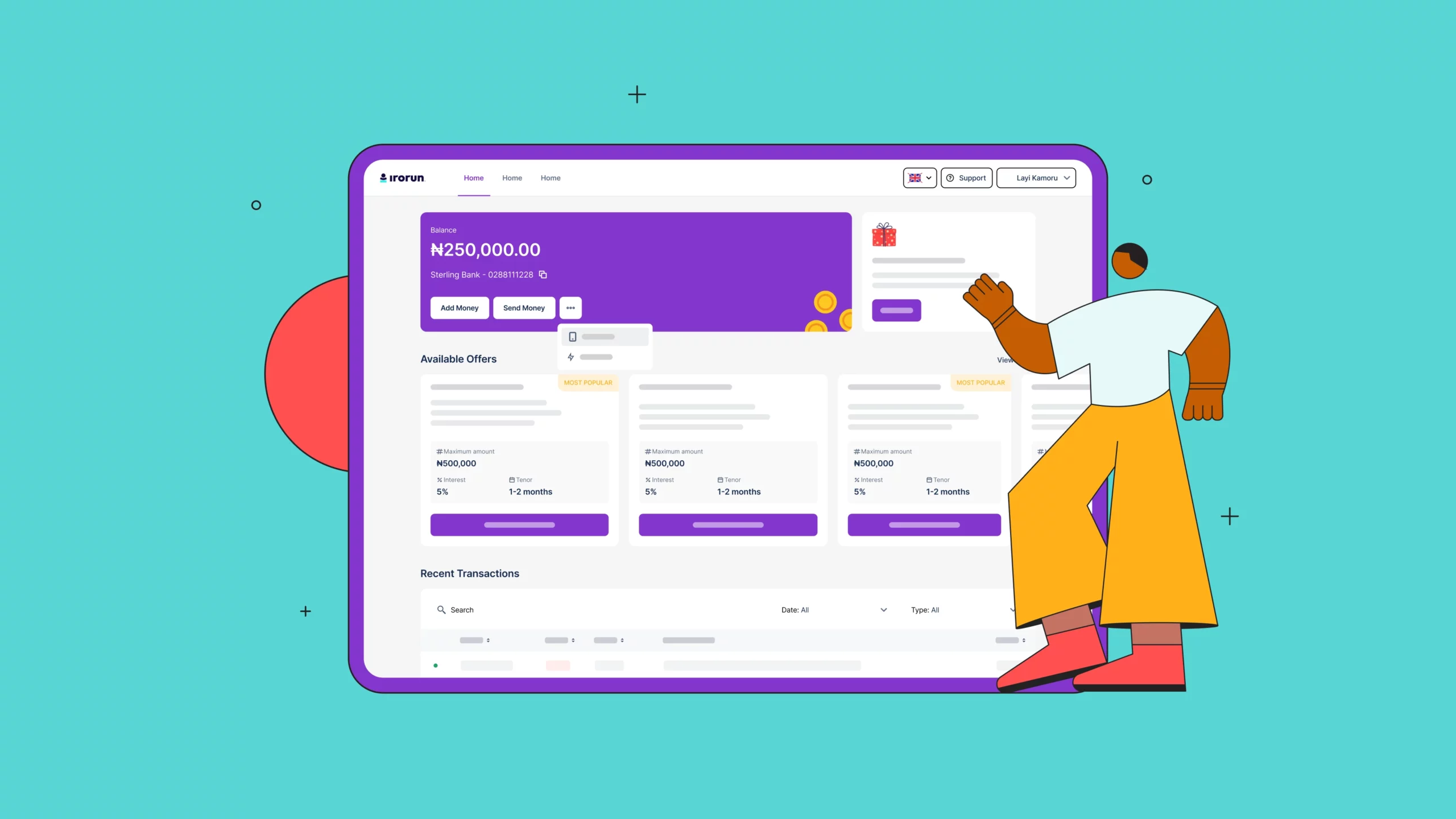

Why we built our lenders’ web app and how it has changed lending forever

“It’s going to change lending forever and we’re not ashamed to say we will be the ones to do that.” Adedeji Olowe, Founder, Lendsqr

4 ways in which Lendsqr wants to use AI for lenders

What if we could develop an AI tool for lenders to quickly sift through the information and make decisions easier and quicker?

VeendHQ Vs. Lendsqr: Which loan management software is right for you?

The difference between a flourishing lender and one that’s struggling to stay afloat is often evident in one critical factor: the lender’s technology or, in this case, the lender’s loan management software (LMS). VeendHQ and Lendsqr boasts of excellent features and benefits. But which one truly stands out?

What you need to know about blacklists

A blacklist is an organized list that records the details of individuals who have engaged in misconduct. And there are so many blacklists all over the world. Today, we talk about KARMA.

Lendsqr vs Loandisk: Which loan management software is right for you?

Prioritize your loan business needs and goals when choosing between Lendsqr vs Loandisk, and you'll make the right choice.