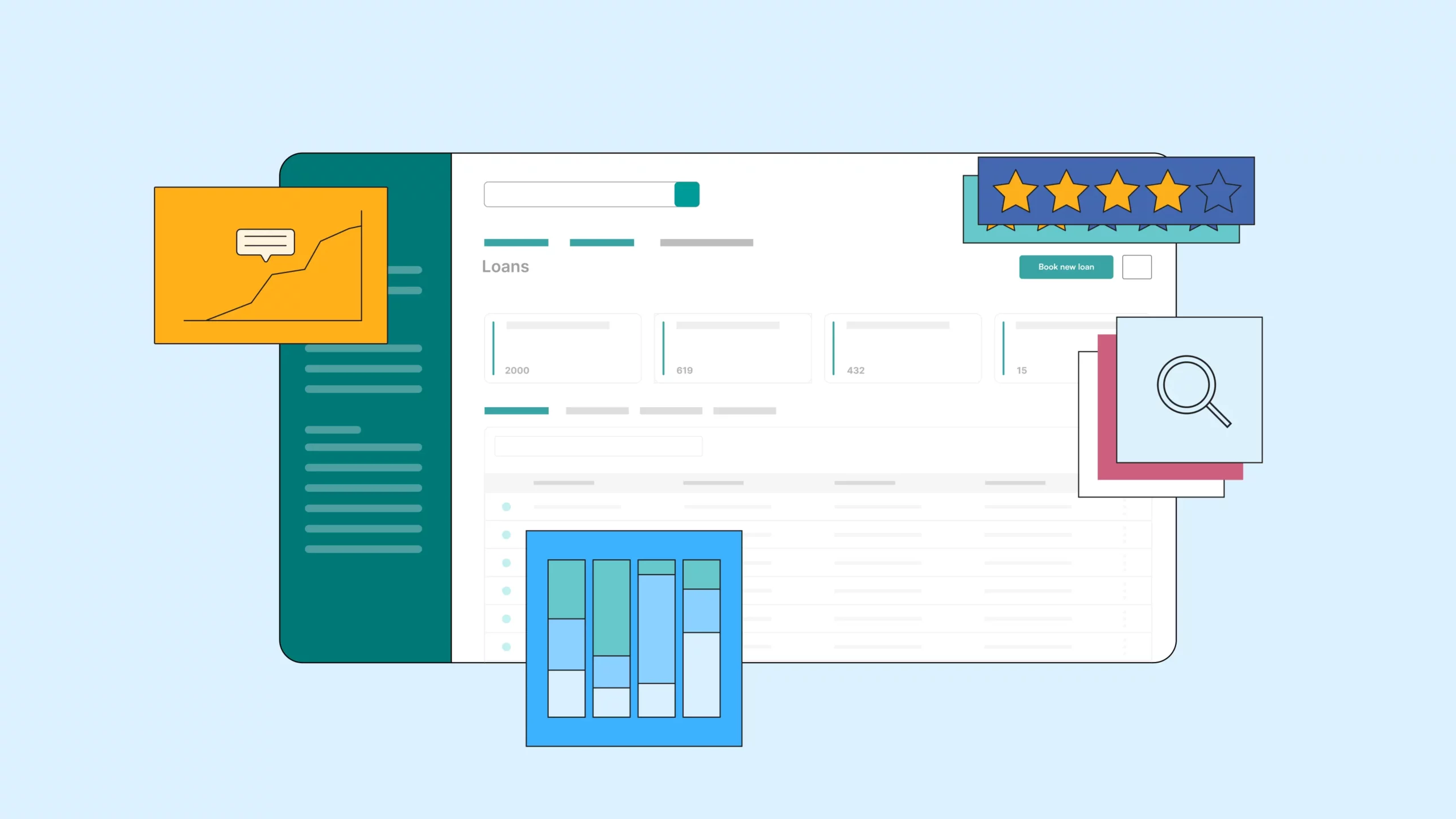

Lendsqr vs Evolve Credit: Which loan management software is right for you?

Due to the abundance of available choices, selecting the right loan management platform, be it Evolve Credit or Lendsqr, requires careful consideration.

The 5 best AWS alternatives for lending cloud infrastructure

When it comes to cloud infrastructure service providers, Amazon Web Services (AWS) is the global leader. But is AWS the only cloud solution available?

5 best Paystack alternatives for card payment in Nigeria

When it comes to getting paid as a lender, having a dependable card payment solution is paramount. So, if you're curious to find the right fit for your lending business, come along.

5 types of lending model

A lending model is a lender’s map. Let’s take a look at some of the lending models available to lenders.

Important regulators every Nigerian lender should know

The ease at which one can wind up in trouble when handling money is unprecedented. For an industry as delicate as lending, it’s even 10x faster to end up in one regulatory mishap or the other. Unless you know your way around...

What is a loan management software?

A loan management software is the operating system for lenders, without which most modern and progressive lenders cannot succeed. Any idea what it is?

Legal compliance pitfalls lenders must avoid in Nigeria

Gone are the days of loan-sharking tactics in Nigeria's modern, regulated lending ecosystem. Lenders who hope to make a lasting impact and withstand the hurdles in this space must be prepared to toe the line of honest, legal and ethical lending. Else, they risk being booted out of the ecosystem. Stay out of trouble with these 10 legal compliance areas.

What license do I need to lend?

To own and operate a lending business in Nigeria, you need a license. However, knowing what license is right could be a little difficult. Understand which license best represents your business’s needs.

Lendsqr and Mono partner to power the next generation of lenders

Lendsqr and Mono have joined forces to redefine what is possible for digital lenders in Africa. By combining Lendsqr’s robust lending infrastructure with Mono’s seamless financial data access, this partnership unlocks smarter credit decisions, faster onboarding, and safer lending for millions.

Ethical ways to recover loans

Recovering loans ethically is one of the toughest challenges Nigerian lenders face. Contrary to common assumptions, the biggest obstacle isn’t funding, technology, or regulation, it’s the alarming reality that many Nigerians simply don’t pay back their loans. While financial hardship plays a part, a significant number of borrowers are willfully reluctant to repay. This article explores ethical, effective strategies lenders can use to recover loans without resorting to harassment or illegal practices.

Lenders battle against fraudsters; a case for an industry blacklist

As digital lending surges in Nigeria, fraud has quietly become one of the industry’s biggest threats, with coordinated identity theft and serial loan defaulters overwhelming individual lenders who battle in isolation. The danger isn’t unique. Kenya offers a stark warning, with an estimated 3.2 million people blacklisted on the country’s TransUnion credit bureau. Without a unified industry blacklist to identify and curb repeat offenders, Nigerian lenders risk following the same path, continually staying several steps behind increasingly sophisticated fraudsters.