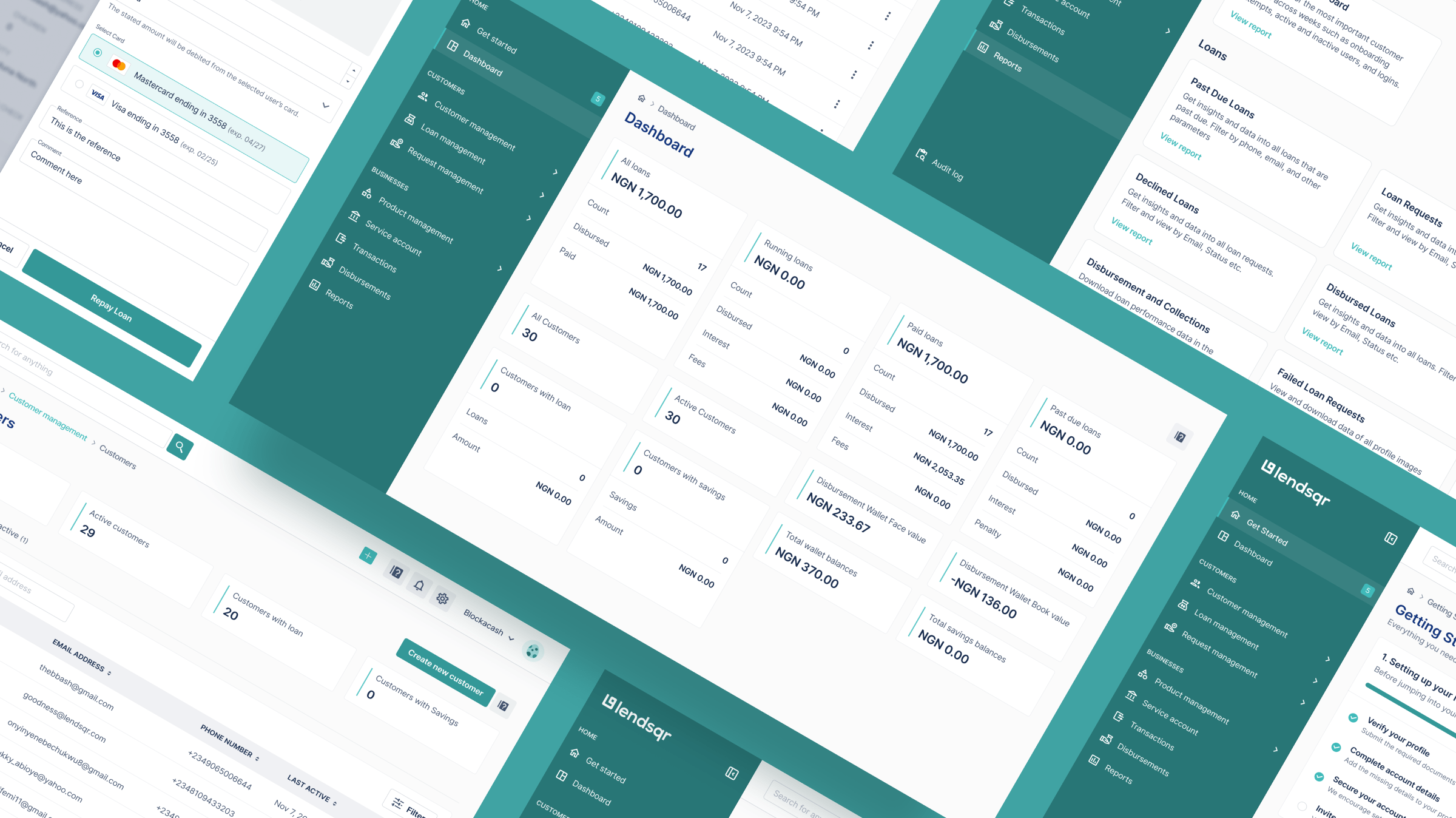

FAQ on Lender web app

The Lender Web App is Lendsqr’s white-label platform that lets lenders manage lending under their own brand. This guide answer questions to help you run your microsite.

9 common issues lenders face when setting up

Setting up a lending operation isn’t always straightforward, Over time, we’ve learned where most lenders stumble. Here are the issues that consistently slow things down.

How lenders go live with Lendsqr in under 7 days

We’ve seen lenders come in, set up, test, and go live in under seven days. Here’s what that journey usually looks like.

What do bankers do when they retire?

Anybody ever wonder where bankers go when they hang their suits? What do they do when they retire?

5 financial mistakes African immigrants make in their first year abroad

Moving abroad is exciting but costly if you’re unprepared. Here are five common financial mistakes African immigrants make and how to stay ahead.

Where to get loans in Ghana without collateral

In this article, we'll show you where to get loans without collateral in Ghana; who you should trust, the options available to you.

7 loan apps in Ghana with low interest

This article looks closely at 7 loan apps in Ghana that stand out for how their products hold up in practice and their interest rate.

📝 Design your forms, just the way you want it

Hello there! 👋 Happy new month and welcome to October! 🌞 To our amazing lenders in Nigeria, we’re also wishing you a Happy Independence Day! 🇳🇬✨ October is not just the start of another month. It is the beginning of the final quarter of the year, a perfect moment to pause, reflect on how far […]

Lendsqr has partnered with CreditRegistry and CRC Credit Bureau to provide free, automated loan reporting for licensed digital lenders in Nigeria.

Lendsqr is revolutionizing credit risk management! Through our new partnership with CreditRegistry and CRC, lenders can now enjoy free credit reporting, making it easier to track borrower behavior and reduce defaults across the board.

Frequently asked questions about onboarding to Lendsqr

This FAQ gathers those questions and reframes them into a narrative you can follow. It connects the process and purpose, showing how each step; sign-up, setup, and disbursement, flows into the next.

Why micro lending management software is critical for community lenders

Micro-lending management software has become essential for community lenders who need to serve borrowers quickly and reliably. With growing demand and limited staff capacity, manual processes can slow down approvals, increase errors, and hinder impact. The right software streamlines onboarding, scoring, disbursement, and tracking, allowing lenders to operate efficiently while reaching more people.