5 reasons why you should embed credit into your products and services

Even the most compelling marketing efforts can fail if consumers lack the means to pay. This is where embed credit becomes indispensable.

3 reasons why direct debit hasn’t become a hit in Nigeria

We've championed direct debit as a better solution for loan repayments and recovery. For its efficiency and simplicity.

How to start a lending business in Nigeria from Canada, UK, and the US

So, if you’re serious about starting a lending business in Nigeria from the comfort of your Japa base, you’re in the right place. We’ve laid out the steps you need to turn that vision into reality.

Why direct debit is the silent hero of loan recovery in Nigeria

Unlike cards, direct debit cuts through the noise, offering a simpler and dependable way to ensure payments are made on time, every time.

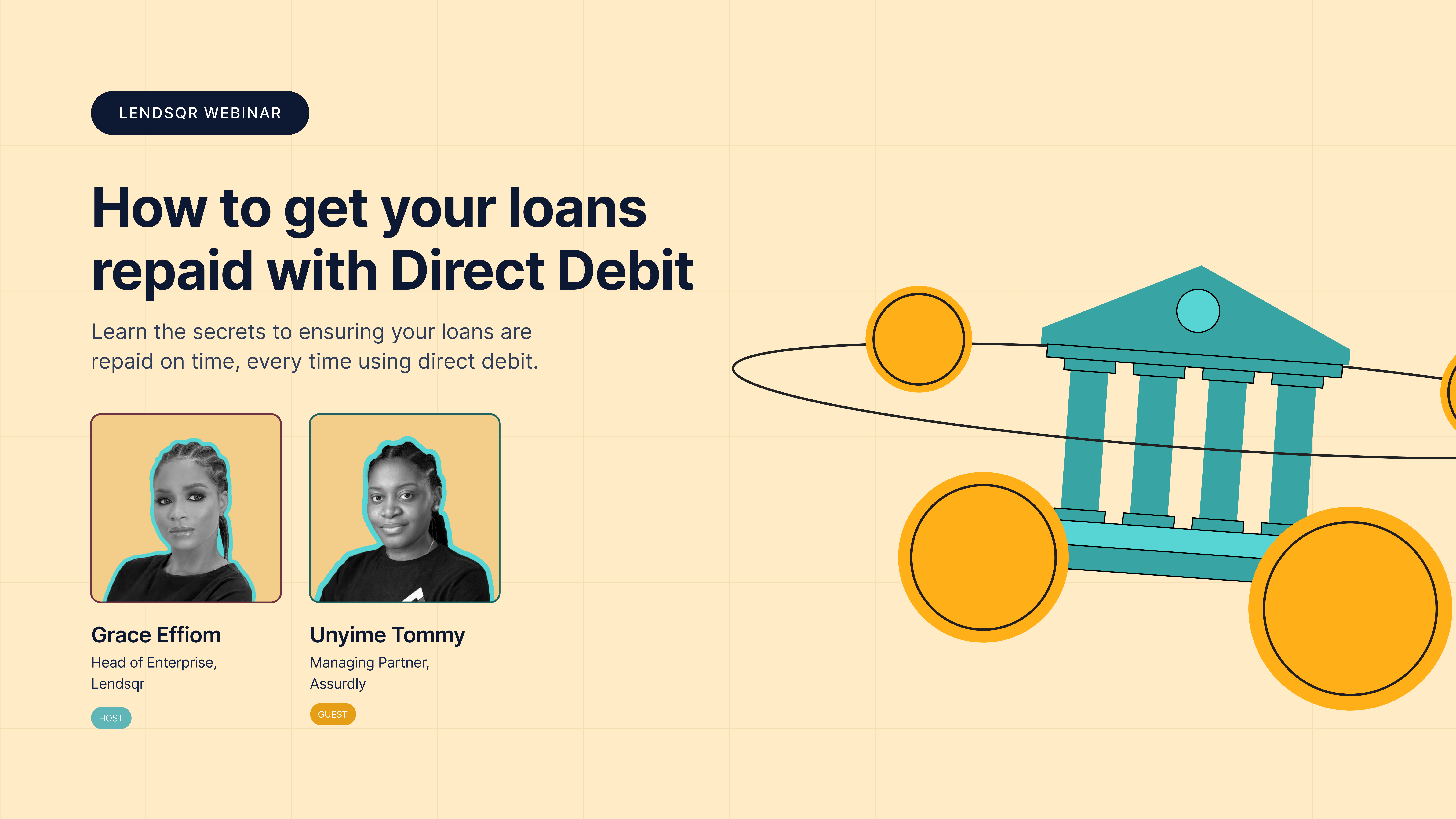

How to get your loans repaid with Direct Debit

Grace Effiom, Head of Enterprise at Lendsqr, sat down with Unyime Tommy, the CEO and Managing Partner of Assurdly, to discuss the fundamentals of direct debit and its benefits for lenders.

How to get a lending license in the Philippines

Whether you're a newbie lender with big dreams or an established lender looking to expand, This guide will walk you through the essential steps to obtaining a lending license in the Philippines.

Why GSI fails for borrowers with unpredictable income

Today, we’ll be highlighting three major challenges lenders may encounter when using GSI to recover loans from borrowers with unpredictable income:

GSI vs Direct Debit: Similarities and differences

To clear the air and empower lenders to make informed decisions, let’s dive into the nuances between GSI vs direct debit.

Why and how Lendsqr doesn’t work with predatory lenders

We've met a lot of predatory lenders. This is why we've implemented stringent measures to protect our platform and our users.

Effective strategies to market your loan products

As of 2023, the global lending market was valued at over $7 trillion, with thousands of institutions vying for the attention of borrowers. So, how do you make your loan products stand out in such a full market?

5 reasons why you may need a student loan

Before you hit the panic button, remember that student loans aren't the big, bad wolf they're often portrayed as. In reality, they could be the solution you need. Let's explore five reasons why we think you may need a student loan.