5 best loan apps in Zimbabwe with low interest

Discover the 5 best loan apps in Zimbabwe with low interest. Understand the loan eligibility criteria and interest rate for each lender.

Why non-financial companies are offering credit products

This article looks at why non-financial companies are offering credit products, how they structure these offerings, and what it means for lenders operating in African markets.

How utility bills and rent payments can build your credit

This article is all about how to turn those "boring" monthly bills into a powerful track record, helping you prove to banks and landlords alike that you’re a safe bet, even if you’ve never taken a formal loan in your life.

How to fix common causes of delinquency in your lending portfolio

Loan delinquency is one of those issues every lender plans for, budgets around, and still worries about. It shows up at first as a few missed repayments here and there, then starts to spread across segments if it is not addressed early.

Frequently asked questions about personal loans

This guide is here to strip away the confusion and give you the answers to the most frequently asked questions about personal loans.

Frequently asked questions about invoice financing

This guide explores the fundamental architecture of invoice credit, providing the clarity needed to determine if an advance is a powerful tool for your growth or a weight that will eat too far into your margins.

Frequently asked questions about business loans

Applying for a business loan in 2026? From understanding the latest credit score requirements to comparing traditional banks vs. online lenders, our FAQ guide provides the essential answers to fuel your growth.

Key KPIs every digital lender should track month-over-month

Lending KPIs show the operational strength of the business and the quality of decisions being made across credit, risk, pricing, and customer acquisition.

Frequently asked questions about equipment financing

Ready to upgrade your business tools? Our comprehensive FAQ guide covers everything you need to know about equipment financing, from application requirements to repayment structures.

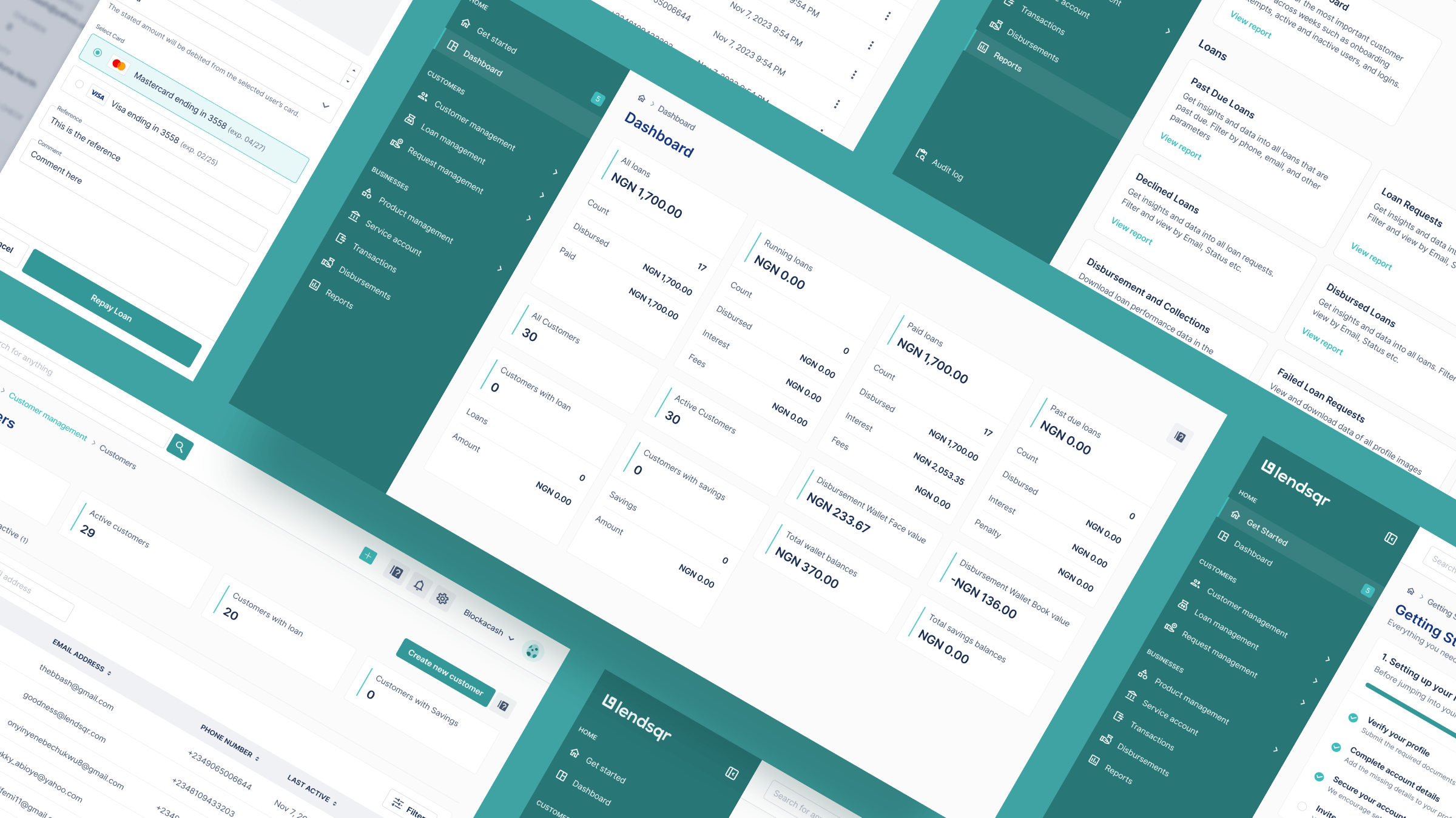

What you should expect from Lendsqr in 2026

Hello there! 👋 Happy New Year and welcome to 2026! 🌞 Before we talk about what’s next, we want to say a sincere thank you for entrusting your business to Lendsqr. Your feedback played a huge role in shaping the platform in 2025, and for many of you, choosing Lendsqr proved to be one of […]

Frequently asked questions on student loans

Navigating student loans in 2026? From understanding the Repayment Plan to managing borrowing caps, our FAQ guide breaks down everything you need to know.